199A Deduction SSTB Computation

The examples below use 2025 rates.

Probably the best way to understand this deduction is by considering some examples starting with what happens when the taxpayer’s taxable income exceeds the threshold. Remember SSTBs are treated differently than other qualified trades or businesses and are far less complicated.

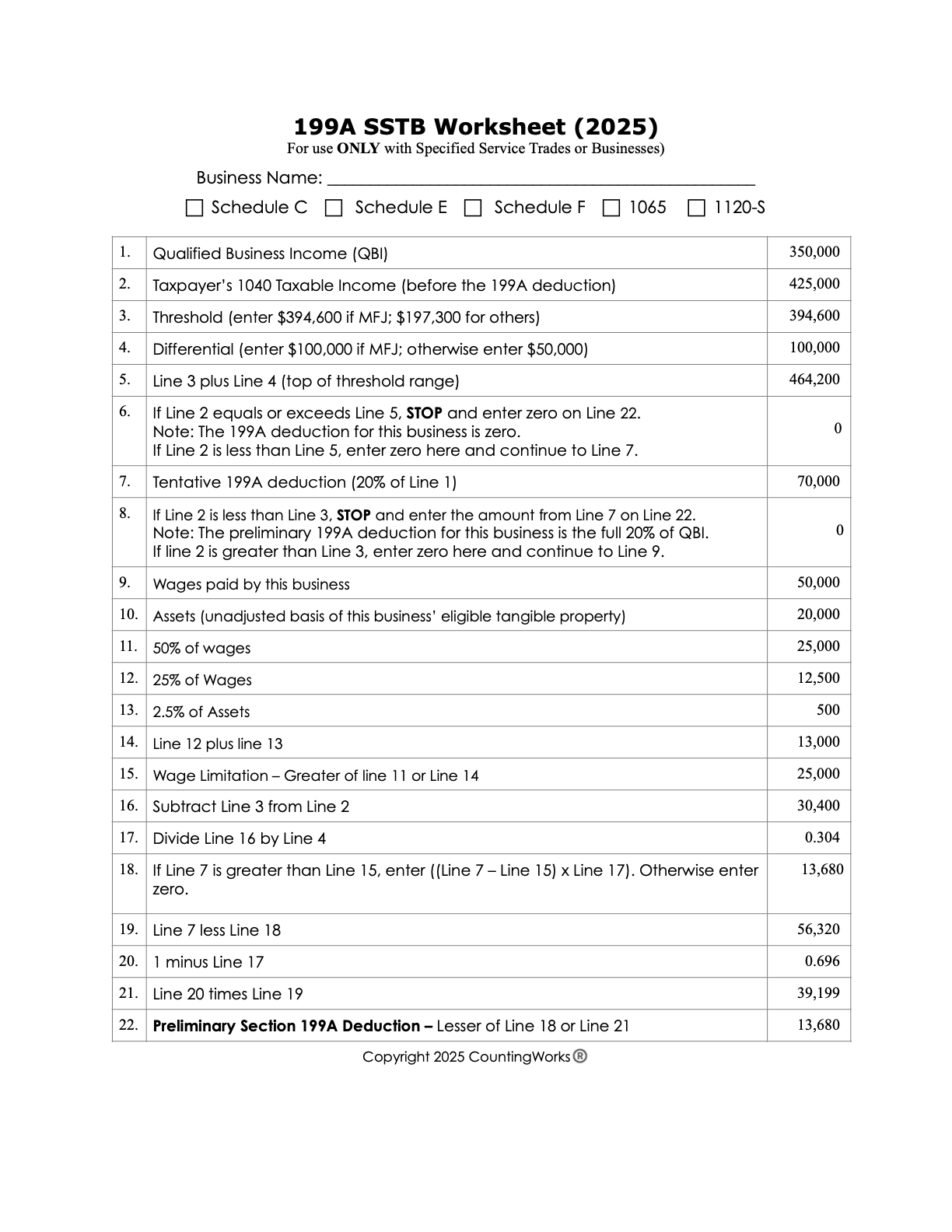

SSTB Example #1 – Taxable Between the Threshold and Phaseout Cap - Gary, who files jointly with his spouse, is a CPA and his 2025 net profit (QBI) from his Schedule C sole proprietorship is $350,000. He had no capital gains. Gary’s 1040 taxable income before the 199A deduction is $425,000. Since his taxable income is above the $394,600 threshold, there will be a limitation to Gary’s QBI deduction; see worksheet on subsequent page.To complete the worksheet, we need some additional information: the wages Gary paid his employees (for this example $50,000) and the unadjusted basis of his business equipment (we will use $20,000).

Note 1: If Gary’s $350,000 of QBI had been from a partnership K-1 (not counting guaranteed payments) the result would have been the same. It could have also been from an S corporation K-1 with the same result.

Note 2: To keep this example and those that follow as uncluttered as possible, we are ignoring that some of the pass-through income is subject to SE Tax. However, if it is subject to SE tax, the taxpayer would be entitled to an adjustment to income for ½ of the SE tax which would reduce the taxable income and provide a different 20% of taxable income result. Further, before multiplying the QBI by 20%, the QBI must be reduced by the SE tax deduction, as well as any adjustment the taxpayer claimed for SE health insurance premiums and certain retirement plan contributions. Thus, the preliminary QBI deduction will also be less. Again, we are omitting this adjustment from the examples to minimize the clutter and concentrate on the concepts.

Commentary

It is important to note the taxpayer’s 1040 taxable income is the decisive factor whether or not any limitations are triggered. In the prior example the QBI income was purposely made higher than the taxpayer’s taxable income to illustrate that point.

SSTB Example #2 – Taxable Income Above the Phaseout Cap - If Gary’s 2025 taxable income in Example #1 was above the cap of $494,600 (threshold of $394,600 plus $100,000), then Gary’s 199A deduction for would be zero, completely phased out.

SSTB Example #3 – Taxable Income Below Threshold - If Gary’s taxable income in Example #1 had been below the phaseout threshold, there would be no phaseout. Gary’s preliminary 199A deduction would be $70,000 (20% of $350,000) but also limited by his taxable income to $85,000 (20% x $425,000). So, the deduction would be the lesser of the two: $70,000.

We have developed a SSTB worksheet that includes the phase-out computation. The phase-out is an awkward calculation that takes into consideration the wages paid by the business and the qualified property of the business. Both of these items will be explained later in the guide. As you can see from the worksheet, Gary’s deduction has been partially phased out and his deduction is only $13,680.

Instructions: This worksheet can only be used for specified service trades or businesses. It is designed to determine the preliminary 199A deduction for a single business. The results of this worksheet must be combined with the results from other businesses and flow-through income of the taxpayer to determine the combined preliminary Sec 199A deduction for the taxpayer. The combined preliminary Sec 199A deduction is further limited to 20% of the adjusted taxable income of the taxpayer.

CountingWorks has a separate worksheet for use with other qualified businesses. Although we believe the worksheets compute the deduction correctly, ultimately, the IRS worksheets or forms will take precedence.

Specified Service Trades or Businesses

Generally, includes any trade or business described in Sec 1202(e)(3)(A), but excluding engineering and architecture and trades or businesses that involve the performance of services that consist of investment-type activities. Specified service businesses include trades or businesses involving the performance of services in the fields of: health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees, as defined in Reg. 1.199A-5(b)(2).