Reverse Exchange Tax Rules

If you plan to engage in a reverse exchange transaction, or you already have during his tax year, it is important to understand the tax implications before you file.

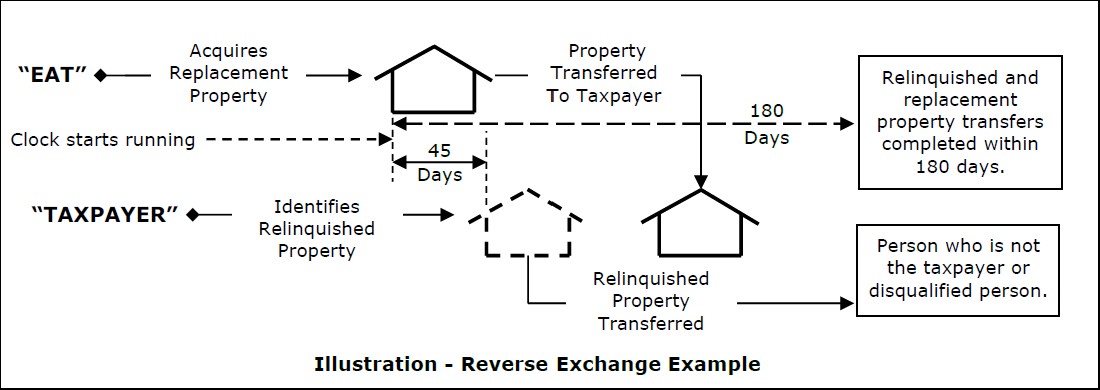

A reverse exchange is a transaction in which a taxpayer receives replacement property and subsequently transfers relinquished property. It is distinguished from a deferred exchange, which is a transaction in which a taxpayer transfers relinquished property and subsequently receives replacement property. Rev. Proc. 2000-37 offers guidance for taxpayers that engage in so-called “reverse” like-kind exchanges.

Until Rev. Proc. 2000-37 was published, there was no authority on which taxpayers could safely rely to structure reverse exchanges. In Rev. Proc. 2000-37, the Service took the position that a taxpayer may use a “parking arrangement” to effectuate the equivalent of a reverse exchange and thereby qualify for like-kind exchange treatment. The Procedure consists of three parts:

-

Safe harbor,

-

Nine requirements,

-

Several allowed agreements

Reverse Exchanges Require Financial Resources

To accomplish a reverse exchange requires the replacement property be acquired before the equity in the relinquished property is available. Thus, the taxpayer must have the ability to fund the purchase of the replacement property without the benefit of the capital from the relinquished property.

Safe Harbor

The Rev. Proc. 2000-37 safe harbor is found in Section 4.01 of the Procedure and states: The Service will not challenge the qualification of property as either "replacement property" or "relinquished property" (as defined in section 1.1031(k)-1(a)) for purposes of Section 1031 and the regulations thereunder, or the treatment of the exchange accommodation titleholder [EAT] as the beneficial owner of such property for Federal income tax purposes, if the property is held in a QEAA [qualified exchange accommodation arrangement].

Thus, if either the replacement property or the relinquished property is held in a QEAA, the Service will treat the EAT as the beneficial owner of the property so held. The effect of this rule is that the Service will ignore factors often used by courts in determining who owns property and treat the EAT as the owner of the property. To obtain this treatment, however, the property must be held in a QEAA. Property is treated as being held in a QEAA if all of the requirements listed in the Procedure (discussed below) are met.

-

The EAT must satisfy certain requirements. A person other than the taxpayer or a disqualified person must serve as the EAT. The Service does not define "disqualified person" in the Procedure. The definition of "disqualified person" found in Reg. 1.1031(k)-1(k) (i.e., the taxpayer's agent or a person related to the taxpayer), however, appears to apply in this context.

-

The EAT must be subject to U.S. income tax.

-

The EAT must hold qualified indicia of ownership. The Procedure defines "qualified indicia of ownership" to mean "legal title to the property, other indicia of ownership of property that are treated as beneficial ownership of the property under applicable principles of commercial law (e.g. a contract for deed), or interests in an entity that is disregarded as an entity separate from its owner for Federal income tax purposes (e.g., a single-member limited liability company) and that holds either legal title to the property or such other indicia of ownership."

-

The taxpayer must have a bona fide intent to do a Section 1031 exchange., At the time the EAT receives the qualified indicia of ownership, the taxpayer must have the bona fide intent that the property held by the EAT represents either replacement property or relinquished property in an exchange that is intended to qualify for nonrecognition of gain (in whole or in part) or loss under Section 1031.

-

The agreement must be in writing. The taxpayer and the EAT must enter into a written agreement no later than five business days after the accommodation titleholder receives qualified indicia of ownership. The agreement must provide that:

-

The EAT is holding the property for the benefit of the taxpayer in order to facilitate an exchange under Section 1031 and Rev. Proc. 2000-37.,

-

The taxpayer and the EAT agree to report the acquisition, holding, and disposition of the property as provided in Rev. Proc. 2000-37.,

-

The EAT will be treated as the beneficial owner of the property for all Federal income tax purposes. Furthermore, the taxpayer and the EAT must report the tax attributes of the property on their tax returns in a manner consistent with this agreement. This means that the taxpayer cannot deduct depreciation for property held by the EAT. The EAT must also recognize gain or loss on the disposition of any property it holds unless the gain or loss is otherwise specifically excluded from the EAT's income.

-

-

Relinquished property must be properly identified. The taxpayer must identify the relinquished property within 45 days after the EAT receives a qualified indicia of ownership of the replacement property. Identification must be made in accordance with Reg. 1.1031(k)-1(c), and the taxpayer may identify alternative and multiple properties, as described in Reg. 1.1031(k)-1(c)(4).

-

Holding period limitation: exchange-last arrangements. In an exchange-last arrangement, within 180 days after the EAT receives qualified indicia of ownership in the replacement property, the replacement property must be transferred either directly, or indirectly, through a qualified intermediary to the taxpayer.

-

Holding period limitation: exchange-first arrangement. If the transaction is an exchange first arrangement, within 180 days after the EAT receives a qualified indicia of ownership in the relinquished property, the relinquished property must be transferred to a person who is not the taxpayer or a disqualified person.

-

Aggregate holding period limitations. The replacement property and relinquished property cannot be held in a qualified exchange accommodation arrangement for more than a combined total of 180 days.

Allowed Agreements

The true benefit of Rev. Proc. 2000-37 is found in its Section 4.03, which states that the Service will allow taxpayers to enter into several agreements with an EAT without affecting the safe harbor. Discussed below are the allowed agreements.

-

EAT as qualified intermediary - The EAT may enter into an exchange agreement with the taxpayer to serve as a qualified intermediary so long as the EAT otherwise qualifies as a qualified intermediary. Thus, if the EAT qualifies as a qualified intermediary, the EAT is not treated as the taxpayer's agent for purposes of determining whether the taxpayer is in constructive receipt of money or other property held by the EAT., Thus, the EAT may sell the taxpayer's relinquished property and use the proceeds from the sale to acquire other replacement property or make improvements on property held by the EAT without causing the transaction to fail to qualify for like-kind exchange treatment.

-

Guarantee allowed - The taxpayer or a disqualified person may guarantee some or all of the obligations of the EAT, regardless of whether such obligations are secured or unsecured. Furthermore, the taxpayer may indemnify the EAT against costs and expenses incurred with respect to the transaction. This provision allows the EAT to protect itself against any unexpected costs that may arise with respect to the transaction. Thus, the EAT may immunize itself from a significant amount of risk to which an owner of property would otherwise be exposed.

-

Other-than-market loans allowed - A taxpayer or a disqualified person is allowed to loan or advance funds to the EAT at other than an arm's-length rate of interest or guarantee a loan or advance to the EAT. This provision allows the EAT to use the taxpayer's money interest-free. As mentioned below, this may come with strings attached since Sections 7872 and 1272 may result in interest income being imputed to the taxpayer.

-

Other-than-market leases allowed - The EAT may lease the property of which it holds a qualified indicia of ownership to the taxpayer or a disqualified person at other than an arm's length rental amount. This provision allows the taxpayer to take possession of the property rent-free, while the EAT holds title to the property.

-

Other-than-market services allowed - The taxpayer or a disqualified person may manage the property, supervise improvement of the property, act as contractor, or otherwise provide services to the EAT with respect to the property at other than an arm's-length charge during the period the EAT holds title to the property. Thus, a taxpayer may construct an improvement on the property while the EAT holds qualified indicia of ownership of the property, and the EAT may receive such services for a nominal amount. Furthermore, a taxpayer may transfer property to an EAT and continue to manage the property after it is transferred. Under such a situation, there will be no noticeable change in the ownership of the property. These allowances give the taxpayer great latitude in setting up “parking arrangements”.

-

Option-type agreements allowed -The taxpayer and the EAT may enter into option-type agreements or arrangements relating to the purchase or sale of the property. These types of agreements allow the taxpayer to obtain an option to purchase replacement property that the EAT holds and allows the EAT to obtain an option to sell replacement property to the taxpayer at the end of the 180-day holding period. By using this type of agreement, the contract between the taxpayer and the EAT can create a present obligation in the EAT to execute and deliver a deed to the taxpayer and can create a present obligation in the taxpayer to make payments to the EAT either in cash or in the form of relinquished property.

-

Adjustments for economic risk allowed - The taxpayer and the EAT may agree or arrange for the taxpayer to advance additional funds or receive funds from the EAT if the value of the relinquished property fluctuates while held by the EAT. An agreement of this sort allows the parties to shift the economic risk of loss or damage to the property to the taxpayer without affecting whom the Service considers to be the beneficial owner of the property.