Definition of Temporary Workplace For Tax Purposes

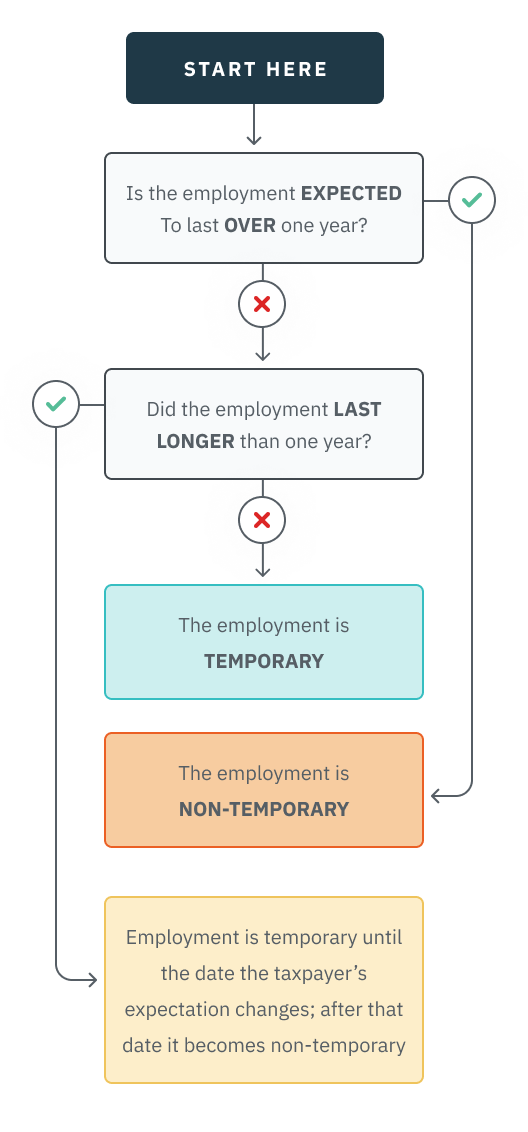

Learn how the IRS defines a temporary workplace for tax purposes. The flowchart [above] can be used to help you determine the status of your current workplace if you have questions. Remember, the IRS's view of a temporary place of employment may not align with your personal view, so it is important to remember this definition is specifically for tax reasons.

Rev Rul 99-7, 1999-5 IRB outlines the IRS’s definition of “temporary workplace” for purposes of determining whether transportation between work and home is deductible. This ruling states:

Employment is temporary if it is realistically expected to last (and does last) for a year or less.

-

If employment at a location is expected to last for over a year, the employment isn’t temporary, regardless of whether it actually exceeds one year.

-

If employment at a location initially is expected to last for one year or less, but later the expectation is for it to exceed a year, the employment is temporary until the date the taxpayer’s expectation changes. After that date, it is non-temporary.

Example - Temporary Job - Ina Hurry normally takes the train 5 miles to work in the city. However, due to output problems, the manager asked her to work for a few months at the company factory located 35 miles away. Ina drives from home to the factory each day; she is reimbursed for her expenses at the business mileage rate. The work at the factory lasts 3 months. Ina’s assignment at the factory is temporary.

-