Simplified View of the 199A Tax Deduction

As you'll learn throughout this TaxBuzz Guide, the 199A tax deduction can be extremely complicated to understand. This simplified view of difficult tax topic is meant to help all small business owners.

The 199A can be very simple or it can be very complex. In fact, it may be one of the most complex deductions ever to come out of Congress. So, before getting into the nitty-gritty of this deduction we will first look at it in its simplest form and work up to the more complex issues.

To begin, let’s first get an understanding of some of the terminology and definitions used in computing the Sec 199A deduction:

Taxable Income

When figuring the deduction for each passthrough activity of an individual, the deduction may be limited based upon the individual’s 1040 taxable income (before the deduction). Do not confuse the taxpayer‘s 1040 taxable income with a pass-through activity’s taxable income.

Qualified Business Income (QBI)

Is generally the net profit from a Schedule C, E or F, a 1065 K-1, and 1120S K-1, a 1041 K-1, REITS (dividends) and pass-through income from publicly traded partnerships (PTP). But also see QBI Reductions for AGI Adjustments on page 3.24.17

The Deduction

The deduction is equal to 20% of the pass-through income (the qualified business income (QBI)) from various business activities. For purposes of this introduction, we will only consider QBI from sole proprietorships (Schedule C net profit), partnership K-1s (but not including guaranteed payments) and S corporation K-1s.

Business Categories

There are two categories of business entities when computing the deduction (note: there is actually a third category for farming cooperatives which is quite complicated that we discuss later in the chapter).

a. Qualified Trades or Businesses (QTB), and

b. Specified Service Trades or Businesses (SSTB) – Which are basically those businesses providing personal services, such as tax practitioners. More details later in the chapter.

Why Are QTB and SSTB in Separate Categories?

-

If you recall, the purpose of the prior Sec 199 domestic production deduction was to promote manufacturing in the U.S. and only allowed the deduction to produce goods and not services. Sec 199A replaces the prior Sec 199 and in doing so carried over some of its characteristics, which leads us to believe that is why QTBs and SSTBs (which only provide services) have been put into separate categories.

Limitations

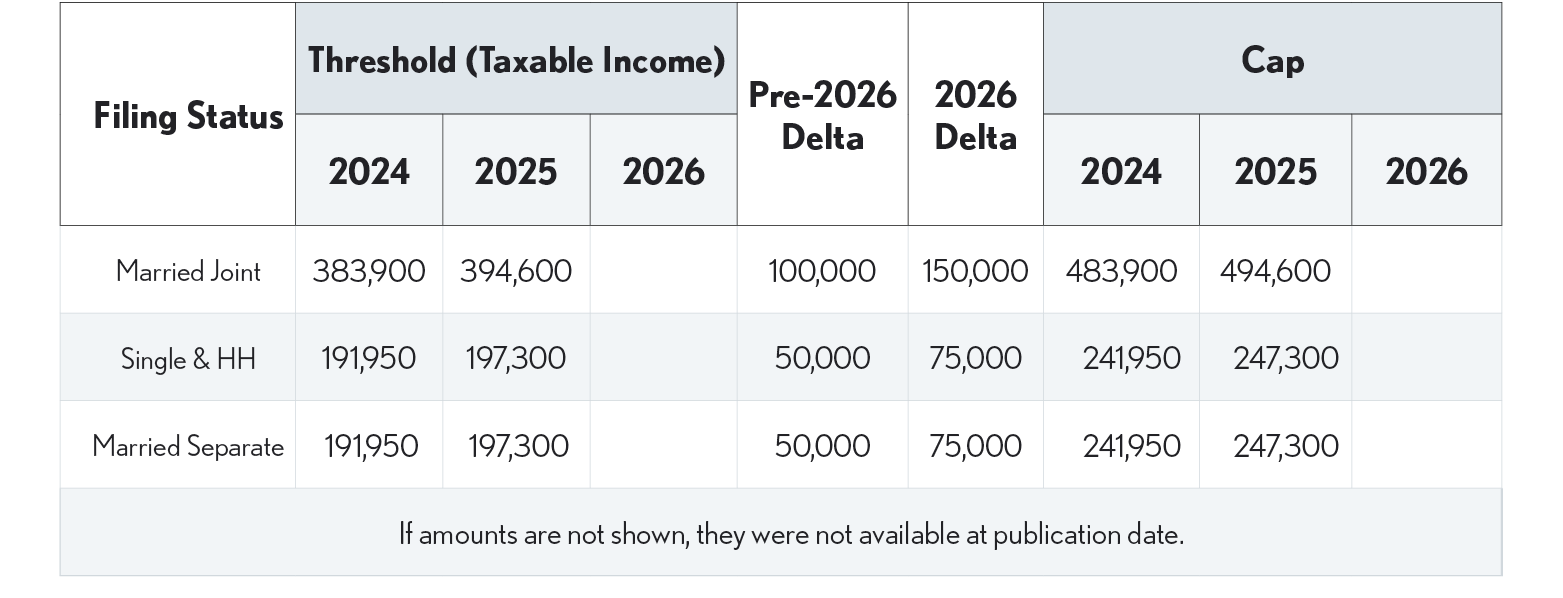

The major distinction between QTBs and SSTBs is that the 199A deduction phases out for SSTBs for taxpayers with 1040 taxable incomes between the threshold and the cap shown in the table below, while QTBs continue to qualify if they pay wages or have qualified property.