Comprehensive Real Property Section 1031 Exchange Example

Below, find a comprehensive example of a real property exchange following the regulations in IRS tax code Section 1031. If you need help understanding this example, or if you have other questions about tax-deferred exchanges, schedule a consultation with a local tax professioanl

Step #1 – Make sure the transaction qualifies for Sec 1031 treatment.

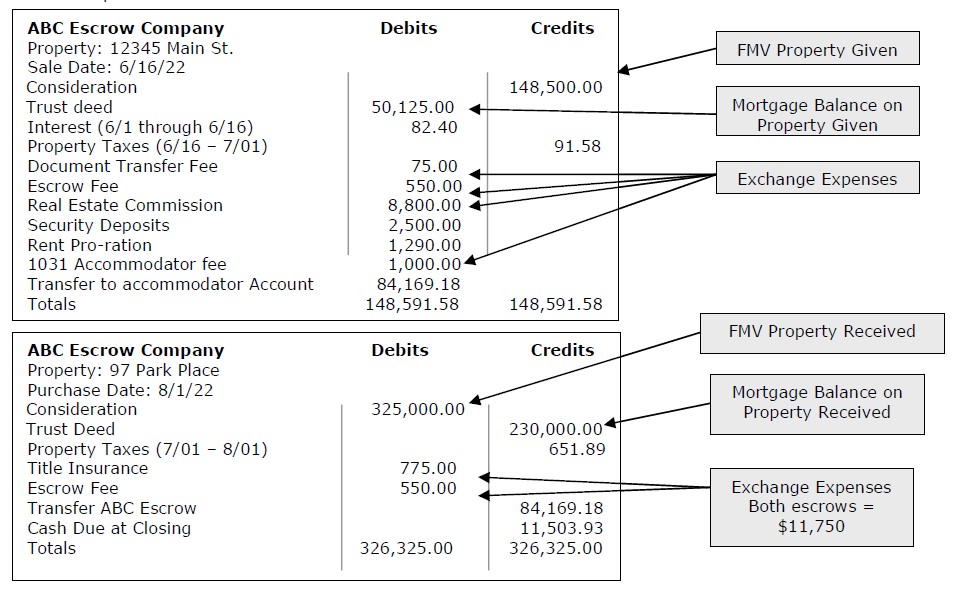

Step #2 – Analyze the sale and purchase escrows determining FMVs, Mortgage Balances, and Exchange expenses.

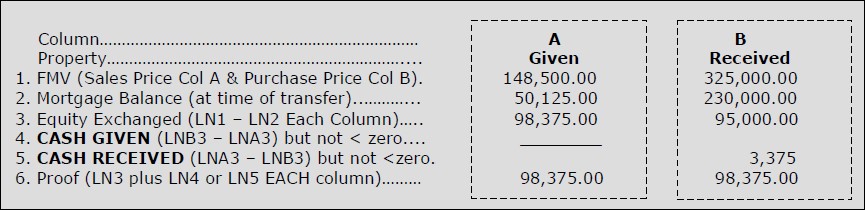

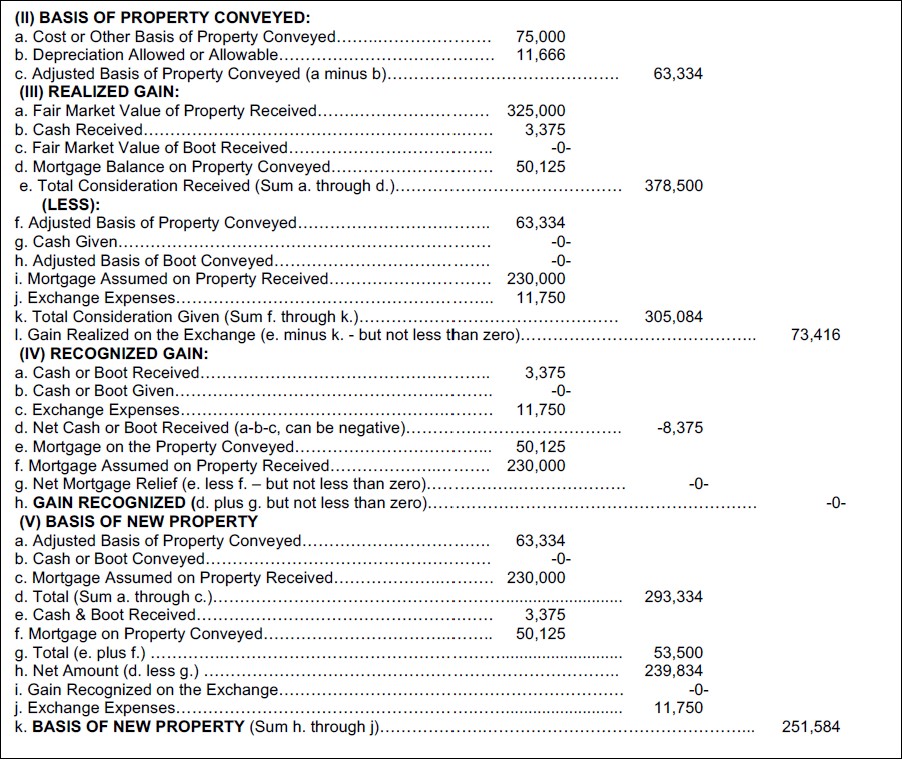

Step #3 - Determine the cash given or received in the exchange. From the worksheet below, we determine that cash in the amount of $3,375 was received in the exchange. Note: Cash generally represents taxable gain, but that gain can be reduced by exchange expenses. Thus, without going any further, we are reasonably sure there is no taxable event in this exchange.

Step #4 – Complete the Schedule E and depreciation schedule for the property given which has been used as a residential rental. In this example, we had the following items from the sale escrow that flow over to the Schedule E.

-

Income adjustment for prorated rents <1,290>

-

Income adjustment security deposits (if originally treated as income) <2,500>

-

Credit for property tax pro-ration in escrow <91.58>

-

Mortgage Interest (if not already included on 1098 for the year) 82.40

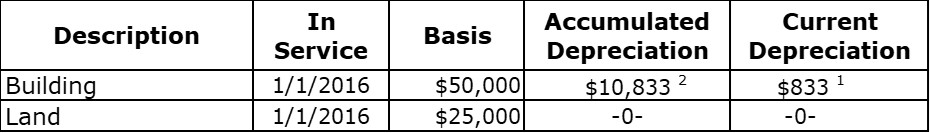

Finish the depreciation schedule since the basis and accumulated depreciation will be needed to complete the Section 1031 computation.

[1] $50,000 x .03636 x 5.5/12 (Half month convention Jan – May = 5 + ½ for June)

[2] $50,000 x .03636 x 5.95833 = $10,833 5 yrs + 11.5 months = 5.95833

Thus, the:

-

Original basis is $75,000 ($50,000 + $25,000).

-

Accumulated depreciation to the date of the exchange is $11,666 ($10,833 + $833).

-

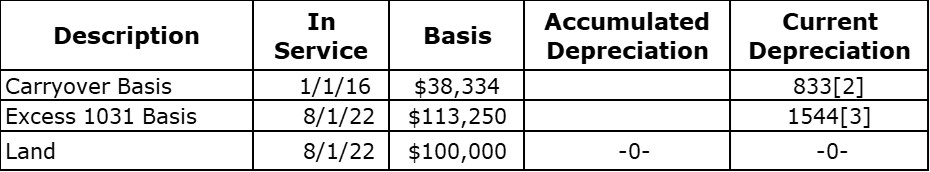

Adjusted basis at exchange date $63,334 ($50,000 – 11,666 + $25,000), of which the remaining depreciable basis is $38,334 ($50,000 – 11,666).

Now you have accumulated all of the numbers required to complete the exchanges computation.

Step #5 – Complete the 1031 Exchange Worksheet.

Step #6 - The hardest part of an exchange is to get the information into your tax preparation software and have the software compute the exchange correctly. Seems they all do it a little differently. But you have the answer and know what the results should be.

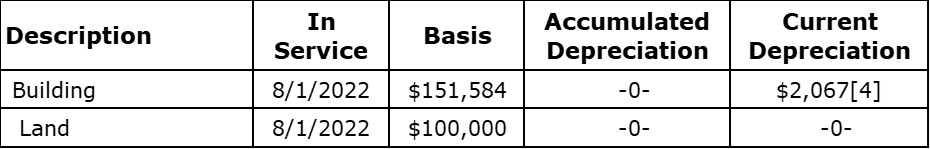

Step #7 – Set up the depreciation for the replacement (acquired) property, which is also going to be used as a residential rental. Assuming a land allocation of $100,000, the depreciation options for this property would be:

Non-elective depreciation for the replacement property would look like:

[2] $38,334 x .04743 x 4.5/12 = 682 $38,334 = 50,000 – 10,833 – 833 .04743 = 1/21.083 years (remaining life)

[3] $113,250 x .03636 x 4.5/12

Electing out of the split-basis approach, the depreciation would look like: