IRS Limit on Not-For-Profit Deductions and Losses

If a taxpayer's activity is defined as not-for-profit, the IRS has a number of rules, including limits on deductions and losses that can be taken.

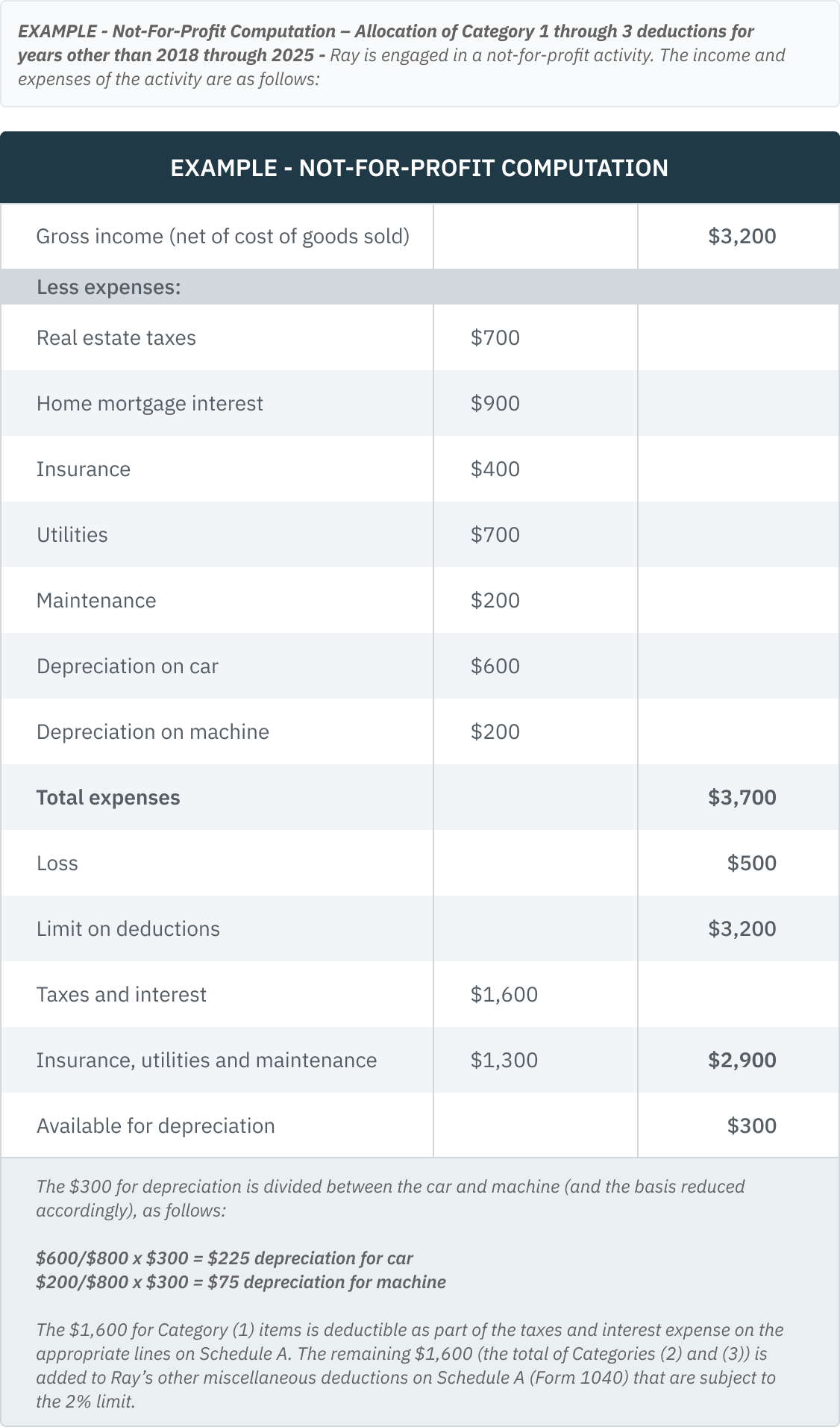

If an activity is not carried on for profit, deductions are used only in the following order, are limited to three categories, and are allowed only if a taxpayer itemizes.

-

Category 1. This category includes deductions for home mortgage interest, taxes, and casualty losses. Report them on the appropriate lines of Schedule A.

-

Category 2. Deductions that don’t result in an adjustment to the basis of property are allowed next, but only to the extent gross income from the activity is more than the deductions under Category 1. Most business deductions, such as those for advertising, insurance premiums, interest (other than home mortgage interest), utilities, wages, etc., belong in this category.

-

Category 3. Business deductions that decrease the basis of property are allowed last, but only to the extent the gross income from the activity is more than deductions under the first two categories. The deductions for depreciation and amortization belong in this category.

Additional limit PRIOR to 2018 - Individuals must claim the amounts in categories (2) and (3) as miscellaneous deductions on Schedule A, subject to the 2% of AGI reduction, and as a result, they are not deductible for alternative minimum tax.

Additional limit AFTER 2017 – Due to the itemized deduction limitations imposed by TCJA the ability to deduct not-for-profit activity expenses other than home mortgage interest and taxes has been suspended for the years 2018 through 2025. That is because casualty losses (other than disaster losses) and miscellaneous deductions subject to the 2% of AGI reduction (tier 2 deductions) are suspended and therefore not allowed at all for 2018 through 2025. This includes depreciation which for a not-for-profit activity would be a tier 2 miscellaneous deduction. As result, the calculation illustrated below will not apply for years 2018 through 2025.

Self-Employment Tax

A trade or business for purposes of determining whether an individual has self-employment income, subject to the self-employment (SE) tax, has the same meaning as when used for federal income tax purposes in allowing trade or business expenditures under Code Sec. 162 (i.e., a continuous, regular activity engaged in with a profit motive) (Code Sec. 1402(c); Reg § 1.1402(c)-1).

However, since the gross income from a not-for-profit activity (hobby) is reported on (1040 Schedule 1, line 8i, 2021), make sure your software does not assess SE tax on it since the activity isn’t a trade or business. Use Schedule C when the activity is a trade or business of a sole proprietor.