Worksheets & IRS Forms For 199A Deduction

Below, you will find worksheets and IRS forms that you may need to submit to claim the Section 199A deduction. Not every taxpayer will necessarily need to submit every form. A local tax professional can look at your unique situation and help you fill out the necessary tax paperwork.

The following blank worksheets are provided:

CAUTION

SECTION 199A IS COMPLEX IN ITS WORDING AND ALTHOUGH WE USED OUR BEST EFFORTS TO DEVELOP WORKSHEETS TO COMPUTE THE DEDUCTION, THE ULTIMATE IRS INTERPRETATION MAY BE SOMEWHAT DIFFERENT THAN OURS. THEREFORE, IF YOU USE THESE WORKSHEETS, YOU DO SO AT YOUR OWN RISK.

The IRS provides forms that take the place of the worksheets used in this gide. These forms are:

-

Form 8995 - Qualified Business Income Deduction Simplified Computation with 10 pages of instructions. Used when the taxpayer’s taxable income is less than the threshold amount.

-

Form 8995-A - Qualified Business Income Deduction with 11 pages of instructions. In addition, the following schedules were used to feed amounts to the 8995-A:

-

Sch A (Form 8995-A – For SSTBs when taxpayer’s taxable income is between the threshold and the cap.

-

Sch B (Form 8995-A) – For aggregation of business operations.

-

Sch C (Form 8995-A) – For loss netting and carry forward.

-

Sch D (Form 8995-A) – Deals with farming cooperatives and patrons.

-

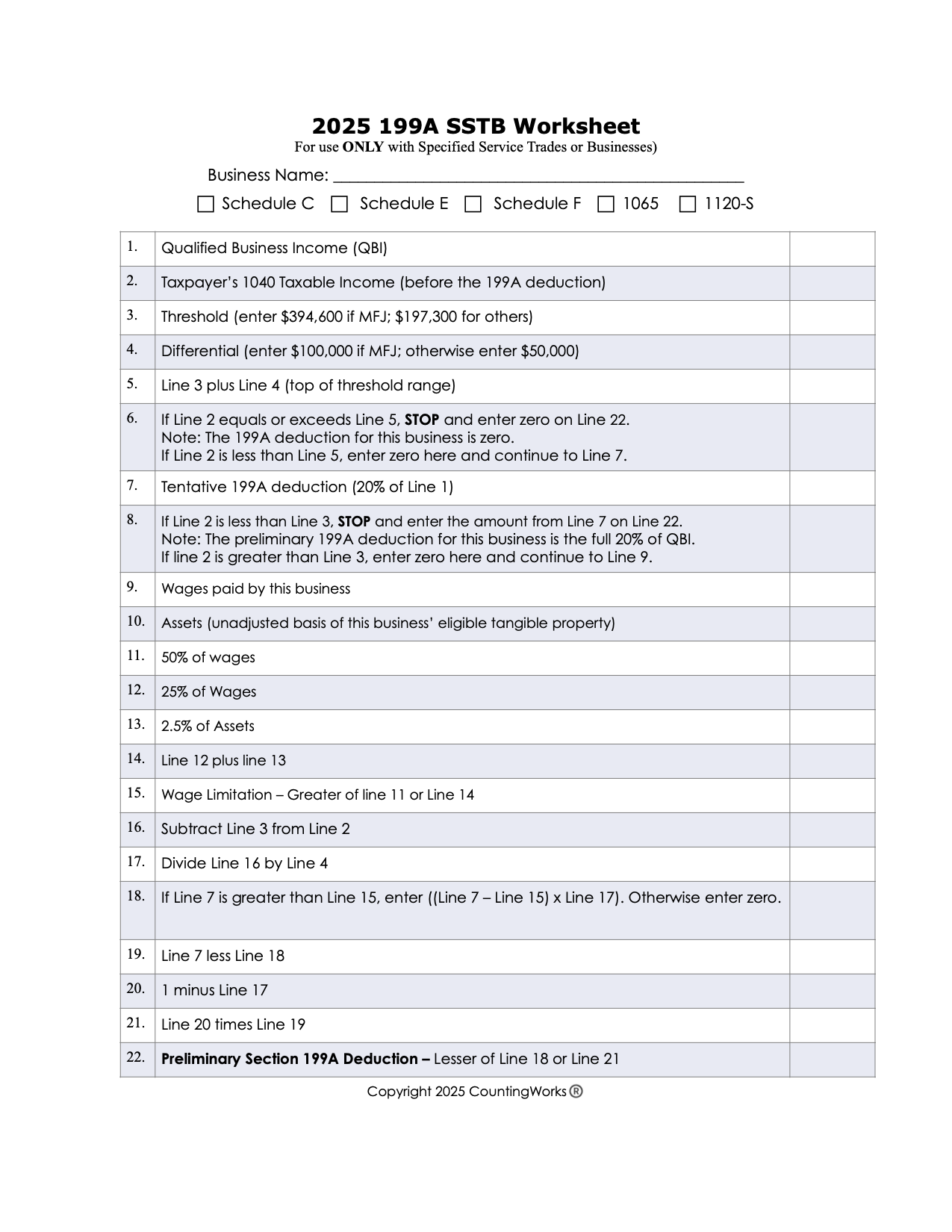

Instructions: This worksheet can only be used for specified service trade or businesses. It is designed to determine the 199A deduction for a single business. The results of this worksheet must be combined with the results from other businesses and flow-through income of the taxpayer to determine the combined Sec 199A deduction for the taxpayer. The combined Sec 199A deduction is further limited to 20% of the adjusted taxable income of the taxpayer.

CountingWorks has a separate worksheet for use with other qualified businesses. Although we believe the worksheets compute the deduction correctly, ultimately, the IRS forms and schedules take precedence.

Specified Service Trade or Businesses: Generally, includes any trade or business described in Sec 1202(e)(3)(A), but excluding engineering and architecture and trades or businesses that involve the performance of services that consist of investment-type activities. Specified service businesses include trades or businesses involving the performance of services in the fields of: health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees as defined in Prop Reg. 1.199A-5(b)(2)(xiv)

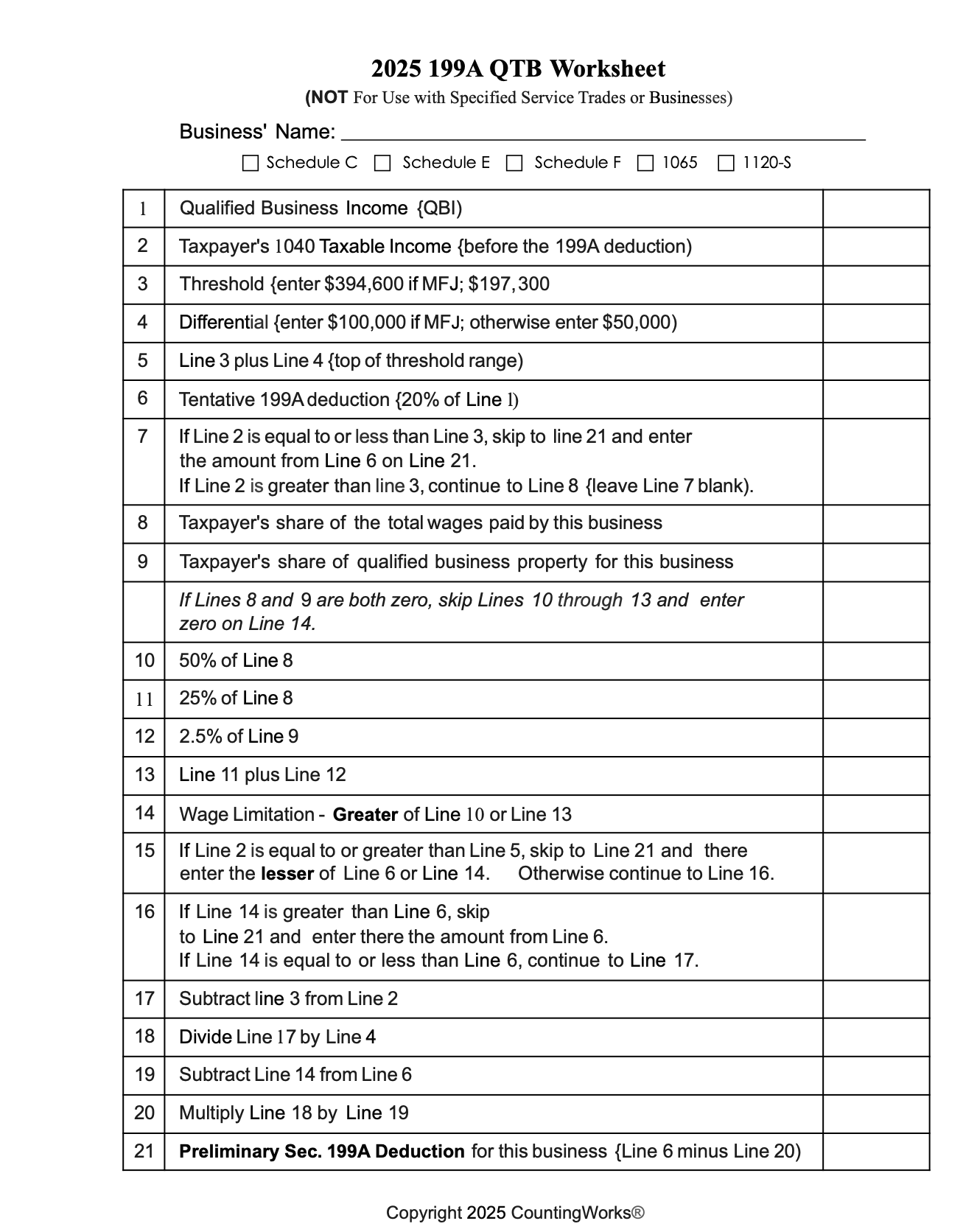

Instructions: This worksheet is designed to determine the 199A deduction for a single business activity. However, it cannot be used for specified service trades or businesses. The results of this worksheet must be combined with the results from other businesses and flow-through income of the taxpayer to determine the combined Sec 199A deduction for the taxpayer. The combined Sec 199A deduction is further limited to 20% of the adjusted taxable income of the taxpayer.

CountingWorks has a separate worksheet for use with specified service trades or businesses. Although we believe the worksheets compute the deduction correctly, ultimately, the IRS forms and schedules take precedence.

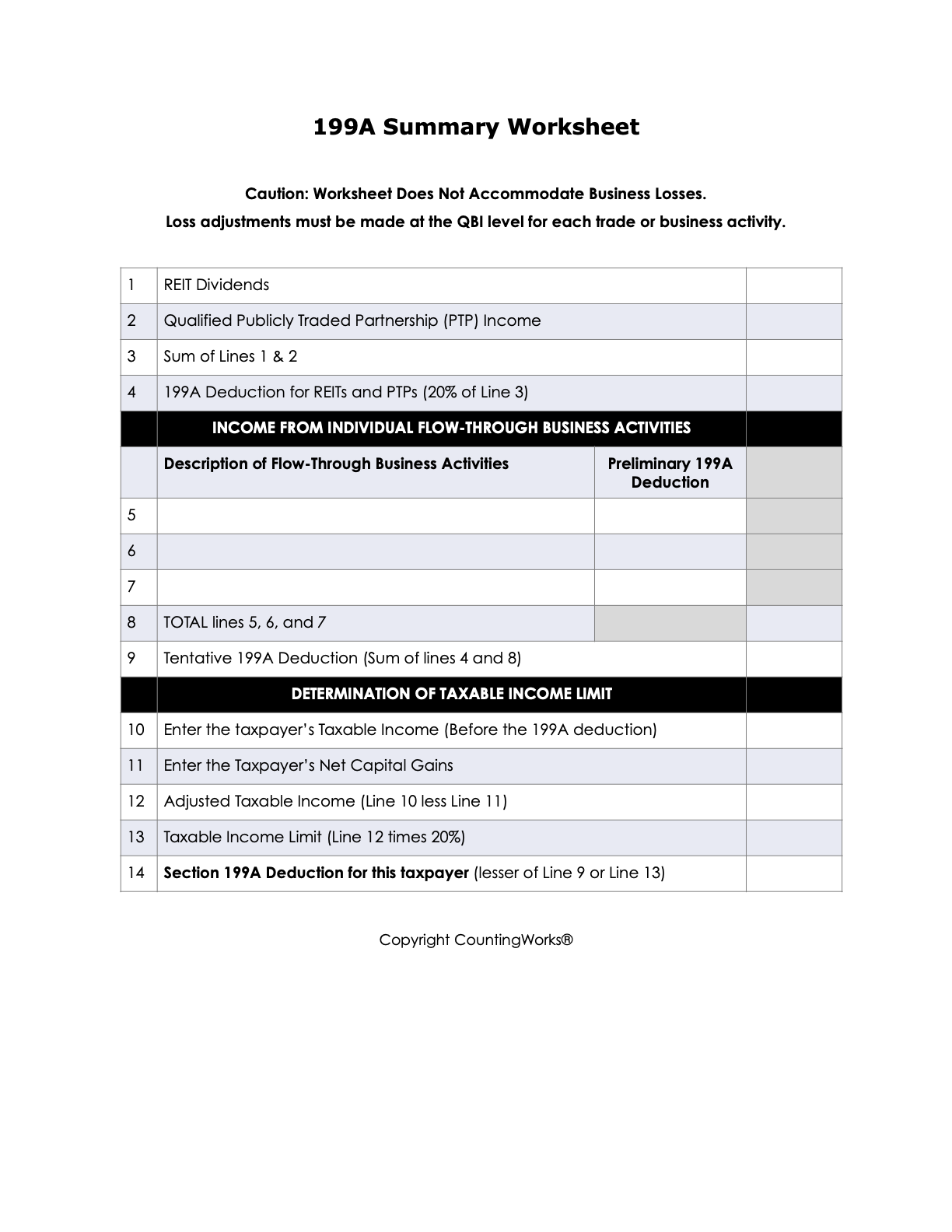

Instructions: This worksheet is designed to summarize all of the 199A deductions of the taxpayer and apply the final taxable income limit. It does not accommodate situations where one or more of the taxpayer’s pass-through businesses has a negative QBI.

CountingWorks has two worksheets to develop the information needed for lines 5 thru 9. They include (1) Worksheet for most businesses and a (2) Worksheet for specified services trades or businesses. Although we believe the worksheets compute the deduction correctly, ultimately, the IRS forms and schedules take precedence.

Instructions:

1. Precautions:

a. The taxpayer’s taxable income is assumed to be such that without benefit of the wage limitation the 199A deduction would be zero.

b. Do not include any SSTBs, as they are not allowed to be aggregated.

c. If any entity is showing a loss, the allocation of the negative QBI among the positive QBIs must be completed before using this worksheet.

2. Enter the IDs of the QTBs to be aggregated in Column A, the QBIs from the businesses in column B, the wages in column D and the UBIAs in column E.

3. Next, complete the calculation indicated for columns C, F, G, H, I, J and K for each QTB and enter the results in the box for that QTB.

4. Next, total the amounts in column K and enter results in the “total” box.

5. Next, In the “Aggregated QTBs” row, total the amounts in columns B, D and E.

6. Next, for the “Aggregated QTBs” row, complete the calculations indicated for columns C, F, G, H, I, J and K.

7. The benefit from aggregation is the excess of the amount in the “Aggregation” box over the amount in the “Total” box.

8. CAUTION: Just because this worksheet indicates the aggregation provides a benefit does not mean the QTBs aggregated in this worksheet qualify to be aggregated. That is a separate determination. This worksheet does not take the place of Schedule B of Form 8995-A.