Late S-Election Tax Information

Below, learn how a late S-election could impact your business taxes. This is an issue you should discuss with a local tax professional, as well.

If the election was not made within the 2 months and 15 days prescribed to make the election (see above), then a late election must be made.

Rev. Proc. 2013-30

Provides the consolidated and simplified relief procedures that may be used when your client is filing a late S Corp election due to reasonable cause.

Before filing the late election pursuant to Rev. Proc. 2013-30, make sure all of the following conditions are true:

-

The corporation meets all requirements to be an S corporation.

-

The corporation has reasonable cause for its failure to make a timely election and includes a statement that explains the reasonable cause/inadvertence, signed under penalties of perjury.

-

All shareholders must include statements that they have reported all items on all affected tax returns, as if the corporation was an S corporation. This means that proper Schedule K-1s have been issued to the shareholders and each shareholder properly reported his or her share of the corporation's income, whether or not distributed, on his or her income tax return.

-

Form 2553 must state at the top "FILED PURSUANT TO REV. PROC. 2013-30."

-

If Form 2553 is attached to Form 1120S, Form 1120S must state at the top "INCLUDES LATE ELECTION FILED PURSUANT TO REV. PROC. 2013-30."

File a late S election pursuant to Rev. Proc. 201330 where your client normally files Form 1120-S if the election will be attached to the return. File a late S election with the applicable service center shown in the Form 2553 instructions (or as otherwise directed in the instructions), if the election will be filed independently, without a Form 1120-S.

Mail the election and all required attachments using certified mail and request a return receipt.

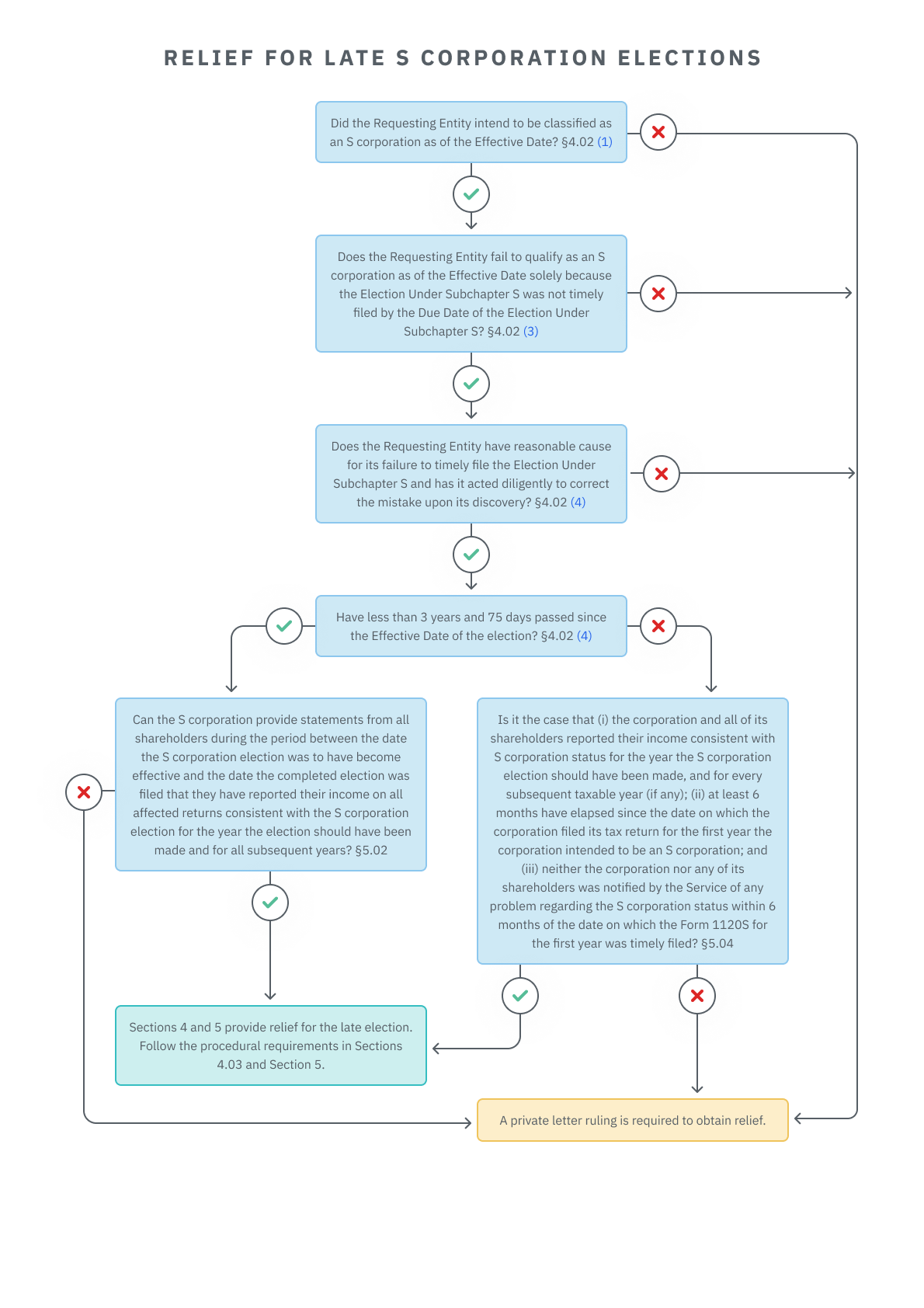

Note: “Sections” (§) in the flow chart refer to those in Rev. Proc. 2013-30.

An entity that can show that it failed to file Form 2553 on time due to reasonable cause may be eligible for both a late S Corporation election and a late entity classification election, generally under the same procedures and time frame as described above. Details are in the instructions to Form 2553. See flow chart below