Understanding IRS "Dwelling Unit" Limitations

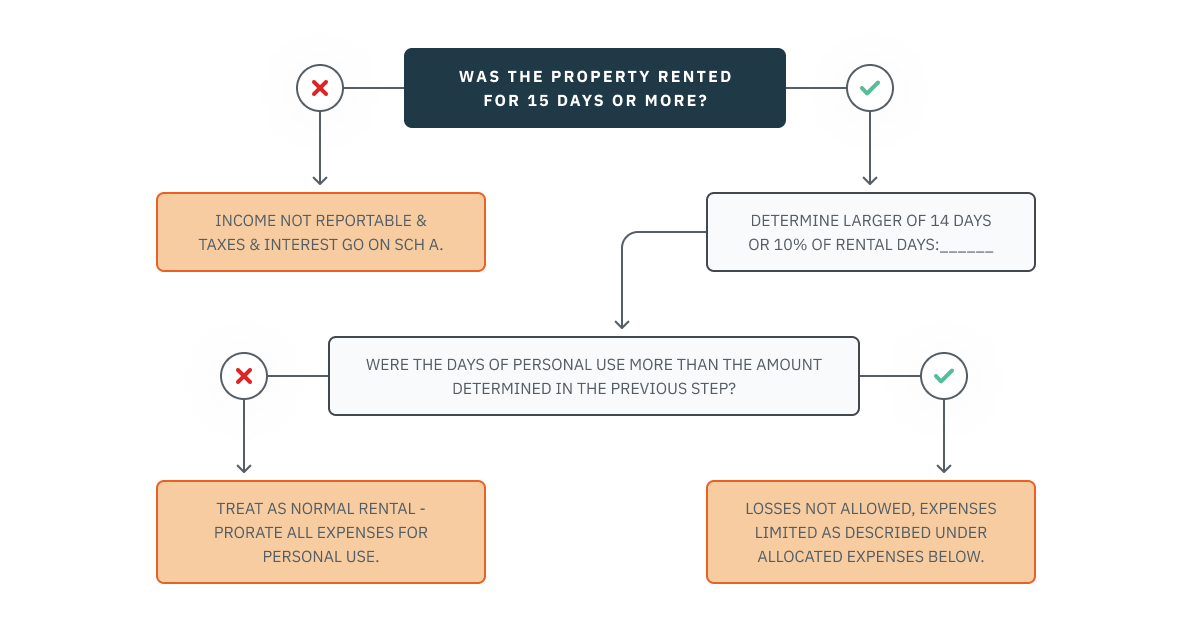

The IRS has special rules for "dwelling units" rented for fewer than 15 days out of a tax year. These limitations are further explained in the flowchart below.

"Dwelling Unit" is Rented for Fewer Than 15 Days

If the “dwelling unit” is rented for fewer than 15 days - Exclude the rental income. Claim no deductions (except qualified mortgage interest and taxes).

Strategy - Rent 14 Days or Less

The rule excluding rental income where the home is rented for fewer than 15 days offers some opportunities for substantial tax-free income, especially for more expensive homes. Here are some examples:

-

Rental as a film location – typically film production companies will pay substantial amounts (thousands per day) for the short-term use of properties as a movie set. Individuals with unique properties can register with a local film location company.

-

Home in vacation locale – individuals with homes in popular tourist or vacation locales can rent their home out while they are on vacation themselves.

-

Home in the area of a special event – when a one-time or special event such as a major sports event (think the Super Bowl) or convention comes to town, hotel rooms may be scarce or even fill up. Homeowners in these locations may want to rent their homes short-term during the activity while getting out of town to avoid the crowds.

Definition of a Day

This is generally “the 24-hour period” for which a day’s rental would be paid. Thus, a person using a dwelling unit from Saturday afternoon through the following Saturday morning would generally be treated as having used the unit for seven days, even though the person was on the premises on eight calendar days.

Unit is Rented 15 Days or More

If the Unit Is Rented 15 Days or More AND the Taxpayer’s Personal Use Is for Fewer Than 15 Days or 10% or Less of the Rental Days - Allocate expenses according to personal vs. rental days. No further limitation is necessary (except the usual “not-for-profit” rules must be considered). A loss can be claimed.

Taxpayer Use is 15 Days or More

If Taxpayer Use Is 15 days or More and Over 10% of the Rental Days - First allocate expenses by personal vs. rental days, as in the previous paragraph. Deduct allocable taxes and interest first, then maintenance and other operating expenses, then depreciation until the net is ZERO. A loss cannot be claimed.