De Minimis Safe Harbor Rule

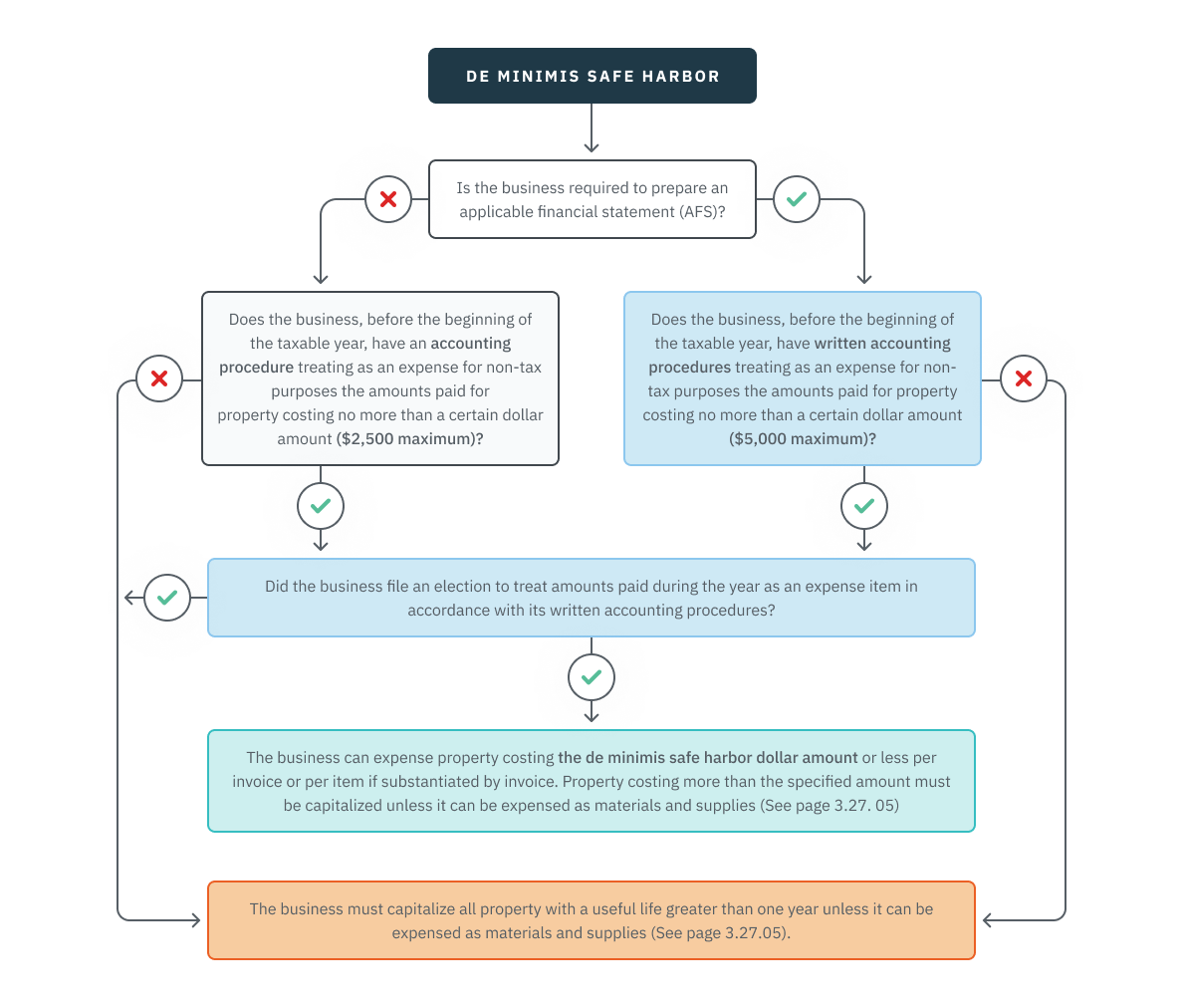

The de minimis safe harbor rule allows businesses to expense rather than capitalize the purchase of tangible property based on the safe-harbor cost of the item. This regulation applies differently to large businesses and small businesses.

-

Large Businesses – For purposes of these regulations are ones with “applicable financial statements” (audited financial statements, SEC filings or other government non-tax financial report filing duty).

-

Small Businesses – Are those without “applicable financial statements”.

To adopt a de minimis safe harbor, a business must have an accounting procedure in place before the beginning of the business’s tax year that specifies the business’s de minimis safe harbor. Failure to do so will result in a safe harbor amount of zero and the only items that can be expensed would be those with a useful life of one year or less or those for which the Sec 179 election is made.

Safe Harbor Amounts

The amount of the safe-harbor is not a single fixed amount for all businesses, but rather an amount adopted by the business subject to a maximum amount. The maximum amounts are:

-

For Large Businesses the maximum is $5,000

-

For Small Businesses the maximum is $2,500

Example: Pop’s Corner Grocery is a small business so Pop can establish a de minimis safe harbor for any amount between $0 and $2,500. When Pop files his Schedule C, any expenses claimed under the de minimis rule are to be reported in Part V, Other Expenses, not on any other lines (2021 Sch C instructions).

-

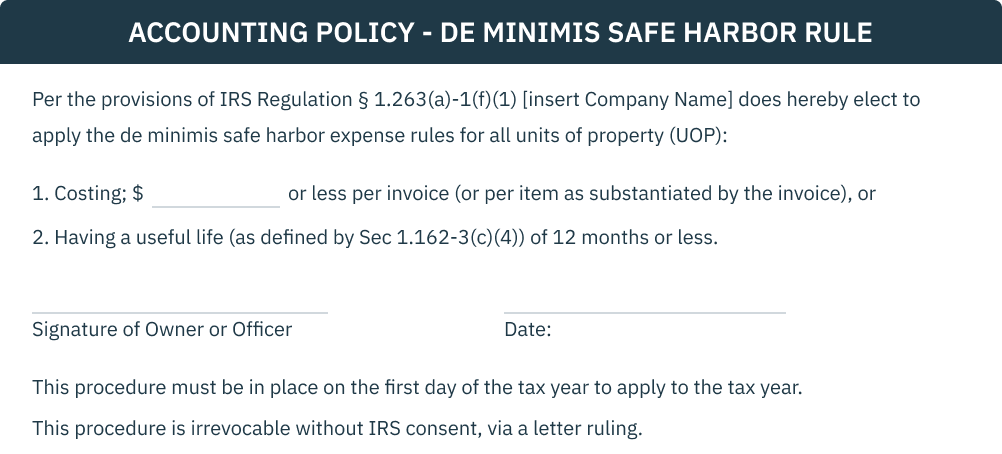

Accounting Procedure

In order to establish a de minimis safe harbor, the business must have an accounting policy in effect before the start of the tax year. The regulations don’t require a written accounting procedure for small businesses. However, consider how you might prove the policy was in place if it is not in writing.

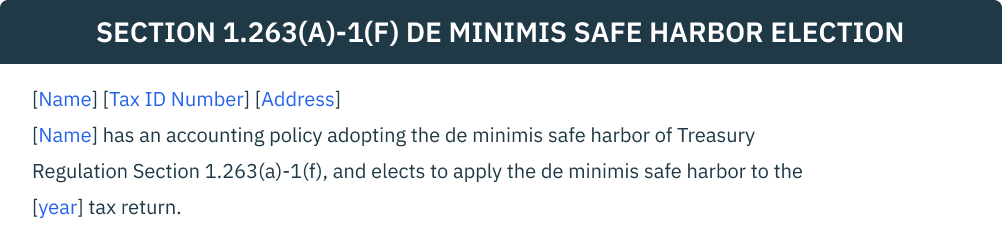

CAUTION - ANNUAL ELECTION ALSO REQUIRED

In addition to the accounting procedure, EACH year the business (or an individual if the business is reportable on Sch C, E, or F) must include an election on its timely filed return (including extensions) to apply the de minimis safe harbor. The election automatically extends to materials and supplies.

A taxpayer or small business that has elected to apply the de minimis safe harbor for the acquisition of tangible property must apply the de minimis safe harbor to amounts paid for all materials and supplies that meet the safe harbor requirements of the de minimis safe harbor (there are exceptions for rotable and temporary spare parts not covered in this material). If the taxpayer properly applies the de minimis safe harbor to amounts paid for materials and supplies, then these amounts are not treated as amounts paid for materials and supplies under the general expense rules.

Example – ABC, Inc., a small business, purchases 30 laptop computers. Each laptop computer is a separate unit of property (UOP) costing $1,450 each. ABC has a written accounting policy allowing ABC to expense amounts paid for units of property costing $2,500 or less AND has elected to apply the de minimis safe harbor to the current year and thus ABC will expense the computers.

-

DE MINIMIS VERSUS SEC 179 EXPENSING

-

One can always utilize the Sec 179 election to expense qualified personal tangible property and that might be considered the most efficient way. However, Sec 179 has recapture issues and investment limits. So don’t dismiss the de minimis safe harbor without considering its benefits.

The following is a short form accounting policy prepared by CountingWorks. It has not had any legal review. Use at your own risk. Those companies with formal accounting policies in place may wish to use a more formal format.

The following is a de minimis election statement format prepared by CountingWorks. It has not had any legal review. Use at your own risk. Check to see if your software has this election built in. The election is attached to a timely filed return, including extensions. Remember this election must be made annually!

CAUTION – REALLY IMPORTANT!!!

In general, most clients are not familiar with this election requirement and need to be contacted and made aware of this annual requirement before year-end.

Exceptions to the De Minimis Safe Harbor

The de minimis safe harbor does not apply to amounts paid for property that is, or is intended to be, included in inventory property; land; and certain rotable, temporary, and standby emergency spare parts a taxpayer elects to capitalize and depreciate; and standby emergency spare parts the taxpayer accounts for under the optional method of accounting (note rotable, temporary, and standby emergency spare parts are not covered in this material).

All or Nothing Election

A taxpayer making this election must make the election for all amounts paid for qualifying expenses during the taxable year including materials and supplies