Aggregating (Grouping) Passive Activities

Aggregating, or grouping, passive activities is a tax strategy that can be beneficial for some taxpayers.

A taxpayer can elect to treat one or more trade or business activities, or rental activities, as a single activity if those activities form an appropriate economic unit for measuring gain or loss under the passive activity rules.

Benefits of Grouping

If a taxpayer groups two (or more) activities into one larger activity, the taxpayer need only show material participation in the activity as a whole. For rental properties, grouping can be important in determining whether the 10% ownership requirement for active participation in rental real estate is achieved.

Drawbacks of Grouping

The main downside to grouping is that if only one of the activities in the group is disposed of, then the taxpayer has not disposed of his or her entire interest in the activity, and the suspended passive losses cannot be released at that time.

What Constitutes an Economic Unit?

The following factors have the greatest weight in determining whether activities form an appropriate economic unit:

-

Similarities and differences in the types of trades or businesses

-

Extent of common control

-

Extent of common ownership

-

Geographical location, and

-

Interdependencies between or among activities (for example, the extent to which the activities purchase or sell goods between or among themselves, involve products or services that are generally provided together, have the same customers or employees, or are accounted for with a single set of books).

A rental activity and a trade or business activity cannot be grouped together unless either activity is insubstantial when compared to the other activity. Further, a rental of real property activity and an activity involving the rental of personal property generally cannot be treated as a single activity.

Aggregation Election & Disclosure Requirement

Once the election to aggregate activities is made, the taxpayer is not allowed to regroup the activities unless the original grouping was clearly inappropriate or the facts and circumstances have changed, making the original grouping inappropriate. The IRS may regroup the activities if the taxpayer’s grouping fails to reflect economic reality and one of the primary purposes of the taxpayer’s original grouping was to avoid the Sec. 469 rules.

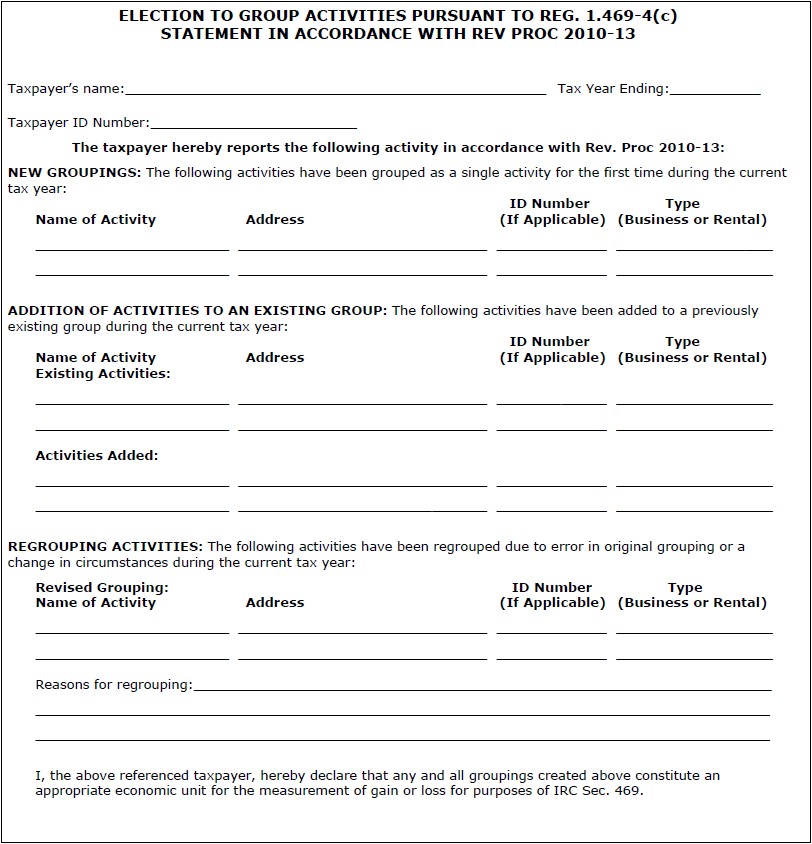

Rev. Proc. 2010-13 requires taxpayers to disclose changes made to the grouping of activities by including a statement with the timely filed (including extensions) return for the year in which two or more activities are first grouped together, a new activity is added to an existing group, or an existing group is regrouped. The disclosure requirement is effective for tax years beginning after January 24, 2010. Failing to report these changes results in each activity being treated as a separate activity. Sample election and statement are shown below.

Grouping Fresh Start Allowed for Taxpayers Subject to the 3.8% Surtax

Because of the enactment of Sec 1411, the 3.8% tax on net investment income (see chapter 12.05), proposed regulations include amendments to the Sec 469 regulations to permit taxpayers to elect to regroup their activities for passive activity loss purposes in the first taxable year that they become subject to the 3.8% surtax. Without permitting regroupings, taxpayers would be bound by their original grouping decisions – some of which may be two decades or more old. Any regrouping must comply with the disclosure and reporting requirements of Reg. 1.469-4(e) and Rev. Proc. 2010-13. A taxpayer may regroup activities only once under this provision, and the regrouping will apply to the taxable year for which the regrouping is done and all subsequent years.