Trade or Business Aggregation to Maximize 199A Deduction

One way to potentially maximize the 199A deduction is with trade or business aggregation. If you have further questions about this tax strategy after reading this guide, consult with a qualified tax professional in your area.

Aggregating (grouping) trades or businesses offers taxpayers a means of combining their trades or businesses for purposes of applying the W-2 wage and UBIA of qualified property limitations and potentially maximizing the deduction under Section 199A. If such aggregation were not permitted, taxpayers could be forced to incur costs to restructure their business activities solely for tax purposes. In addition, business and non-tax law requirements may not permit many taxpayers to restructure their operations. The IRS feels Sec 469 passive activity grouping is inappropriate relative to the 199A deduction, and therefore provides a separate form of grouping for 199A purposes, that permits the aggregation of separate trades or businesses, provided certain requirements are satisfied.

These grouping rules can become quite complicated because they may be made at the business entity level as well as the individual level. For purposes of this material, although we do include the rules applicable to entity aggregation, we will generally limit the discussion to aggregations at the individual level.

Who Should Consider Aggregation?

Taxpayers whose taxable income exceeds the 199A deduction phaseout thresholds and who must rely on the wage limitation in order to qualify their QTB (not SSTB) for a deduction. Taxpayers with taxable income below the phaseout threshold amount do not benefit from aggregation. Aggregation is optional.

Before getting into an illustration, remember the 199A deduction figured at entity level is the lesser of:

-

20% of QBI (net of the Form 1040 adjustments for 50% of SE tax, retirement plan contributions and SE health insurance premiums), or

-

The wage limitation.

The wage limitation is the greater of:

-

50% of the W-2 wages paid by the business or

-

25% of the W-2 wages paid by the business plus 2.5% of the unadjusted basis of the business’s qualified property (abbreviated UBIA).

Illustrations – The illustrations below assume the taxpayer’s taxable income is such that the wage limitation will apply in all cases. It also assumes that none of the businesses are SSTBs, which cannot be included in an aggregation. The 199A deduction determined in the illustrations is the amount determined before the final limitation that caps the combined 199A deductions from all sources to 20% of the taxpayer’s taxable income before the 199A deduction and net of any capital gains.

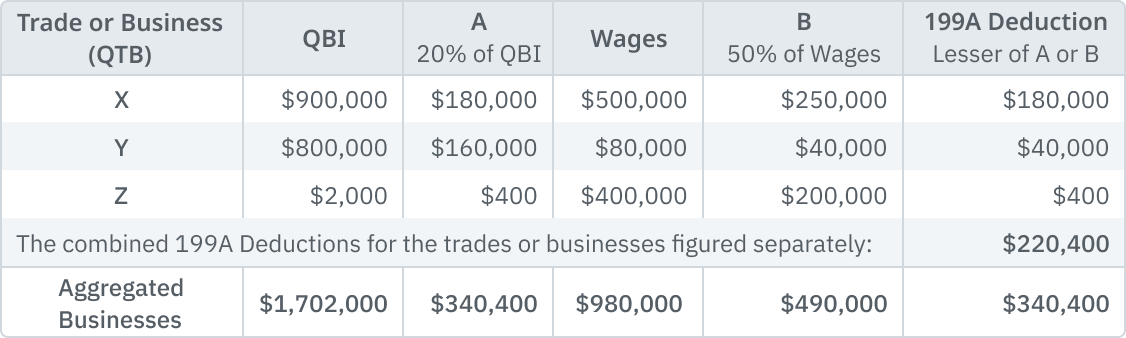

Illustration #1 – To simplify the comparison, this illustration assumes the QTBs only have wages and no UBIA. The outcome is that aggregating these three QTBs results in a substantial increase in the 199A deduction.

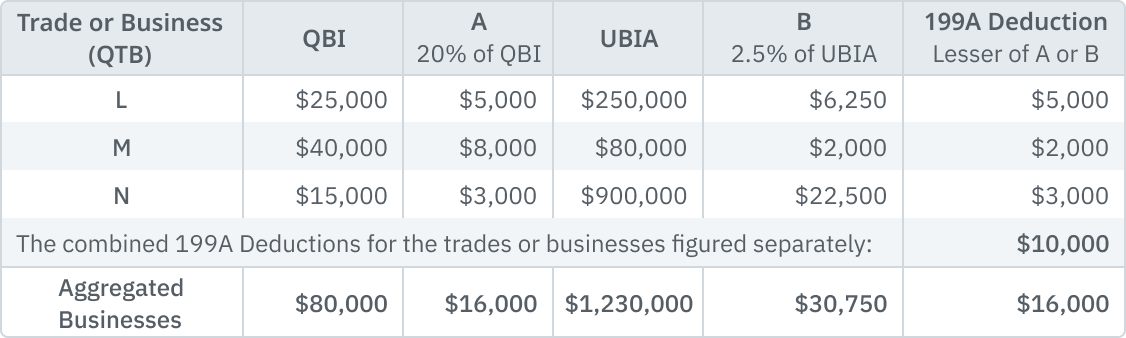

Illustration #2 – This illustration assumes the QTBs only have UBIA and no wages. The results show that aggregating these three QTBs provides the taxpayer a substantial increase in the 199A deduction.

QBI Losses – When making the aggregation analysis remember that losses from any QTB or SSTB entity proportionally reduce the QBI of the taxpayer’s other entities. So, an aggregation excluding an entity with a loss does not overcome the reduction of QBI for the profitable entities.

Next Step – The next step is to see if the proposed aggregation is permissible under the “aggregation qualification general rules” discussed next and whether the taxpayer is willing to abide by the “operating rules” and the “aggregation rules” also discussed later in this material. One important issue to consider is that once aggregated the eligible QTBs are generally aggregated for all future years.

Aggregation Worksheet

A worksheet taking into account both wages and UBIA is included below.

(b)(1) - Aggregation Qualification General Rules

Under regulation §1.199A-4, trades or businesses may be aggregated only if an individual or relevant passthrough entity (RPE) can demonstrate that:

-

The same person, or group of persons, directly or indirectly, own a majority interest in each of the businesses to be aggregated for the majority of the taxable year in which the items attributable to each trade or business are included in income. In the case of trades or businesses owned by an S Corp, own 50% or more the outstanding shares of stock and in the case of a partnership, have 50% or more of the capital or profits in the partnership.

-

The ownership exists for a majority of the taxable year, including the last day of the taxable year, in which the items attributable to each trade or business to be aggregated are included in income.

-

All of the items attributable to each trade or business to be aggregated are reported on returns with the same taxable year, not taking into account short taxable years, D. None of the aggregated trades or businesses can be an SSTB.

-

Individuals and trusts must establish that the trades or businesses meet at least two of three factors, which demonstrate that the businesses are in fact part of a larger, integrated trade or business. These factors are:

-

The businesses provide products, property or services that are the same (for example, a restaurant and a food truck) or they provide products, property or services that are customarily provided together (for example, a gas station and a car wash)

-

The businesses share facilities or share significant centralized business elements (for example, common personnel, accounting, legal, manufacturing, purchasing, human resources, or information technology resources); or

-

The businesses are operated in coordination with, or reliance on, other businesses in the aggregated group (for example, supply chain interdependencies).

-

-

Consistent with other provisions in the proposed regulations, each trade or business must itself be a trade or business as defined in §1.199A-1(b)(13).

Operating Rules

(i) Individuals.

-

An individual may aggregate trades or businesses operated directly or through an RPE to the extent an aggregation is not inconsistent with the aggregation of an RPE.

-

If an individual aggregates multiple trades or businesses, QBI, W-2 wages, and UBIA of qualified property must be combined for the aggregated trades or businesses for purposes of applying the W-2 wage and UBIA of qualified property limitations of the wage limitation.

-

An individual may not subtract from the trades or businesses aggregated by an RPE but may aggregate additional trades or businesses with the RPE's aggregation if the aggregation rules are otherwise satisfied.

(ii) RPEs (relevant pass-through entities).

-

An RPE may aggregate trades or businesses operated directly or through a lower-tier RPE to the extent an aggregation is not inconsistent with the aggregation of a lower-tier RPE.

-

If an RPE itself does not aggregate, multiple owners of an RPE need not aggregate in the same manner.

-

If an RPE aggregates multiple trades or businesses, the RPE must compute and report QBI, W-2 wages, and UBIA of qualified property for the aggregated trade or business.

-

An RPE may not subtract from the trades or businesses aggregated by a lower-tier RPE but may aggregate additional trades or businesses with a lower-tier RPE's aggregation if the rules of this section are otherwise satisfied.

An individual is permitted to aggregate trades or businesses operated directly and trades or businesses operated through relevant pass-through entities (RPEs). Individual owners of the same RPEs are not required to aggregate in the same manner.

Aggregation Rules (Reg 1.199A-4(c)(1) and (2)) - Once aggregated, the taxpayer must consistently report the activities as such in all future years.

-

If failed to aggregate on an original return, can’t aggregate on an amended return except for 2018 tax year.

-

May add newly created or acquired (including by non-recognition transfers) trades or businesses.

-

If in the future the aggregation no longer meets the aggregation qualification, then the aggregation ceases to apply, and the taxpayer may reapply qualifications to determine if a new aggregation is permissible.

-

In the case of an individual - The individual must report aggregated trades or businesses of an RPE in which the individual holds a direct or indirect interest.

-

In the case of an RPE – The RPE must report aggregated trades or businesses of a lower-tier RPE in which the RPE holds a direct or indirect interest.

Disclosure - For each year, the individual or RPE must attach a statement to the return that includes:

-

A description of each trade or business;

-

The name and EIN of each entity in which a trade or business is operated;

-

Information identifying any trade or business that was formed, ceased operations, was acquired, or was disposed of during the taxable year;

-

Information identifying any aggregated trade or business of an RPE in which the individual holds an ownership interest.

Example #1 - Jack Wholly owns and operates a catering business and a restaurant through separate disregarded entities. The catering business and the restaurant share centralized purchasing to obtain volume discounts and a centralized accounting office that performs all of the bookkeeping, tracks and issues statements on all of the receivables, and prepares the payroll for each business. Jack maintains a website and print advertising materials that reference both the catering business and the restaurant. He uses the restaurant kitchen to prepare food for the catering business. The catering business employs its own staff and owns equipment and trucks that are not used or associated with the restaurant.

-

Because the restaurant and catering business are held in disregarded entities, Jack will be treated as operating each of these businesses directly and thereby satisfies paragraph (b)(1)(i) of the qualification. With regard to meeting 2 of the 3 requirements of (b)(1)(v), Jack satisfies the following factors: (b)(1)(v)(A) is met as both businesses offer prepared food to customers; and

(b)(1)(v)(B) is met because the two businesses share the same kitchen facilities in addition to centralized purchasing, marketing, and accounting.

Thus, Jack may aggregate the catering and restaurant businesses. (Reg Ex #1)

Example #2 – Same facts as example #1 except the catering and restaurant businesses are owned in separate partnerships and Jack and three of his friends each own a 25% interest in each of the two partnerships. Because under paragraph (b)(1)(i) of this section Jack and three of his friends together own more than 50% of each of the two partnerships, they may each aggregate the catering business and the restaurant as a single trade or business. (Reg Ex #2)

-

Example #3 - Phil owns a 60% interest in each of four partnerships (PRS1, PRS2, PRS3, and PRS4). Each partnership operates a hardware store. A team of executives oversees the operations of all four of the businesses and controls the policy decisions involving the business as a whole. Human resources and accounting are centralized for the four businesses.

-

Phil owns more than 50% of each partnership, thereby satisfying paragraph (b)(1)(i). With regard to meeting 2 of 3 of the requirements of (b)(1)(v), Phil satisfies the following factors:

(b)(1)(v)(A) because each partnership operates a hardware store.

(b)(1)(v)(B) because the businesses share accounting and human resource functions.

Phil decides to only aggregate PRS1, PRS3, and PRS4 and report PRS2, which generates a net taxable loss, as a separate trade or business. Phil’s decision to aggregate only PRS1, PRS3, and PRS4 into a single trade or business is permissible. The loss from PRS2 will be netted against the aggregate profits of PRS1, PRS3, and PRS4 pursuant to Sec. 1.199A-1(d)(2)(iii). (Reg Ex#4)

Example #4 - George owns 80% of the stock in an S corporation (S1) and 80% of two partnerships organized as limited liability companies (LLCs). Thus, George meets the ownership requirements of (b)(1)(i). LLC1 manufactures and supplies all of the widgets sold by LLC2. LLC2 operates a retail store that sells LLC1's widgets. S1 owns the real property leased to LLC1 and LLC2 for use by the factory and retail store.

-

(b)(1)(v)(A) is met for LLC1 and LLC2 because they sell the same product.

(b)(1)(v)(B) is met for S1, LLC1 and LLC2 because they share significant centralized business elements and are operated in coordination with, or in reliance upon, one or more of the businesses in the aggregated group.

(b)(1)(v)(C) S1 owns the real property leased to LLC1 and LLC2 for use by the factory and retail store. Thus, S1 operated in coordination with, or reliance on, other businesses in the aggregated group.

Thus, each entity meets 2 of the 3 requirements of (b)(10(v) and they may be aggregated. (Reg Ex #8)

Example #5 – Same as example #4, except George owns 80% of the stock in S1 and only 20% each of LLC1 and LLC2. George’s son owns a majority interest in LLC2, owns no stock in S1 and has no interest in LLC1. George’s mother owns a majority interest in LLC1, owns no stock in S1 and has no interest in LLC2. Since the same group of persons, including George, own a majority interest in LLC1 and LLC2 George is considered to have met the ownership requirements of (b)(1)(i). (Reg Ex #9)

-

Example #6: Clive owns 60% of PRS1, a partnership, that sells non-food items to grocery stores. He also owns 55% of PRS2, a partnership, which owns and operates a distribution trucking business. The predominant portion of PRS2's business is transporting goods for PRS1. Clive meets the (b)(1)(i) ownership test. With regard to meeting 2 of the 3 requirements of (b)(1)(v), Clive only satisfies one of the factors:

-

(b)(1)(v)(C) - The businesses are operated in coordination with, or reliance on, other businesses in the aggregated group

Clive does not meet either (b)(1)(v)(A) – provide the same products, property or services or (b)(1)(v)(B) – share the same centralized business elements. Thus, Clive cannot aggregate the wholesaler and trucking company. (Reg Ex#12)

Example #7: PRS1, a partnership, owns 60% of a commercial rental office building in state A, and 80% of a commercial rental office building in state B. Both commercial rental office building operations share centralized accounting, legal, and human resource functions. PRS1 satisfies the ownership requirements. With regard to meeting 2 of the 3 requirements of (b)(1)(v), PRS1 satisfies the following factors:

-

(b)(1)(v)(A) - provide products, property and services that are the same.

(b)(1)(v)(B) - share significant centralized business elements (accounting, legal, and human resource functions).

Thus, PRS1 may aggregate its commercial rental office buildings. (Reg Ex #16)

Example #8: S, an S corporation owns 100% of the interests in a residential condominium building and 100% of the interests in a commercial rental office building. Both building operations share centralized accounting, legal, and human resource functions.

-

S satisfies the ownership requirements. With regard to meeting 2 of the 3 requirements of (b)(1)(v), S satisfies the following factor:

(b)(1)(v)(B) - share significant centralized business elements (accounting, legal, and human resource functions)

S does not meet either (b)(1)(v)(A) – provide the same products, property or services (commercial vs residential) or (b)(1)(v)(C) – operate in coordination with or reliance on the others. Thus, S cannot aggregate the commercial and residential businesses. (Reg Ex #17)

Precautionary Note

The regulations are taking the position that the commercial and residential activities do not provide the same products, property and services so cannot use (b)(1)(v)(A) for one of the two out of three requirements to group. So, they can only be aggregated together if they meet the requirements of (b)(1)(v)(B) and (b)(1)(v)(C).