Determining W-2 Wages For 199A Deduction

Determining W-2 wages for the 199A tax deduction can be more challenging than taxpayers expect. Get the help you need below.

Although determining the wages for the purposes of computing the Sec. 199A wage limit would seem to be a simple matter of just adding up the wages the business paid, unfortunately it is not. Wages for this purpose will only include wages paid during the calendar year. The wages include wages paid to employees, and if an S corporation, to the officers of the corporation. Reg 1.199A-2(b)(2)(iv) provides the following options in determining wages.

Step One – Determine the W-2 wages. The IRS provides 3 methods to determine the wage amounts with the unmodified box method being the simplest but the one that results in a lower wage number. These methods are the same three options IRS allowed for determining wages eligible for the now-repealed Sec 199 domestic production activities deduction.

Unmodified Box Method

It is the lesser of:

-

Total entries in Box 1 of all Forms W-2 filed with SSA, or

-

Total entries in Box 5 (Medicare wages) of all Forms W-2 filed with SSA.

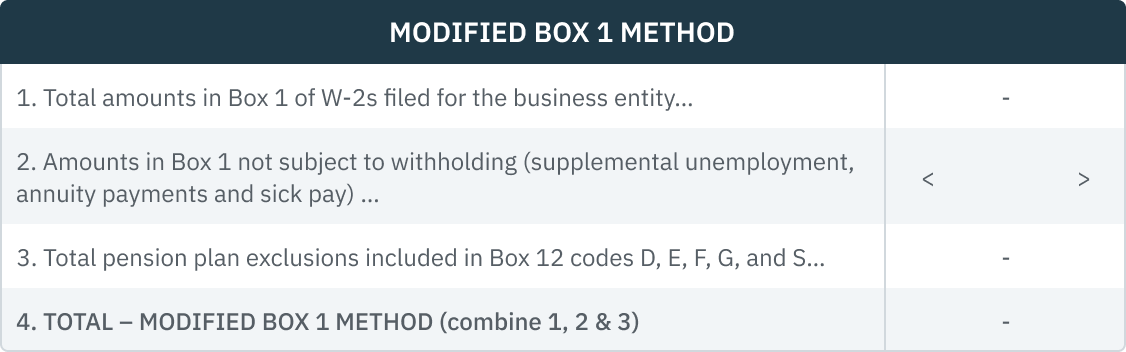

Modified Box 1 Method

Determined as follows:

-

Total the entries in Box 1 of all Forms W-2 filed with SSA, then

-

Subtract the amounts in the Box 1 total that are not wages for FIT withholding, such as supplemental unemployment benefits, annuity payments and sick pay. (IRC Sec 3402(o))

-

Finally add the total amounts reported in box 12 (excludable pension contributions) codes D, E, F, G, and S.

Example: Modified Box 1 method for SL Lewis, Inc., an S Corporation with two shareholders, Susan Lewis who owns 80% of the stock and Jack Miller who owns 20% of the stock. The total Box 1 wages for the stockholders and employees for the year is $300,000. The $300,000 amount included $4,000 of supplemental unemployment compensation benefits. In addition, Box 12 included $35,000 code D amounts (employee 401(k) contributions). The Modified Box 1 amount is $331,000 ($300,000 – 4,000 + $35,000) which is allocated $264,800 to Susan (80% of $331,000) and $66,200 to Jack (20% of $331,000).

-

Tracking Wages Method

The taxpayer actually tracks total wages subject to Federal income tax withholding and makes appropriate modifications. W-2 wages using the tracking wages method are determined as follows:

o Total of the entries in Box 1 of all Forms W-2 filed with SSA, plus

The total amounts reported in box 12 of Forms W-2 that are coded:

• D – Sec 401(k) elective deferrals

• E – Sec 403(b) elective deferrals

• F - Sec 408(k) salary reduction SEP

• G – Sec 457(b) deferred compensation plan

• S – Sec 408(p) salary reduction SIMPLE plan

Compensation paid to statutory employees (Form W-2 box 13 is checked), is not includible in the calculation of W-2 wages under any of these methods. Wages paid by another employer, such as a staffing agency, are included, but both businesses can’t claim the same wages.

Step Two – Properly allocate W-2 wages so only wages associated with QBI are included in the wage limitation calculation. A business entity could have non-U.S. source income, investment income, and capital gains income – none of which is QBI. An activity may have a concoction of business activities and perhaps not all of the activities produce QBI, and an adjustment may be required. (Reg Sec 1.199A(b)(4))