Tax Treatment of Short-Term Rentals

As the popularity of short-term rentals on websites like Airbnb and VRBO has risen, the IRS has implemented specific rules regarding the tax treatment of these properties.

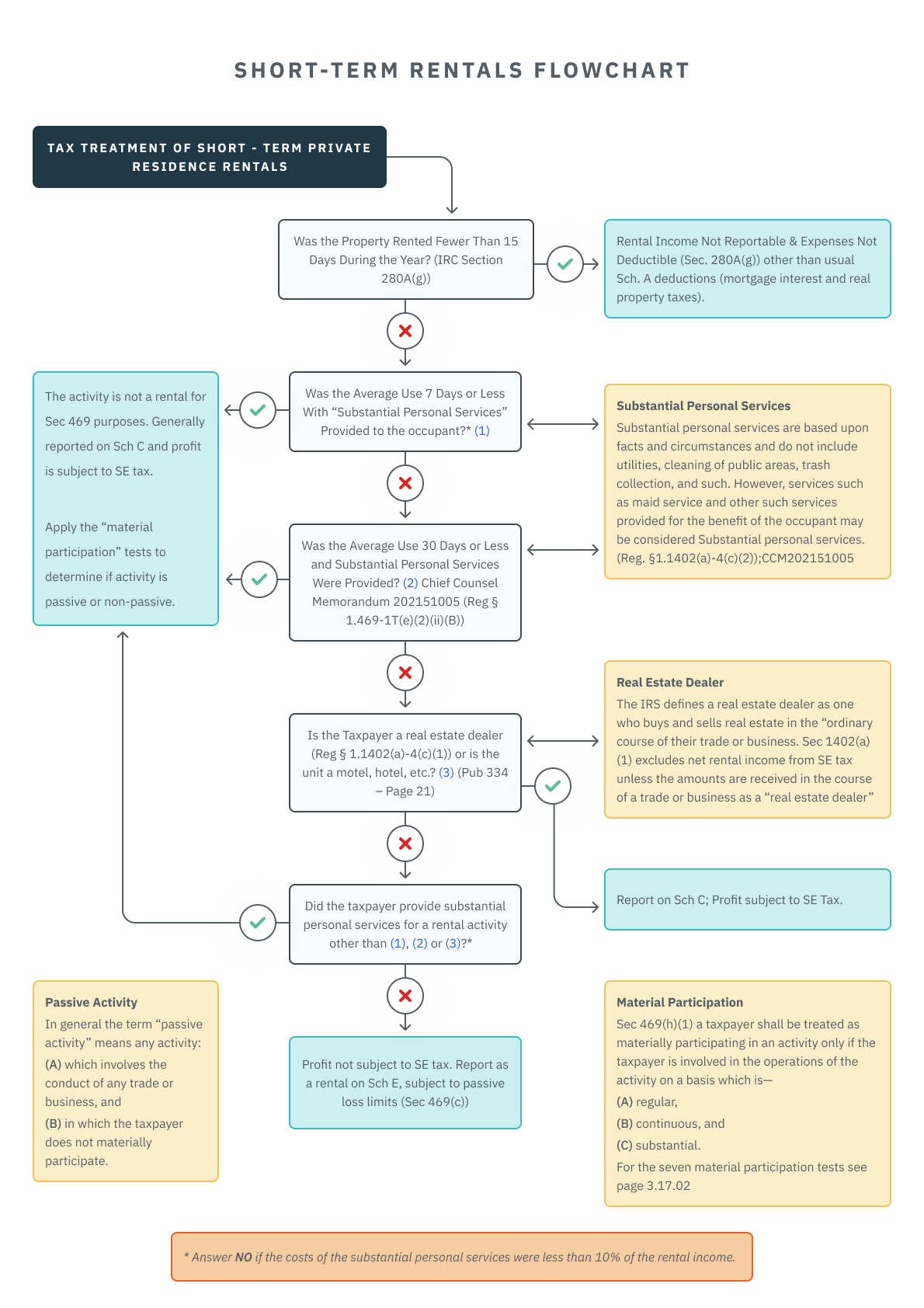

Many taxpayers will rent out their first or second homes using rental agents or online rental services, such as Airbnb, VRBO and HomeAway, that match property owners with prospective renters. When a taxpayer rents their property to others for a short period, special (and sometimes complex) taxation rules come into play, which can make the rents excludable from taxation; other situations may force the rental income and expenses to be reported on Schedule C (as opposed to Schedule E). The following is a synopsis of the rules governing short-term rentals.

Rented for Fewer than 15 Days During the Year

When a property is rented for fewer than 15 days during the tax year, the rental income is not reportable (IRC Section 280A(g)), and the expenses associated with that rental are not deductible. Interest and property taxes are not prorated, and the full amount of the qualified mortgage interest and property taxes, within the limits imposed by the TCJA, are reported on the taxpayer’s Schedule A.

The 7-Day and 30-Day Rules

Rentals are generally passive activities. However, an activity MAY NOT be a rental activity for purposes of the Sec 469 rules if the average customer use of the property is for:

-

7 days or fewer (Reg § 1.469-1T(e)(2)(ii)(A)) or

-

30 days or fewer if the owner (or someone on the owner’s behalf) provides significant personal services (Reg § 1.469-1T(e)(2)(ii)(B)).

Significant Personal Services

Significant personal services do not include utilities, cleaning of public areas, trash collection, and such. However, services that are primarily for the tenant’s convenience, such as regular cleaning, changing linen, maid service, etc., are considered significant personal services (Reg. §1.1402(a)4(c)(2)).

When the activity is a trade or business that is not classified as a rental for Schedule E purposes, the only other option is to report the income and expenses on Schedule C. That opinion is shared by IRS Publication 527. This activity would still be subject to the passive activity loss limitation rules if the taypayer doesn't materially participate in the activity.

Exception to the 30-Day Rule

If the personal services provided are similar to those that generally are provided in connection with long-term rentals of high-grade commercial or residential real property (such as the cleaning of public areas and trash collection), and if the rental also includes maid and linen services, the cost of which is less than 10% of the rental fee, then the personal services are neither significant nor extraordinary for the purposes of the 30-day rule (Reg. 1.469-1T(e)(3)(viii), Example 4).

Where to Report Income

-

Schedule C - if the owner is a real estate dealer (Reg § 1.1402(a)-4(c)(1)) or if the unit is a hotel, motel or similar property (Pub 334 – Page 21).

-

Schedule E - Rent received from real estate held for speculation or investment is reported on Sch E. (Sec 1402(a)(1))

Self-Employment Tax

According to Chief Counsel Memorandum 202151005, net rental income from the rental of living quarters is considered “rentals from real estate” and excluded from net earnings from self-employment when no services are rendered for the occupants. Generally, services are considered rendered to the occupant if they are primarily for the occupant’s convenience and are other than those usually or customarily rendered in connection with the rental of rooms or other space for occupancy only, such as hotels, boarding homes, warehouses and storage garages. (Treas. Reg. § 1.1402(a)-4(c)(2)) So, usually, the typical rental income reported on Schedule E would not be subject to SE tax.

But what about short-term rentals reported on Schedule C are they subject to SE tax? It will depend on the facts and circumstances of each situation and whether the property owner provides substantial services beyond those required to maintain the property in a condition suitable for occupancy. The services provided for the convenience of the occupants must be of such a substantial nature that compensation for them can be said to constitute a material part of the payments made by the occupants.

Example – SE Tax Applies: Mike, who is not a real estate dealer, owns a fully furnished vacation property that he rents out using an online rental marketplace. Mike materially participates in the activity. He provides each renter with linens, kitchen utensils and all other items to make the vacation property fully habitable, and also provides daily maid services, sundries such as individual-use toiletries, dedicated Wi-Fi service for the property, access to the beach and recreational equipment for use during the stay. Mike also provides prepaid vouchers for ride-share services between the rental property and the local business district. The average period of customer use during the year is 7 days, and so the activity is not considered a rental activity for purposes of Sec 469. Because Mike provides substantial services beyond those required to maintain the property in a suitable condition for occupancy, and the services are for the convenience of the renters, the net rental income is self-employment income (i.e., it is not excluded from SE tax under Section 1402(a)(1)).

-

Example – SE Tax Does Not Apply: Diane, who is not a real estate dealer, directly and solely owns and rents, in the course of a trade or business, a fully furnished room and bathroom in a dwelling via an online rental marketplace. The average period of customer use for the year is 7 days, and thus the activity is not considered a rental activity for purposes of Sec 469. Diane does materially participate in the activity, so it is not a passive activity. Renters have access only to the common areas of the home to enter and exit the room and bathroom and do not have access to other common areas such as the kitchen and laundry room. Diane cleans the room and bathroom between customers. Since Diane does not provide substantial services beyond those required to maintain the space in a condition suitable for occupancy, the net rental income is excluded from self-employment income. The cleaning and maintenance services Diane provides are to maintain the space in a suitable condition for occupancy and aren’t furnished primarily for the convenience of the renters.

As to real estate dealers, defined as being engaged in the business of selling real estate to customers with the purpose of making a profit from those sales, the rent received from real estate held for sale to customers is subject to SE tax. However, rent received from real estate held for speculation or investment is not subject to SE tax unless services are rendered for the occupants as explained above.

Trade or Business

In Hazard v Commissioner T.C. 372 (1946), the Tax Court held that the taxpayer’s single rental was a trade or business. The IRS lost its appeal of that decision, and subsequently acquiesced to the Hazard decision. Generally, the courts follow the outcome in Hazard except for the 2nd Circuit where the court of appeals’ position is that broader activity than that in Hazard was needed for a rental to constitute a trade or business (Grier v. U.S., 218 F.2d 603 (2nd Cir. 1955)).