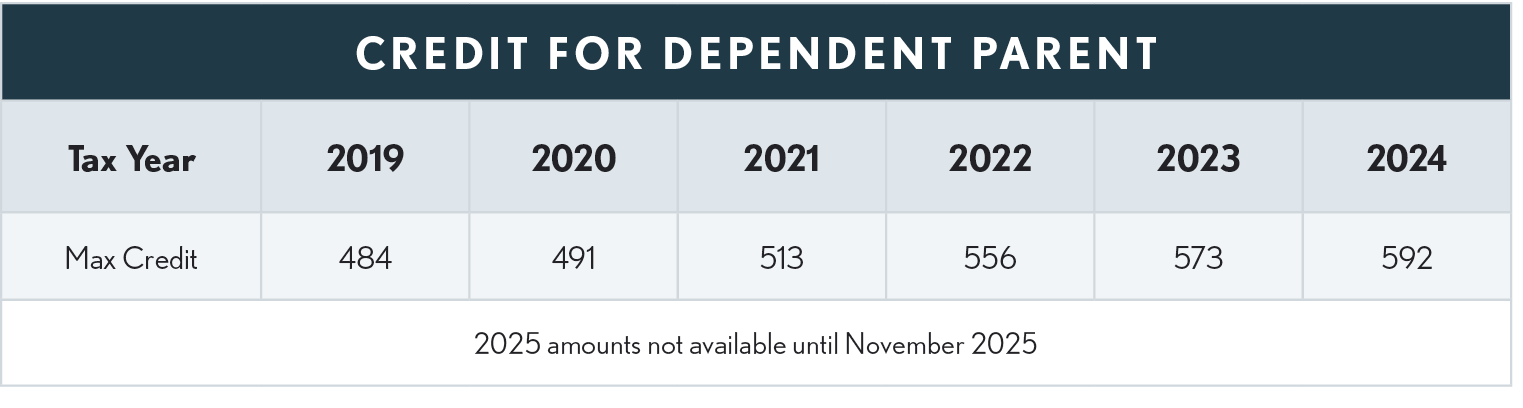

Credit for Dependent Parent

This credit is available to taxpayers who:

-

Were married at the end of the tax year and used the married filing separate filing status;

-

The taxpayer's spouse was not a member of the household during the last six months of the year; and

-

The taxpayer furnished over one-half the household expenses for a dependent mother’s or father’s home, whether or not they lived in the taxpayer's home.

The credit is computed in the same manner as the Joint Custody Head of Household credit.

The credit is the lesser of:

-

30% of the tax (less the tax on accumulation trusts) less exemption credits but before other credits and AMT.