Safe Harbor Rule For Routine Maintenance

The safe harbor rule for routine maintenance is an important financial topic for anyone who owns tangible property.

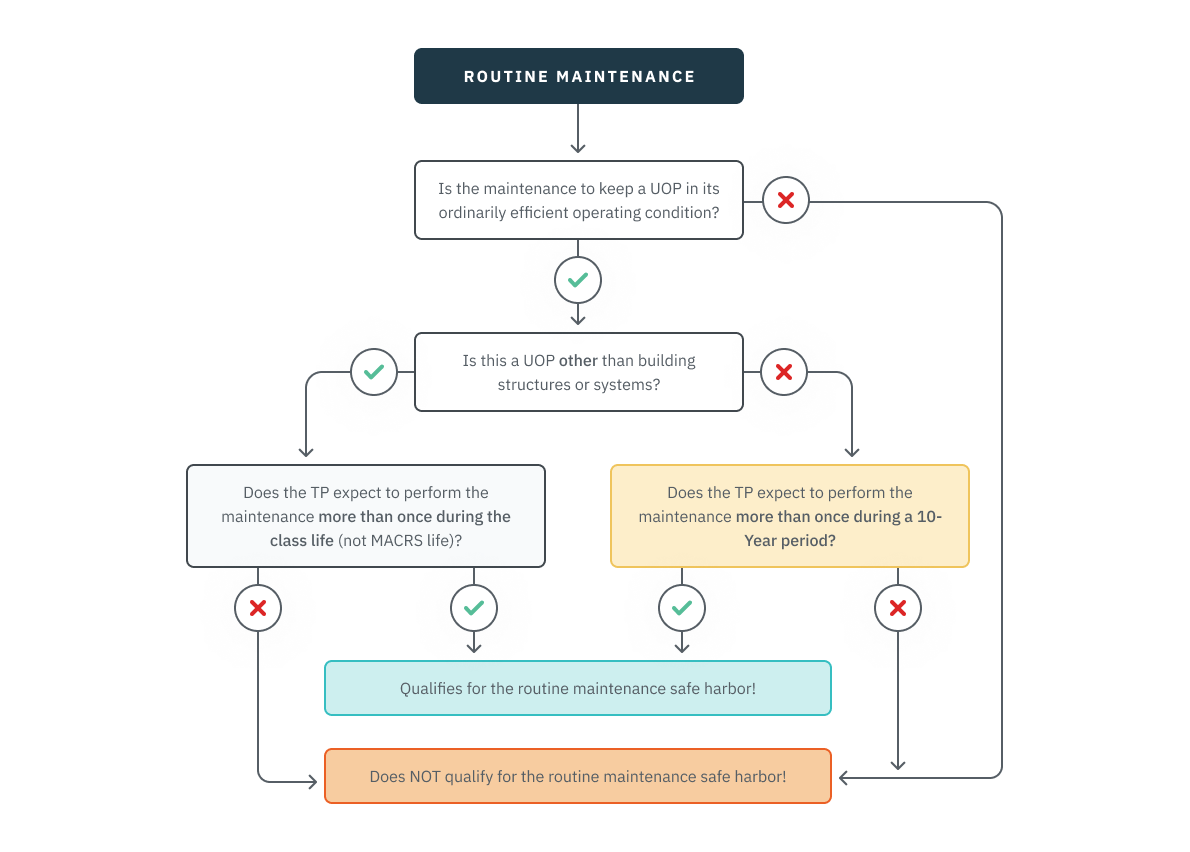

Amounts paid for routine maintenance (as described below) on a unit of tangible property, or in the case of a building (as described below) is deemed not to improve that unit of property and are expensed if they are not otherwise required to be capitalized (Reg. § 1.162-4(a)). Factors to be considered in determining if an expense is routine maintenance include the recurring nature of the activity, industry practice, manufacturer’s recommendations, and the taxpayer’s experience. The regulations define routine maintenance as:

-

Maintenance the taxpayer expects to perform to keep the unit of property (UOP) in its ordinarily efficient operating condition, and

-

When the taxpayer places the UOP in service, the taxpayer expects to perform the activities more than once during:

-

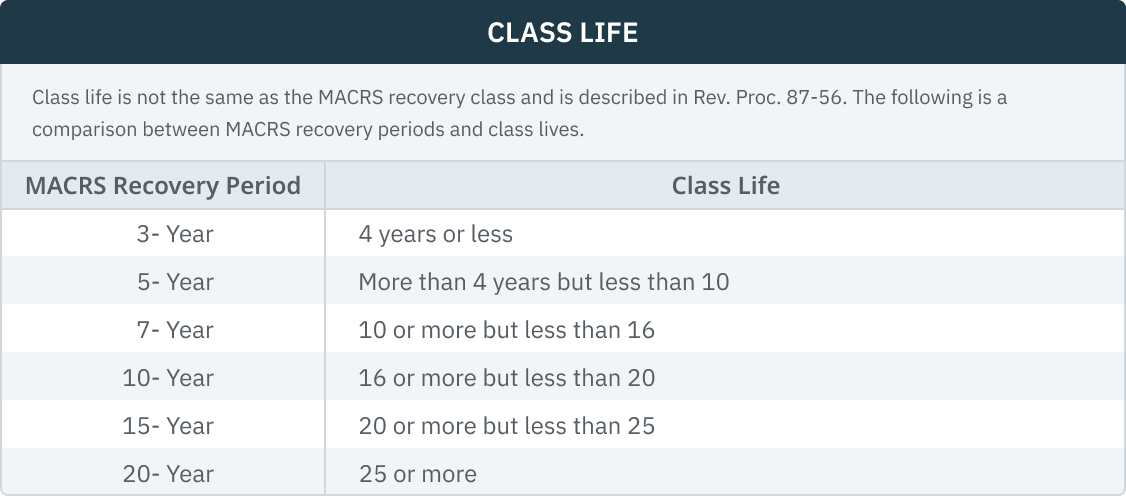

The class life (not the depreciable life) of the UOP, other than building structures or systems.

-

A 10-year period for building structures or systems.

-

Routine Maintenance (Other Than Buildings)

The cost of routine maintenance performed on a UOP that isn’t a building or a structural component is treated as not improving the UOP, and is thus currently deductible. Routine maintenance refers to recurring activities, such as inspecting, cleaning, and testing, and replacing parts with comparable and commercially available replacement parts.

Activities are routine only if, at the time the UOP is placed in service by the taxpayer, the taxpayer reasonably expects to perform the activities more than once during the class life of the UOP. A taxpayer's expectation will not be deemed unreasonable merely because the taxpayer does not actually perform the maintenance a second time during the class life of the UOP, provided that the taxpayer can otherwise substantiate that its expectation was reasonable at the time the property was placed in service.

With respect to a taxpayer that is a lessor of a UOP, the taxpayer's use of the UOP includes the lessee's use of the UOP.

Example (Regulations example #9) – A towboat operator purchases a towboat including its two diesel engines, which are considered a single unit of property. The class life of the towboat is 18 years. The operator is aware that every four years he will need to perform routine maintenance on the two engines to keep them in their ordinarily efficient operating condition. Since the routine maintenance occurs more than once during the towboat’s 18-year class life, the maintenance is considered routine. As a result, the amounts paid for the scheduled maintenance to the towboat engines in Year 5 are deemed not to improve the towboat and are not required to be capitalized.

-

Routine Maintenance for Buildings

Routine maintenance for a UOP that's a building unit is the recurring activities that a taxpayer expects to perform as a result of using the property to keep the building structure or each building system in its ordinarily efficient operating condition. Routine maintenance activities include, for example, the inspection, cleaning, and testing of the building structure or each building system, and the replacement of damaged or worn parts with comparable and commercially available replacement parts.

Routine maintenance may be performed any time during the useful life of the building structure or building systems. However, the activities are routine only if the taxpayer reasonably expects to perform the activities more than once during the 10-year period beginning when the building structure or the building system on which the routine maintenance is performed is placed in service by the taxpayer.

A taxpayer's expectation will not be deemed unreasonable merely because it does not actually perform the maintenance a second time during the 10-year period, if the taxpayer can otherwise substantiate that its expectation was reasonable when the property was placed in service. Factors to be considered in determining whether maintenance is routine and whether a taxpayer's expectation is reasonable include the recurring nature of the activity, industry practice, manufacturers' recommendations, and the taxpayer's experience with similar or identical property. For a taxpayer that is a lessor of all or part of a building, its use of the building unit of property includes the lessee's use of its unit of property. (Reg. § 1.263(a)-3(i)(1)(i))

Example (Regulations example #14) – In Year 1, Harry acquires a new office building, which he uses to provide services. The building contains an HVAC system, which is a building system. In Year 1, when Harry placed his building into service, he reasonably expected that every four years he would need to pay an outside contractor to perform detailed testing, monitoring, and preventative maintenance on its HVAC system to keep the HVAC system in its ordinarily efficient operating condition. This scheduled maintenance includes disassembly, cleaning, inspection, repair, replacement, reassembly, and testing of the HVAC system and many of its component parts. If inspection or testing discloses a problem with any component, the part is repaired, or if necessary, replaced with a comparable and commercially available replacement part. The scheduled maintenance at these intervals is recommended by the manufacturer of the HVAC system and is routinely performed on similar systems in similar buildings. In Year 4, he pays amounts to a contractor to perform the scheduled maintenance. Since this routine maintenance occurs more than once every 10 years, the maintenance is considered routine, and the costs of the maintenance need not be capitalized.

-

However, if Harry does not perform this scheduled maintenance on his building again until Year 11, Harry's reasonable expectation that he would perform the maintenance every 4 years will not be deemed unreasonable merely because he did not actually perform the maintenance a second time during the 10-year period, provided that he can substantiate that its expectation was reasonable at the time the property was placed in service. If Harry can demonstrate that his expectation was reasonable in Year 1, then the amounts he paid for the maintenance of the HVAC system in Year 4 and in Year 11 are within the routine maintenance safe harbor and need not be capitalized.

Repairs Undertaken Contemporaneously with Improvements

The regulations specifically provide that indirect costs made at the same time as an improvement, but that do not directly benefit or are not incurred by reason of the improvement, don't have to be capitalized under Code Sec. 263(a). (Reg. § 1.263(a)-3(g))

Ineligible expenses - These safe harbor provisions do not apply to costs incurred for:

-

The production of property or for resale (inventory).

-

For the betterment of a unit of property.

-

For the cost of replacing components if a retirement loss is claimed and gain or loss is realized upon the sale of the replaced component.

-

For which a basis adjustment is required on account of a casualty loss or event.

-

To restore deteriorated and non-functional property to its ordinarily efficient operating condition.

-

To adapt property to a new or different use.

-

To repair, maintain, or improve rotable or temporary spare parts that were deducted when first installed.

Accounting Method Change

Because the above regulations are based primarily on prior law, taxpayers who were previously in compliance with the rules will generally be in compliance with the regulations. In that case, no action is required. Taxpayers that aren't in compliance or that otherwise want to change their method of accounting to use the routine maintenance safe harbor should file Form 3115, Application for Change in Accounting Method, and compute a Code Sec. 481(a) adjustment. Qualifying small taxpayers conform automatically in 2014 and later years comply without filing a 3115. (Rev. Proc. 2015-20)