Allocating Vacation Rental Expenses For Taxes

Allocating vacation rental expenses for taxes can be a complex matter. Details about how to separate rental days from personal-use days and more can be found below. If you need assistance, reach out to a qualified tax professional in your area.

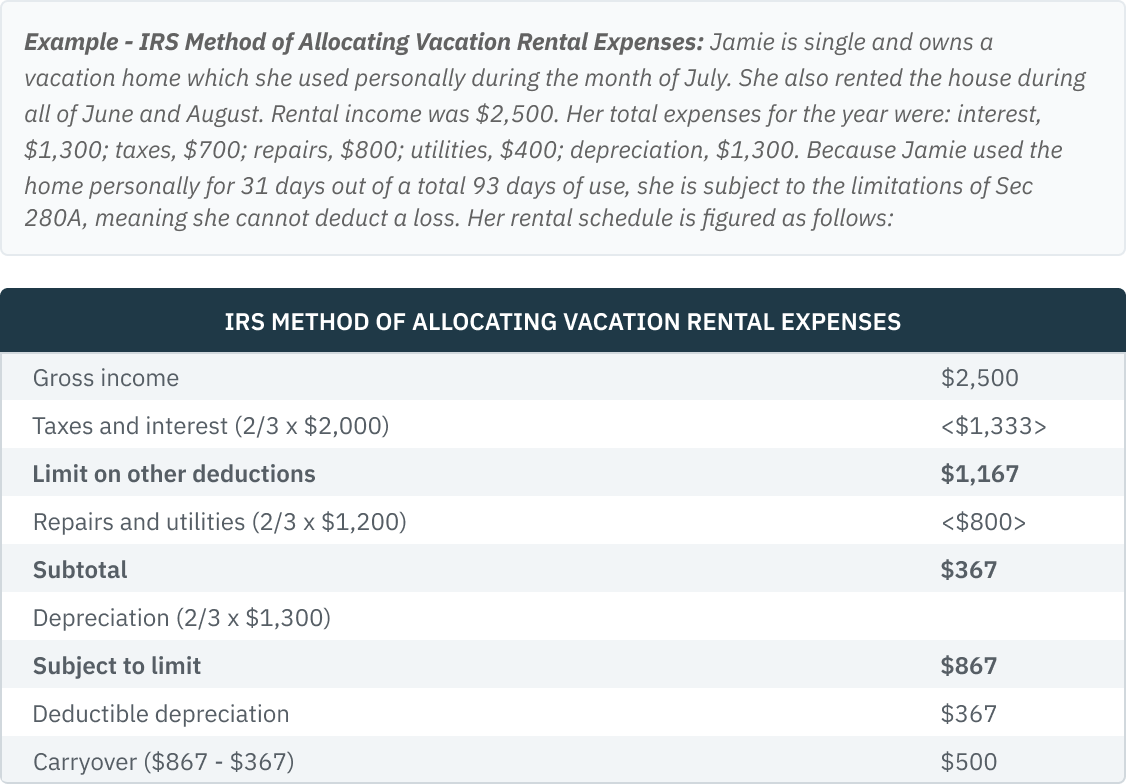

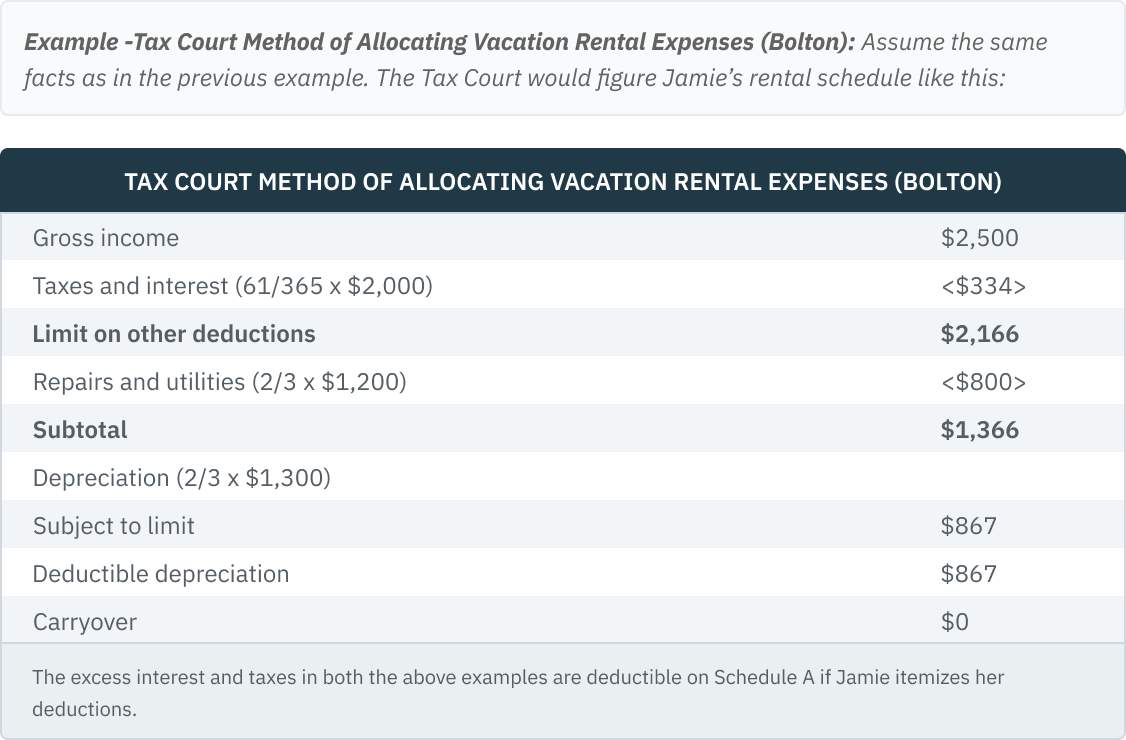

For repairs, utilities, etc., the business percentage is rental days divided by total days used (i.e., personal plus rental). In Bolton v. Comm., 1982, CA9, 694 F2d 556, the Tax Court found that, for computing taxes and interest, the business percentage used is business days divided by 365. The portion of interest and taxes above the percentage are deducted as itemized deductions. This method “frees up” greater deductions for cash expenses or depreciation. The IRS, however, says these expenses should be allocated by using the same type of allocation percentage that’s used for repairs, etc. (i.e., rental days/total days used).

Exception for Principal Residence

Personal vs. rental expenses must still be allocated. The overall limit (i.e., “no loss”) does not apply if the rental period is at least 12 months, OR the rental period ends in the sale of the residence.

Rental Days

Rental days are the days rented at fair rental value. They do not include days the property is just available for rent or the days it is rented under a reciprocal arrangement.

Fair Rental By Co-Owners

According to Prop Regs Sec 1.280A-1(g), fair rental by co-owners is “an amount that is equal to the fair rental of the entire unit multiplied by that co-owner’s fractional interest in the unit.” But elsewhere in the Prop Regs, it is noted that “the totality of rights and obligations of all parties under the agreement is taken into account in determining fair rental.” (Prop Regs Sec 1.280A-1(e)(3))

Example - Determining Business vs. Personal Use - Ted and Tabitha are owners of a fully equipped recreational vehicle. During the month of July, the vehicle is used by three individuals; all of the usage listed below is deemed personal use by the owners.• Ted used the vehicle on a seven-day trip.

-

• Terri, Tabitha’s daughter, rented the vehicle at fair rental for ten days.

• Troy rented the vehicle at fair rental for 12 days under an arrangement whereby Tabitha gets to use for nine days, an apartment owned by Troy’s friend, Tim.

Example - Treatment of Maintenance Time - Lionel owns a lake cottage which he rents during the summer. Lionel and his wife, Leanne, arrived late Thursday evening to prepare the cottage for the rental season. The couple made dinner but did no work on the unit that evening. Lionel spent normal workdays repairing the unit on Friday and Saturday. Leanne helped for a few hours each day but spent most of the time relaxing. By Saturday evening, the necessary maintenance work was complete. Neither Lionel nor Leanne worked on the unit on Sunday; they departed shortly before noon. The principal purpose of the time spent at the unit from Thursday evening through Sunday morning was to perform maintenance work on the unit. Consequently, the use during this period was not considered personal use.

-