Tax Information For Multiple Offices Including Home Office

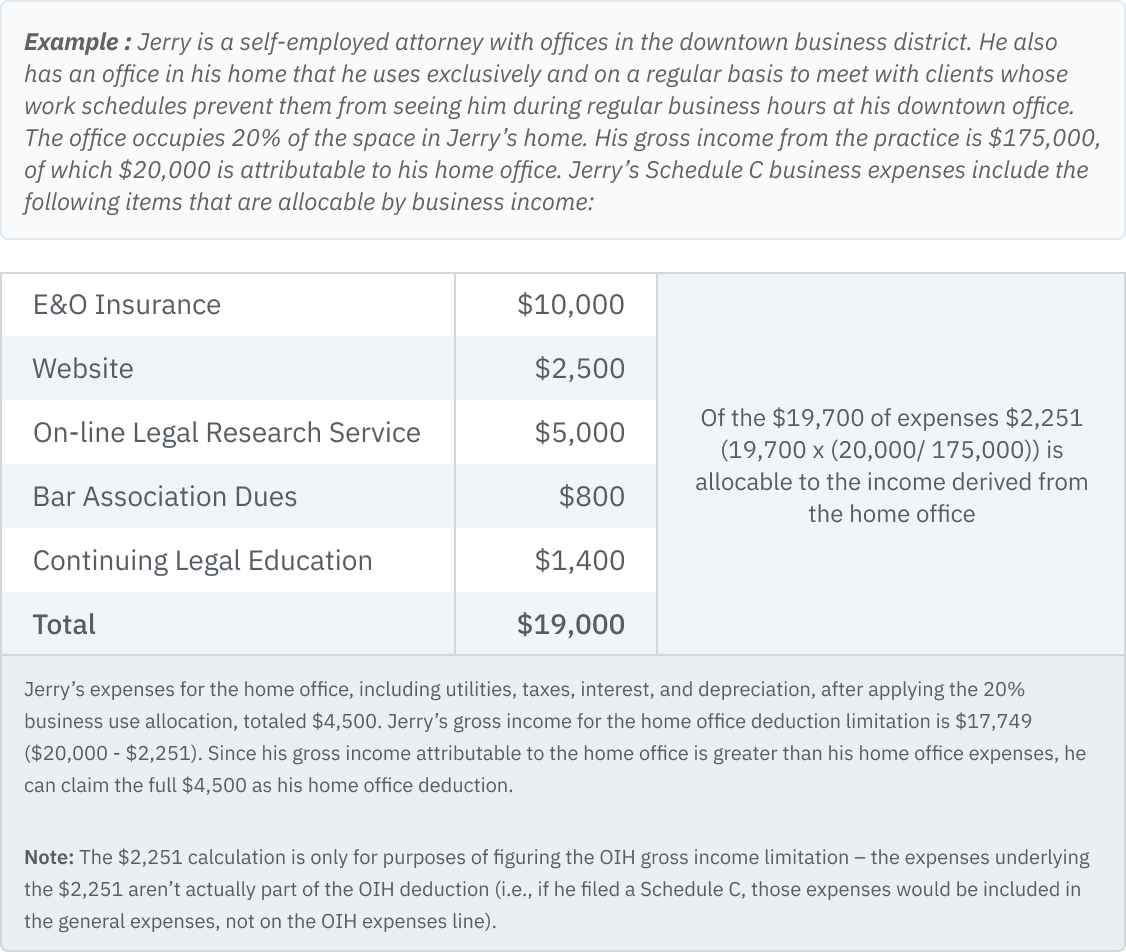

Where gross income is derived both from the business use of a home office and from the business use of other facilities, a reasonable allocation, based on the facts and circumstances of each case, must be made to determine what portion of the gross income is derived from the business use of the home. (S Rept No. 94-938 (PL 94-455) p. 149) In making the allocation, the time spent at each business location, the business investment in each location, and any other relevant facts and circumstances, should be taken into account. (IRS Publication 587, 2021, pg. 10; Prop Reg § 1.280A-2(i)(2)(ii)) After determining the part of gross income attributable to the home office (as opposed to other business locations), the taxpayer must subtract from that amount the total expenses (other than those related to use of the home) that are allocable to the business in which the home is used. The result will be the home office deduction limitation. (Form 8829 (2021 Instructions, page 2).

Income Attributable to the Home Office

When determining the income attributable to the home office, consider all business income including Schedule C, Form 8949/Schedule D and Form 4797.

Expenses Allocable to the Home Office (for Gross Income Limitation)

Prorate expenses such as business insurance, professional dues, and education expenses between the home office and the other business locations based upon the income attributable to each location. Other expenses such as utilities, taxes, supplies, salaries, equipment, and similar expenses should be allocated to the specific location where they are used or incurred.