California Inflation Relief Payments (Aka Middle Class Tax Refund)

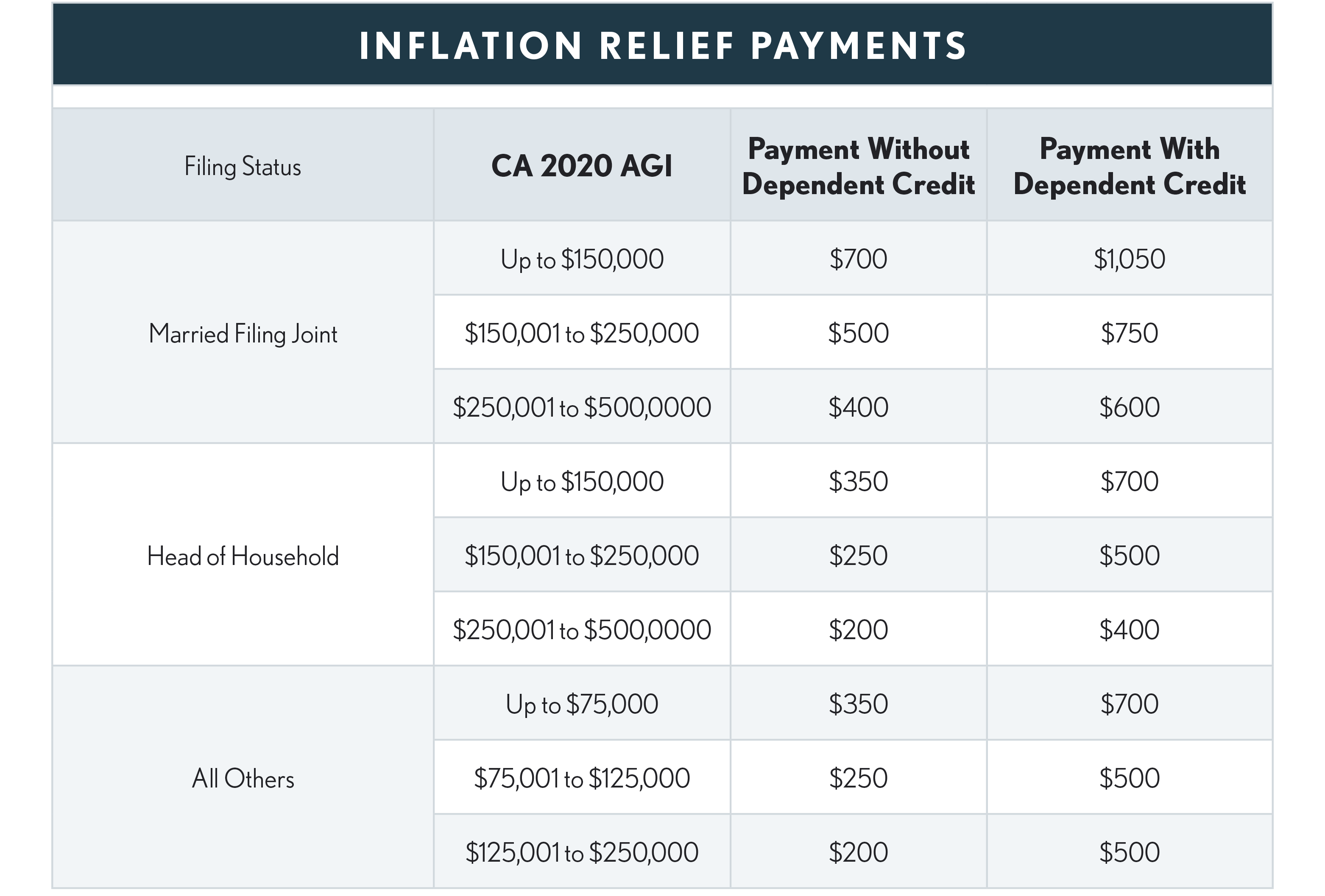

Millions of Californians received "inflation relief" payments that were authorized by AB 192. According to the FTB’s website, as of July 2023 the state has disbursed about $9.2 billion of relief payments, either as direct deposits or debit cards. These payments were as follows:

Qualifications

-

The relief payments are based upon the taxpayer’s 2020 AGI;

-

Must be a California resident on the date the payment is issued;

-

Must have been a California resident for at least six months during 2020;

-

Cannot have been claimed as a dependent on someone else’s 2020 CA tax return, and

-

Must have filed their 2020 tax return by October 15, 2021 (However if applied for ITIN and had not received it by October 15, 2021, must file before February 15, 2022).

-

These individuals Do Not qualify:

-

Individuals deceased on the payment date.

-

Incarcerated individuals, other than if incarcerated pending the disposition of charges, in a jail, prison, or similar penal institution or correctional facility on the date the payment would otherwise be issued.

-

These payments are exempt from garnishment orders other than a garnishment order in connection with an action for, or a judgment awarding, child support, spousal support, family support, or a criminal restitution payable to victims.

The payments are excluded from the gross income of recipients for California personal income tax purposes, per the original enacting legislation. Even so, California issued 1099-MISC forms for payments in 2022 greater than $600 because it was uncertain how the payments were to be treated for federal purposes. In late February, 2023, the IRS announced it had determined it “would not challenge the taxability of payments related to general welfare and disaster relief,” including the California payments. Those who had included the payment as income on 2022 federal returns filed before the IRS announced its position may want to amend their 1040s to delete the income.

In the December 2023 FTB Tax News, the FTB announced they would be issuing 1099s for payments.

Payments from FTB began in October 2022 and nearly all payments were issued by early 2023. Generally, an eligible taxpayer who e-filed their 2020 return and received their California refund by direct deposit received their relief payment by direct deposit. Others, as listed below, were issued a debit card for the relief payment if they:

-

Filed a paper return.

-

Had a balance due.

-

Received their Golden State Stimulus payment by check.

-

Received their tax refund by check regardless of filing method.

-

Received their 2020 tax refund by direct deposit but have since changed their banking institution or bank account number.

SB 131, enacted July 10, 2023, prohibits the FTB from issuing any new Middle Class Tax Refunds after September 30, 2023, but the FTB and their third-party vendor could have reissued stale, dated, or replacement warrants or debit cards through May 31, 2024. A reminder letter, with instructions on how to activate the debit card, was sent to those individuals who had not booted-up their payment card.