1120-S Domestic Filing Exception

The 1120-S domestic filing exception is an IRS tax rule that applies to certain businesses.

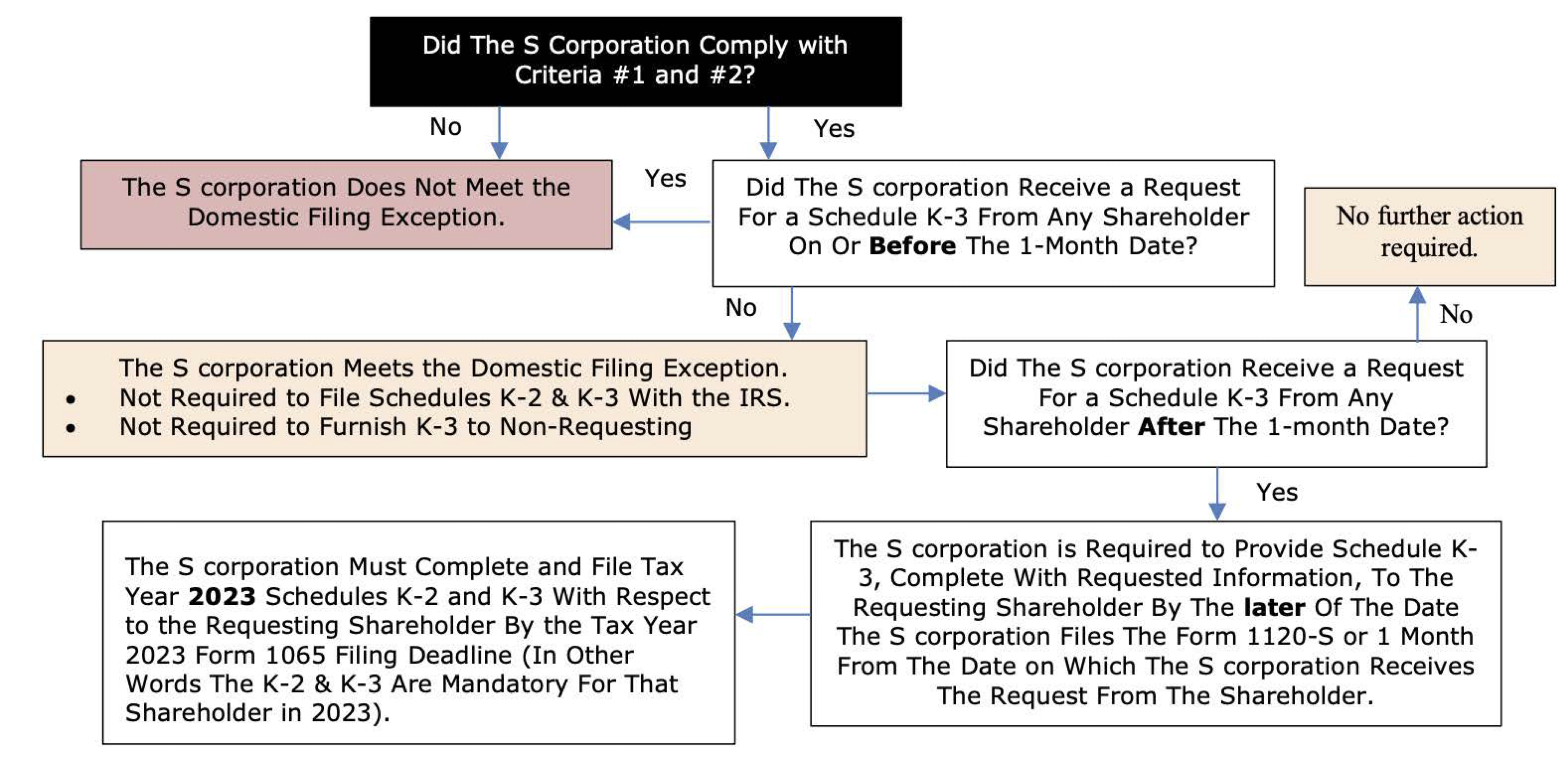

Specifically, an S-corporation does not need to:

-

complete and file with the IRS the Schedules K-2 and K-3, or,

-

furnish to a shareholder the Schedule K-3 (except where requested by a shareholder after the 1-month date (defined in criteria 3, below)).,

if each of the following three criteria are met with respect to the S corporation’s tax year 2022.

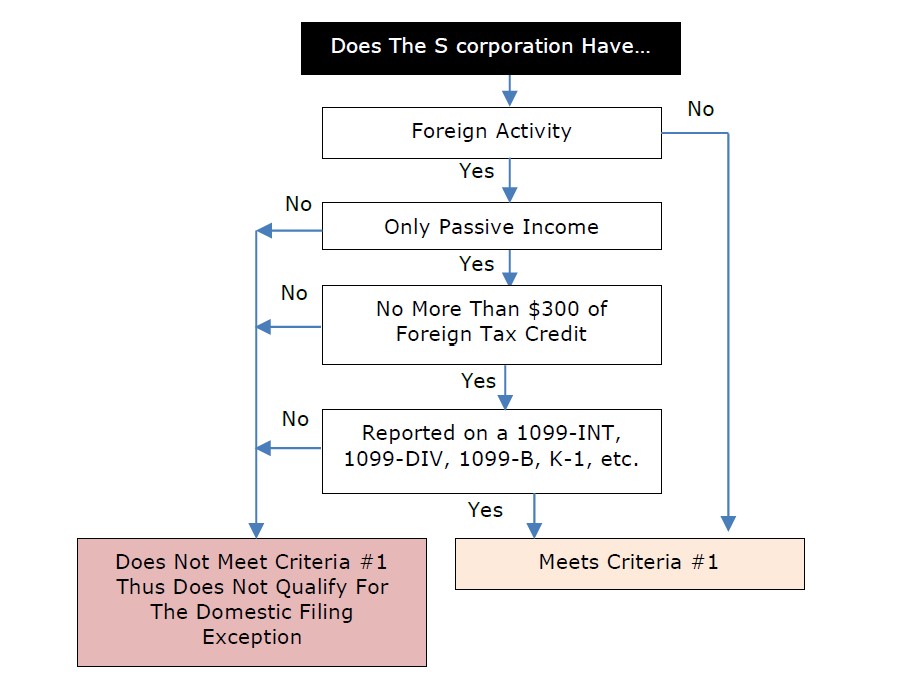

Criteria #1- No or limited foreign activity. During an S corporation’s tax year 2022, the S corporation either has no foreign activity (as defined later), or if it does have foreign activity, such foreign activity is limited to:

-

Passive category foreign income (determined without regard to the high-taxed income exception under section 904(d)(2)(B)(iii)),

-

Upon which not more than $300 of foreign income taxes allowable as a credit under section 901 are treated as paid or accrued by the S corporation (Note: if this test fails, the Form 1116 exception may apply, see page 9), and

-

Such income and taxes are shown on a payee statement (as defined in section 6724(d)(2)) that is furnished or treated as furnished to the S corporation.

Note: See partnership criteria #1 for the definition of a foreign activity.

Criteria #2 - Shareholder notification. With respect to an S corporation that satisfies criterion 1, shareholders receive a notification from the S corporation at the latest when the S corporation furnishes the Schedule K-1 to the shareholder.

The notice can be provided as an attachment to the Schedule K-1. The notification must state that shareholders will not receive Schedule K-3 from the S corporation unless the shareholders request the schedule.

Criteria #3 - No 2022 Schedule K-3 requests by the 1-month date. The S-Corporation does not receive a request from any shareholder for Schedule K-3 information on or before the 1-month date. The “1-month date” is 1 month before the date the S corporation files the Form 1120-S. For tax year 2022 calendar year S corporations, the latest 1-month date is August 15, 2023, if the partnership or the S-Corporation files an extension.