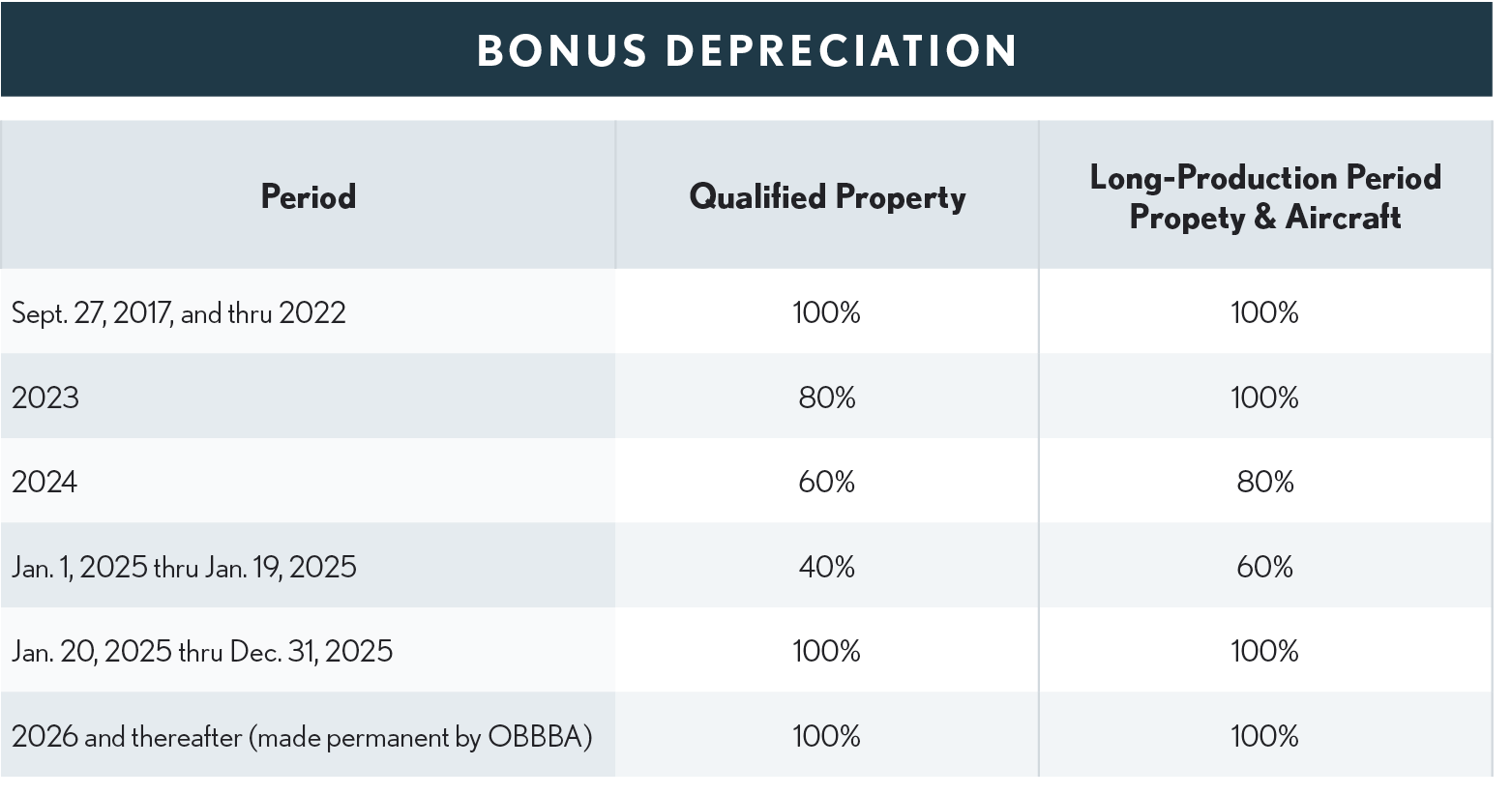

MACRS Bonus Depreciation

Bonus depreciation was substantially changed under TCJA for property acquired and place in service after 09/27/2017 and made permanent by OBBBA.

Qualifying Property - Can be new or used and the bonus rate applies to:

-

All tangible assets except structures( but see Qualified Production Property above), with a MACRS life of 20 years or less

-

Qualified film productions.

-

Qualified television productions.

-

Qualified live theatrical productions.

-

Qualified improvement property.

-

Certain fruit and nut trees grafted or planted after September 27, 2017.

-

Computer software (excluding software being amortized under Code Section 197)

-

Specifically excluded from qualified property is public utility property and vehicle dealer property.

Qualified Improvement Property - Means “any improvement to an interior portion of a building which is nonresidential real property if such improvement is placed in service after the date such building was first placed in service,” except expenditures attributable to the enlargement of the building, any elevator or escalator, and the internal structural framework of the building do not qualify.

Commentary: Bonus depreciation prior to September 28, 2017, only applied to new property while bonus depreciation after September 27, 2017, applies both to new and used property.

-

Commentary: Both the bonus depreciation and the Sec 179 expensing provide means of substantially reducing business profits. However, TCJA added some issues that need to be considered before utilizing these provisions.

1. The Sec 199A deduction is based on qualified business income (QBI). QBI is generally net profits for Schedule Cs and Fs, real estate rentals (Schedule E), and flow-through income from partnerships and S-Corporations. Writing off large capital purchases reduces an entity’s profit and in turn will generally reduce the amount of the Sec 199A deduction.

2. On the flip side, lowering a taxpayer’s taxable income may be helpful in avoiding certain 199A phaseouts and limitations.

Revoking the Bonus Depreciation Election

Generally, the election out of bonus depreciation can only be revoked with IRS consent, except that if made on a timely filed return, the election-out can be revoked on an amended return filed within six months of the original return's due date (excluding extensions). (Reg § 1.168(k)-1(e)(7))

Reg § 1.168(k)-1(e)(7)(ii) - Automatic 6-month extension - If a taxpayer made an election specified in paragraph (e)(1) of this section for a class of property, an automatic extension of 6 months from the due date of the taxpayer's Federal tax return (excluding extensions) for the placed-in-service year of the class of property is granted to revoke that election, provided the taxpayer timely filed the taxpayer's Federal tax return for the placed-in-service year of the class of property and, within this 6-month extension period, the taxpayer (and all taxpayers whose tax liability would be affected by the election) files an amended Federal tax return for the placed-in service year of the class of property in a manner that is consistent with the revocation of the election.

-

Qualified Improvement Property

With enactment of the TCJA, qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property did not qualify for bonus depreciation, which only applies to property with a 20-year or less recovery period. While it had been the intent of Congress to combine these properties as qualified improvement property with a 15-year MACRS recovery period, a drafting error in the TCJA legislation caused them to be assigned to the 39-year recovery period, which made them ineligible for bonus depreciation. This oversight was finally corrected in the CARES Act, enacted March 27, 2020, by retroactively assigning qualified improvement property placed in service after 2017 to the 15-year category.

The 15-year recovery period for qualified improvement property applies only to improvements "made by the taxpayer." The final regulations clarify that an improvement is considered made by a taxpayer if the property is constructed for the taxpayer.

AMT Depreciation Relief

Property for which the bonus depreciation is claimed is exempt from the alternative minimum tax (AMT) depreciation adjustment, which requires that certain property depreciated on the 200% declining balance method for regular income tax purposes must be depreciated on the 150% declining balance method for AMT purposes. Under a change made by the PATH Act of 2015, if a taxpayer elects not to take the bonus depreciation allowance for qualified property, the property will not be subject to an AMT adjustment for depreciation if placed in service after 2015. In other words, AMT depreciation on property eligible for the bonus depreciation is computed the same way as for regular tax purpose with no AMT adjustment, even if the taxpayer elects out of bonus depreciation. (Code Sec. 168(k)(2)(G), as amended by the PATH Act)

Business Autos

The so-called “luxury auto” rules impose a maximum annual deduction for depreciation. In years after 2007 when the bonus depreciation is allowed, the first-year luxury auto limits are increased by $8,000 if the taxpayer elects bonus depreciationwith the following exceptions. In the case of a passenger automobile acquired by the taxpayer before September 28, 2017, and placed in service by the taxpayer:

-

September 28, 2017, through 2018, the limit is increased by $8,000.

-

During 2019, the limit is increased by $4,800.

Other Rules That Apply

-

Related party rules.

-

Section 179 is applied first, and the basis adjusted prior to computing any bonus allowed.

-

The bonus depreciation on “qualified property” under Code Sec. 168(k) is not taken into account as a cost in applying the percentage of completion method.

BONUS DEPREICATION & SEC 179 APPLICATION COMPARISION TABLE

There is a table that compares the items that are qualified for either bonus deprecation or Sec 179 expensing or both included in the guide titled IRS Tax Code Sec 179 Overview.