Business Energy Credits

Caution

Under OBBBA this credit's sunset date has been moved up to December 31, 2025, and the credit is no longer available after 2025.

Solar Investment Credit for Rental Properties

The Clean Electricity (aka Solar) Investment Tax Credit (ITC) is designed to encourage the adoption of solar energy by significantly reducing the cost burden. This credit is particularly beneficial for owners of rental properties, allowing them to deduct a notable percentage of their solar installation expenses from their federal tax liabilities.

For solar projects put into service after December 31, 2024, the credit is claimed under the rules of IRC §48E, Clean Electricity Investment Credit. IRC Sec 48, Energy Credit, applies if construction began before January 1, 2025. The credits available to individuals under IRC Sections 25C and 25D are not available for solar or other energy efficient property improvements made to a rental property.

Qualifications - To be eligible for the Solar ITC, the following criteria must be met:

-

The solar energy equipment must be new and installed on property located in the United States.

-

The installation must commence before 2026 to qualify for the credit that amounts to 30% of the cost of the solar system.

-

The solar property must not be leased to a tax-exempt entity; however, tax-exempt entities themselves can receive the ITC via a direct payment.

Labor Standards and Domestic Content Requirements

-

Labor Standards - To qualify for the full ITC rate, certain labor conditions must be met. Construction workers must be paid prevailing wages throughout the initial five years of the project's operation. Additionally, a specific portion of labor must be carried out by apprentices, starting at 10% for projects beginning construction in 2022 and increasing to 15% thereafter.

-

Domestic Content Requirements - Qualifying for a domestic content bonus involves ensuring that relevant structural steel or iron products are produced in the United States. Additionally, a specified percentage of all other manufactured components must be domestically sourced, starting at 40% and ramping up to 55% by 2026.

Limitations - The ITC is limited by several factors including:

-

Output Limitation: Projects should be under 5 megawatts.

-

Eligibility: Is denied for systems primarily serving leisure products.

Systems Over 1 Megawatt - For systems over 1 megawatt that don't meet labor or content stipulations, the credit can be reduced significantly. Here are the key details:

Credit Reduction for Non-Compliance:

-

Systems greater than 1 megawatt that begin construction 60 days or more after the Treasury's issuance of labor guidance and do not meet the labor requirements face an 80% reduction in available tax credits. This reduction also applies to bonuses like the domestic content and energy community bonuses.

Example Calculation:

-

For the Investment Tax Credit (ITC), the reduction calculation means that the usual 30% credit can drop to 6% [(30% + any applicable bonuses) divided by 5].

-

Similarly, for the Production Tax Credit (PTC), a typical value of 2.75¢ per kWh could reduce to 0.55¢ per kWh if reduced by the same factor.

These substantial reductions highlight the importance of adhering to labor and content stipulations to maximize the credits under the specified solar programs.

1) Depreciable Basis Reduction:

-

When claiming the ITC for solar, wind, or geothermal property, the depreciable basis is reduced. The reduction is typically 50% of the credit amount. For instance, if a property's basis is $1,000,000 and qualifies for a 30% ITC, the tax credit reduces the basis to 85% of its original amount, calculated as (100% - 30%/2).

2) Bonus Depreciation:

-

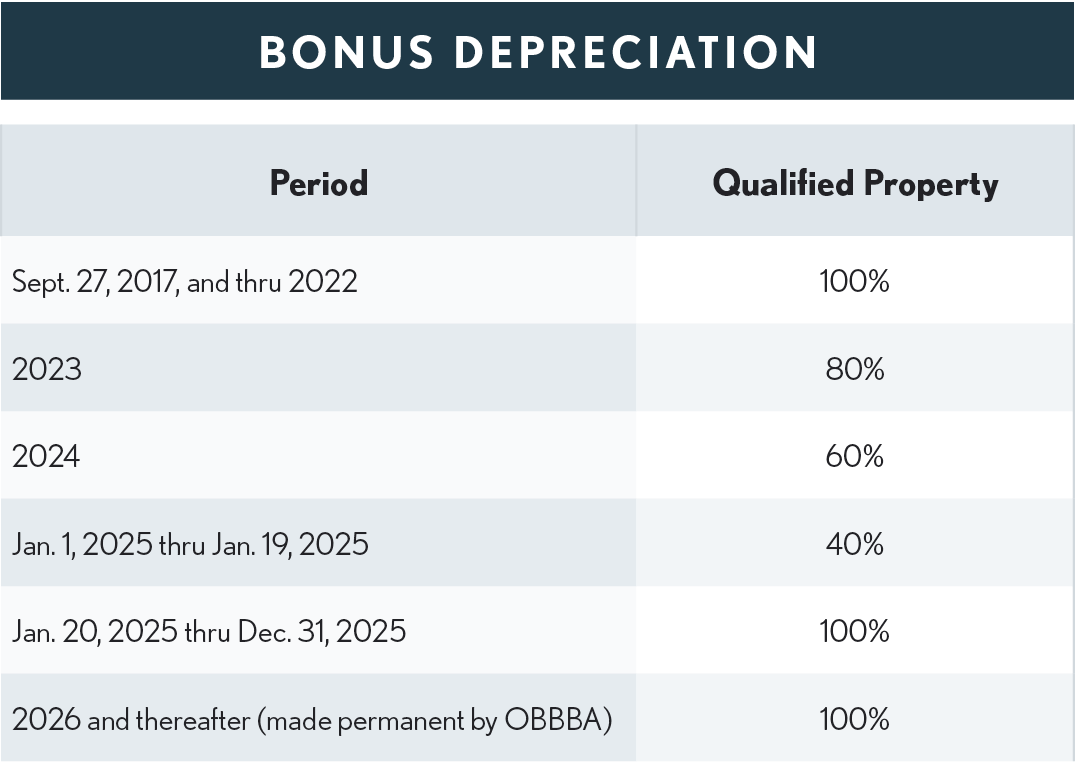

Properties placed in service can qualify for bonus depreciation. Originally, this was 100% for property placed in service by the end of 2022, but due to a phaseout provision, the bonus rate began to reduce as illustrated in the table until OBBBA returned it 100% after January 19, 2025.

3) Accelerated Depreciation (MACRS):

-

These properties can use the Modified Accelerated Cost Recovery System (MACRS) over a five-year schedule.

Integration into General Business Credit - The ITC integrates into a taxpayer's general business credit, which means it can offset various types of federal tax liabilities. This integration enables businesses to optimize their tax positions strategically over time.

Forms and Application Process - Property owners must complete Form 3468 to claim their investment tax credit. This form requires detailed project information, including proof of compliance with labor and domestic content specifications.

Depreciable Life - Per Pub 946, certain geothermal, solar, and wind energy property is 5-year property. Where the panels qualify for the solar credit, depreciable basis is reduced by one-half of the tax credit amount allowed. For example, if you completed installing solar panels in 2020, when the tax credit was 26%, then your depreciation basis would be 87% of the total cost of your solar (100% – [26%*.5]). The annual percentages for 5-year property are included on page 3.04.17.

Typically, property used predominantly for lodging or in connection with lodging is not eligible for the business investment tax credit. This strict rule aims to regulate the tax credit environment, ensuring fairness and resource allocation efficiency. However, certain exceptions provide a strategic advantage for property owners seeking to enhance their facilities with a focus on energy efficiency. (Sec 50 (b)(2))

Exceptions for Energy Property - The tax code makes specific allowances that permit the claiming of investment tax credits even for properties used for lodging under certain conditions. Notably, energy property is a major exception. The exceptions mean that properties incorporating energy-efficient solutions can be eligible for tax credits, fostering efforts towards sustainability. (26 USC § 48(a)(3))