Per-Building Safe Harbor For Qualifying Small Taxpayers

The per-building safe harbor for qualifying small taxpayers can be a useful part of a successful tax strategy. However, it is important to know the details first.

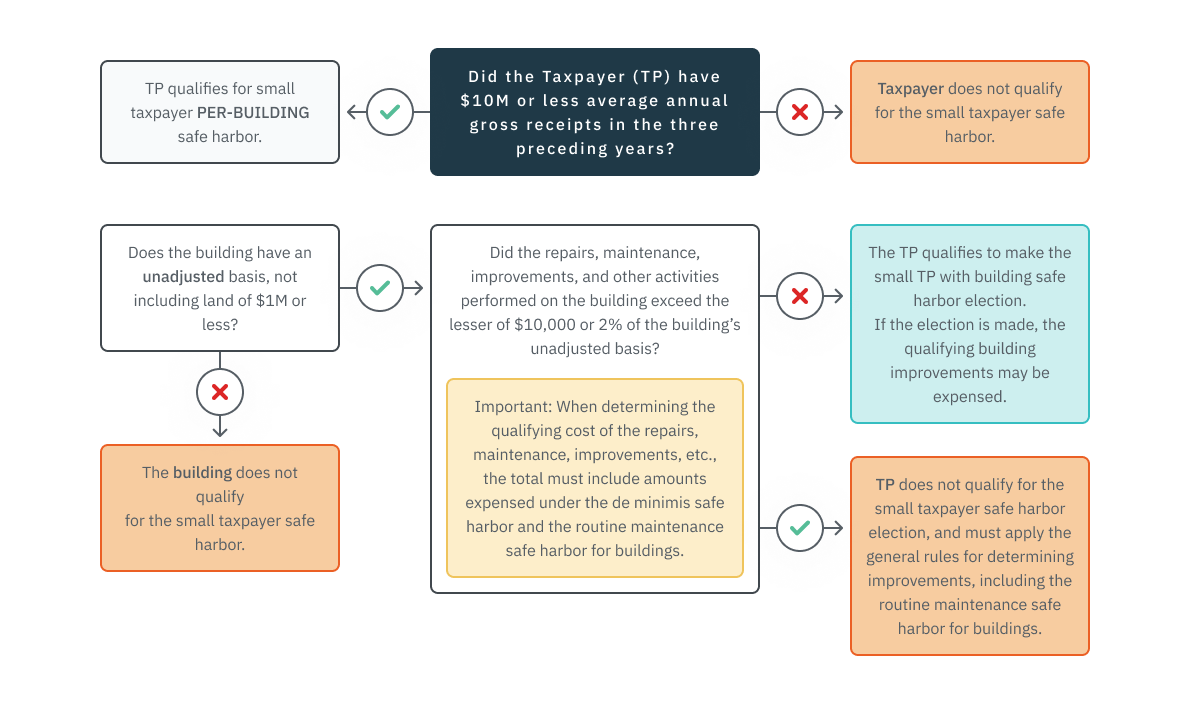

This safe harbor permits qualifying small taxpayers (those with $10 million or less average annual gross receipts in the three preceding tax years) to elect not to treat as capitalized expenses - in other words, to currently deduct - improvements made to an eligible building property (one with an unadjusted basis of $1 million or less, not including land value). This safe harbor election applies only if the total amount paid during the tax year for repairs, maintenance, improvements, and similar activities performed on the eligible building does not exceed the lesser of $10,000 or 2% of the building's unadjusted basis.

This safe-harbor rule applies to tax years beginning on or after January 1, 2014. However, a taxpayer may choose to apply the safe harbor to tax years beginning on or after January 1, 2012.

Under this safe harbor, qualifying small taxpayers include amounts expensed (not capitalized) under the de minimis safe harbor election and under the routine maintenance safe harbor for buildings to determine the annual amount paid for repairs, maintenance, improvements, and similar activities performed on the building. If the amount paid for repairs, maintenance, improvements, and similar activities performed on a building unit of property exceeds the per-eligible-building threshold (lesser of $10,000 or 2% of unadjusted basis) for a tax year, then the safe harbor doesn't apply to any amounts spent during the tax year. In such cases the taxpayer must apply the general rules for determining improvements, including the routine maintenance safe harbor for buildings.

Example (Regulations Example #1) - Safe harbor applies - Albert is a qualifying taxpayer (his 3-year average of gross receipts is less than $10 million) who owns an office building in which he provides consulting services. Albert's building has an unadjusted basis of $750,000, not counting the basis of the land. Albert pays $5,500 for repairs, maintenance, improvements and similar activities to the office building. Because Albert's building unit of property has an unadjusted basis of $1,000,000 or less, his building constitutes eligible building property. The aggregate amount paid by Albert for repairs, maintenance, improvements and similar activities on this eligible building property does not exceed the lesser of $15,000 (2% of the building's unadjusted basis of $750,000) or $10,000. Therefore, Albert may elect to not apply the capitalization rule to the amounts paid for repair, maintenance, improvements, etc., and can expense them.

-

Example (Regulations Example #2) - Safe harbor does not apply - Assume the same facts as in Example 1, except that Albert pays $10,500 for repairs, maintenance, improvements, and similar activities performed on his office building during the year. Because this amount exceeds $10,000 (the lesser of $15,000 (2% x $750K) or $10,000), Albert may not apply the safe harbor for small taxpayers to the total amounts paid for repairs, maintenance, improvements, and similar activities performed on the building. He will need to capitalize (depreciate) the improvements but can deduct the expenses for repairs and maintenance under the usual rules.

New Business

For new businesses, the average annual gross receipts are determined using the average gross receipts for the number of taxable years that the taxpayer or predecessor has been in existence. For short years, the gross receipts are annualized.

Gross Receipts

For this purpose, gross receipts include the taxpayer's receipts for the taxable year that are properly recognized under the taxpayer's methods of accounting used for Federal income tax purposes for the taxable year. Included are total sales (net of returns and allowances) and all amounts received for services. In addition, gross receipts include any income from investments and from incidental or outside sources, such as interest (including original issue discount and tax-exempt interest), dividends, rents, royalties, and annuities, regardless of whether such amounts are derived in the ordinary course of the taxpayer's trade of business. For sales of capital assets or sales of property used in a trade or business, gross receipts are reduced by the taxpayer's adjusted basis in such property. See Reg. Sec. 1.263(a)-3(h)(e)(iv) for additional information on the definition of gross receipts.

Unadjusted Basis

-

Owned property is the cost of the building not reduced by depreciation. Land cost is not included.

-

Leased property is the total amount of undiscounted rent over the entire period of the lease, including reasonably anticipated renewals.

Condominiums and Co-ops

Treated as individual building properties.

Making the Election

-

The election is an annual election, and irrevocable for the year once made.

-

For partnerships and S corporations the election is made at the entity level, not by the partner or shareholder.

-

The election statement should be titled “Section 1.263(a)-3(h) Safe Harbor Election for Small Taxpayers” and include the taxpayer’s name, address, tax ID number and a description of each eligible building property for which the taxpayer is making the election.,

Accounting Method Change

None required.