California LLC Annual Filing Requirements

A California LLC must file its initial report, called the Statement of Information, with the California Secretary of State (SOS) within 90 days of the company's formation. The report is then due to the state biennially by the company's anniversary date. Form LLC-1 accompanied by the LLC’s Operating Agreement is used for that purpose. The form is available on the Secretary of State’s website at www.sos.gov.org. In addition, the LLC will be required to biennially file Form LLC-12 with the Secretary of State. However, Form LLC-12NC (Statement of No Change) may be used in lieu of Form LLC-12 if a previous complete LLC-12 has been filed with the SOS and if there has been no change in any of the information contained in the previous LLC-12. Changes to information contained in a previously filed LLC-12 can be made by filing a new Form LLC-12, completed in its entirety.

Related FTB Publications and Forms

-

Form 100 – Corporate Return

-

Form 568 – Limited Liability Company Return of Income

-

Form 568 Booklet - (https://tbz-prd.s3.us-west-2.amazonaws.com/20896/ai-file-352.pdf)

-

FTB 3522 - LLC Tax Voucher

-

FTB 3536 – Estimated Fee for LLCs,

-

FTB 3537 - Payment for Automatic Extension for LLCs

-

FTB 3832 - Limited Liability Company Non-resident Members’ Consent

-

Form LLC-1 - Limited Liability Company Articles of Organization

-

Form LLC-12 – Statement of Information (Limited Liability Company)

-

Form LLC-12NC –Statement of No Change (Limited Liability Company)

Real Property Held For Sale to Customers

The Franchise Tax Board, in Legal Ruling 2016-01 has held the adjusted basis of real property held for sale to customers in the ordinary course of business is included in the cost of goods sold. As a result, the sales price of the real property must be included in the LLC’s gross income (adjusted basis added back) to determine the LLC fee. This will have a direct impact on taxpayers who are buying, improving and subsequently selling real property, commonly referred to as flipping.

Where property is held for investment purposes only, the property's adjusted basis is not added back to the taxpayer's gross income for purposes of calculating the fee.

LLCs Not Organized in California

(FTB Booklet 568, Page 7) California law requires LLCs not organized in the state of California to register with the California SOS before entering into any intrastate business in California. The laws of the state or foreign country in which the LLC is organized generally govern the internal affairs of the LLC. The California SOS may not deny recognition of an LLC because the laws of the organization’s home state or foreign country differ from California’s laws, except in the case of professional service LLCs, which are not allowed to register as LLCs in California.

Who Must File

An LLC may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The LLC should file the appropriate California return. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply:

-

The LLC is doing business in California.

-

The LLC is organized in California.

-

The LLC is organized in another state or foreign country but registered with the California SOS.

-

The LLC has income from California sources (nonregistered foreign LLCs, see Exceptions to Filing Form 568, below).

The 15 Day Rule

Understanding the 15-day rule and realizing the rule only applies to short taxable years that are 15 days or less, is very important for your client to know when deciding on when to register their business entity with the California Secretary of State.

The 15-day rule states that business entities (limited partnerships, limited liability partnerships, limited liability companies, and corporations) with a taxable year of 15 days or less are not required to file a tax return or pay the $800 annual/minimum tax, if they meet both of the following:

-

They did no business in California during the taxable year

-

Their taxable year is 15 days or less

For example, if a business entity who files on a calendar year basis is formed on or after December 17, and does no business for the remainder of the year, then it may not have to file a tax return and/or pay the $800 annual/minimum tax for that short taxable year.

Additionally, if the business entity meets the 15-day rule and is not required to file a tax return, this short period is not considered the first taxable year. The first taxable year will be the following year.

For example, if a corporation filing on a calendar year basis incorporates on December 20, 2024, and does not conduct business from December 20, 2024, through December 31, 2024, then it meets the 15-day rule and is not required to file a 2024 tax return. The corporation's first taxable year will start on January 1, 2025.

For more information on the 15-day rule for Limited Liability Company Filing Information Publication and Guide for Corporations Starting Business in California.

Registration

LLCs that are formed in California, are required to file articles of organization with the California SOS before doing business in California.

LLCs organized under the laws of another state or foreign country are required to register with the California SOS before entering into intrastate business in California.

Nonregistered foreign (i.e., not organized in California) LLCs that are members of an LLC doing business in California or general partners in a limited partnership doing business in California are considered doing business in California. Regardless of where the trade or business of the LLC is primarily conducted, an LLC is considered to be doing business in California if any of its members, managers, or other agents are conducting business in California on behalf of the LLC.

Penalty for Non-Registered, Suspended, or Forfeited LLC: The FTB will assess a $2,000 penalty against a non-qualified foreign LLC that is doing business within the state while not registered to do business within the state, or while suspended or forfeited.

Exceptions to Filing Form 568 (from FTB 568 Booklet – 2022):

-

The LLC elected to be taxed as a corporation for federal tax purposes.

-

The LLC is a single member limited liability company (SMLLC) that was treated as an association taxable as a corporation prior to January 1, 1997, for California tax purposes, and did not elect to change that tax treatment in the current taxable year.

-

Nonregistered foreign (i.e., not organized in California) LLCs (excluding disregarded entities/single member LLCs) that are not doing business but are deriving income from California or filing to report an election on behalf of a California resident, file Form 565 instead of Form 568.

-

A single-member, nonregistered foreign (i.e., not organized in California) LLC classified as disregarded which is not doing business in California, need not file Form 565 or Form 568.

LLCs classified as a general corporation file Form 100, California Corporation Franchise, or Income Tax Return. LLCs classified as an S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. For LLCs classified as disregarded entities, see General Information S, Check-the-Box Regulations.

The LLC is still required to file Form 568 if the LLC is registered in California even if both of the following apply:

-

The LLC is not actively doing business in California.

-

The LLC does not have California source income.

The LLC’s filing requirement will be satisfied by doing all the following:

-

Completing Form 568 with all supplemental schedules.

-

Completing and attaching California Schedules K-1 (568) for members with California addresses.

-

Writing “SB 1106 Filing” in black or blue ink at the top of Form 568, Side 1.

-

Entering the total number of members in Question K on Side 2 of the Form 568.

Certain publicly traded partnerships treated as corporations under IRC Section 7704 must file Form 100.

A resident member of an out-of-state LLC taxed as a partnership not required to file Form 568, may be required to furnish a copy of federal Form 1065, U.S. Return of Partnership Income, to substantiate the member’s share of LLC income or loss.

Non-Resident Multi-Member LLCs Filing Requirements

When at least one member of a multi-member LLC partnership is a non-resident,

The Franchise Tax Board, in Legal Ruling 14-01, has held that for tax purposes, the business of a partnership is the business of each partner. For this reason, wherever a partnership does business, the activities of the partnership are attributed to each partner, with the consequence that in geographic locations where the partnership is "doing business," the partners are also "doing business."

If an LLC is treated as a partnership for tax purposes, both the LLC and its members, are subject to the same legal principles applicable to any partnership. Thus, if an LLC classified as a partnership for tax purposes is "doing business" in California under Section 23101, the members of the LLC are themselves "doing business" in California. According to the FTB, this is true even in the case of "manager-managed" LLCs. If an LLC is classified as a partnership for tax purposes, the members, who are considered general partners for tax purposes, are "doing business" where the LLC, i.e., a general partnership for tax purposes, is "doing business," even though the members have limited liability protection and are not California residents. Therefore, if the member is deemed to be doing business in California, the member is subject to the LLC filing requirements and taxes.

Swart Case - However, in November 2014, a California Superior Court disagreed with the FTB’s position. The court ruled that an Iowa corporation whose only connection with California was its 0.2% ownership interest in a fund organized as a California LLC was not "doing business" in California. Under California law, the fund was organized as a “manager-managed LLC” rather than a “member-managed LLC”; thus, the out-of-state corporation had no control over the management of the fund and did not have a sufficient percentage interest to indirectly control its management. The court said the corporation was entitled to a refund of the annual franchise tax, interest, and penalties previously collected by the FTB. (Swart Enterprises, Inc. v. California Franchise Tax Board, Fresno Superior Court, No. 13CECG02171, Order on Cross-Motions for Summary Judgment, November 14, 2014)

The FTB appealed this case to the 5th Circuit Court of Appeals and lost the appeal. (Swart Enterprises, Inc. v. California Franchise Tax Board (January 12, 2016) California Court of Appeal, Fifth District, Case No. F070922). The Appeals Court opined that California’s expansive interpretation of doing business “defies a common-sense understanding of what it means to be ‘doing business’. ”This is a precedent-setting case that other taxpayers can rely on. The FTB provided guidance in FTB Notice 2017-01 that any taxpayers who file a claim for refund and who believe their situation has the same facts as in Swart, should cite the holding in Swart and explain how their factual situation is the same as the facts in Swart. So, it seemed that to meet the same fact pattern as in Swart, a taxpayer’s interest in an LLC that meets the other facts of Swart can’t be more the 0.2%. The FTB has said that it is not going to withdraw Legal Ruling 14-01. But the story doesn’t end here. . .

The Office of Tax Appeal, in the Appeal of JALI, LLC (2019 – OTA – 204P, pending precedential), said: “In short, we reject FTB’s 0.2 percent ownership threshold as the new bright-line legal standard for distinguishing between an active and a passive ownership interest in an LLC classified as a partnership. While ownership percentages may be a factor in nexus determinations, it is not necessarily dispositive, as one must still generally conduct a fact intensive inquiry into the relationship between the out-of-state member and the in-state LLC. This may include whether the in-state LLC is manager-managed, whether the out-of-state member holds a non-managing member interest, and whether the out of-state member is actively involved in the business activities of the in-state LLC. We believe such an interpretation properly reflects the rationale of Swart and faithfully adheres to its legal principles.” The OTA went on to rule that JALI was not doing business in California, and therefore wasn’t required to pay the $800 LLC tax.

Tax Basis Reporting

As of taxable year 2023, the FTB will require a taxpayer who files Form 565 (or 568) to annually report its partners' or members' capital accounts on the Schedule K-1 (565 or 568) using the tax basis method as determined under California law.

Withholding Taxes LLC Members – CA Conforms to Federal

Legislation enacted in 2014 (SB 1131) conforms treatment of LLCs to federal law by excluding members of an LLC that is taxed as a partnership from the definition of employee as it relates to personal income tax (PIT) withholding requirements. Thus, the LLC is not required to withhold state PIT from its members. Legislation in 2010 had exempted LLCs taxed as a partnership from unemployment tax and disability insurance withholding. With the passage of SB 1131, California now fully conforms to federal regarding compensation of LLC members.

LLCs & Professional Services In California

According to a ruling in the California Corp. Code, LLCs in the state cannot provide professional services, including chiropractic care and certain activities involving the sale of boats.

An LLC may not render professional services (Corp. Code § 17375). “Professional services” are defined in California Corporations Code sections 13401(a) and 13401.3 as any type of professional services that may be lawfully rendered only pursuant to a license, certification, or registration authorized by the Business and Professions Code, the Chiropractic Act, the Osteopathic Act or the Yacht and Ship Brokers Act.

If the business is required to be licensed, registered or certified, the owner should contact the appropriate licensing authority before registering as an LLC with the California Secretary of State’s (SOS) office in order to determine whether the services are considered professional.

Information on legally establishing an LLC can be found on the Small Business Administration’s web site, www.SBA.gov, or on the California Secretary of State’s web site, www.sos.ca.gov.

Husband & Wife Members of an LLC

A husband and wife who each have a separate interest in the LLC will be treated as separate members. The LLC must file a partnership return and issue a separate Schedule K-1 (FTB Form 568) to each member. A husband and wife who hold a membership interest together are treated as a single member. The LLC must file a return as a disregarded entity if they are the sole owners, and issue them a single K-1 (FTB Form 568).

LLC Tax Credit Limitations

A taxpayer that owns an interest in a single-member LLC that is disregarded for tax purposes may only claim credits or credit carry forwards from the LLC to the extent the member’s tax liability is attributable to the LLC. Disallowed credits may be carried forward to future years.

LLC Fee Exemptions In California

Short Year Relief of $800 Annual Tax - LLCs are not subject to the annual tax and fee if both of the following are true:

-

They did not conduct any business in California during the tax year

-

Their tax year was 15 days or fewer

2021 - 2023 Only First Year Relief of $800 Annual Tax - AB 85, which was signed by the governor on June 29, 2020, provides that for taxable years beginning on or after January 1, 2021, and before January 1, 2024, if a specified appropriation [$1 or more] is made in any budget measure, a limited partnership, a limited liability partnership, and limited liability company that files, registers, or organizes to do business in California is exempt from the payment of the $800 annual tax in its first taxable year. (R&TC 17941(g)) This change aligns these business entities with the first-year exemption that has been available to corporations.

Annual Tax Deployed Military Exemption - For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business (has total CA source income of $250,000 or less) solely owned by a deployed member of the United States Armed Forces is not subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation. “Deployed” means being called to active duty or active service during a period when a Presidential Executive order specifies that the United States is engaged in combat or homeland defense. “Deployed” does not include either temporary duty for the sole purpose of training or processing or a permanent change of station. (R&TC 17941(f))

Annual Tax & LLC Fee In California

LLCs are responsible for a flat franchise tax of $800.00 assessed by the California Franchise Tax Board. The initial franchise tax is due by the 15th day of the fourth month after the company's formation, and annual franchise taxes must be prepaid by the 15th day of the fourth month of each tax year. However, for 2020, the due date was extended to July 15, 2020, because of the COVID-19 pandemic. See also “First Year Relief of $800 Annual Tax,” above. The annual tax is paid using CA Form 3522.

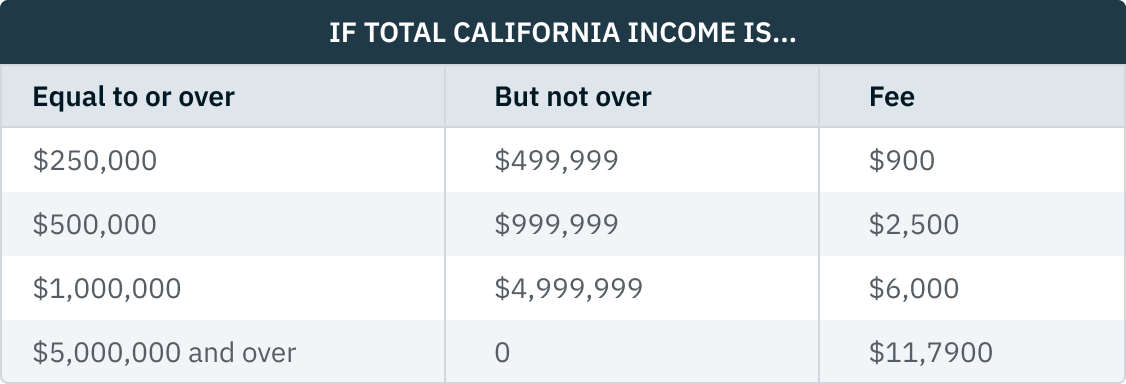

California LLCs, which are required to file Form 568, are also assessed a fee (sometimes termed the gross receipts tax) on annual income exceeding $250,000.00. The fee is based on the LLC's total California source income (not worldwide income) and is determined from the chart below. Paycheck Protection Program (PPP) loans that are forgiven are excluded from California gross income, and for LLCs, the amount of the forgiven PPP loan amount should not be included in the computation of gross income when determining the LLC fee. (FTB Tax News, May 2021)

Estimated Fee Payment Required - The LLC fee must be estimated and paid by the 15th day of the 6th month of the current taxable year. (R&TC 17942(d)(1)) For calendar year filers that normally means the payment is due by June 15. However, due to the COVID-19 pandemic, the due date for tax year 2020 was extended to July 15, 2020. A penalty of 10% of the underpayment of the estimated fee will apply if the estimated fee is underpaid, although no penalty will be imposed if the timely paid estimated fee is equal to or greater than the total of the preceding year’s annual fee. (R&TC 17942(d)(2)) Form FTB 3536 must be used to pay the estimated fee.

E-Pay Requirement - LLCs are subject to the state’s mandatory electronic payment requirement when $20,000 extension payment/$80,000 tax liability thresholds are met.

Deducting the LLC Tax and Fee - For federal purposes both the $800 tax and the income-based fee are deductible on the LLC’s tax return, but for California purposes, only the fee paid is deductible.

In addition, an LLC filing Form 568 that has members that are not residents of California must file the agreements of those non-resident members acknowledging that California may tax them and may collect tax from them, agreeing to file a California return and pay tax on the members’ share of California source income of the LLC. For any non-residents that do not sign an agreement, the LLC must pay tax on the non-residents’ share of LLC income.

Commencing and Dissolving LLCs - Commencing and dissolving LLCs are exempt from tax during the year of organization or dissolution if the tax year is 15 days or less and the LLC does no business in California during the tax year. For example, a calendar year LLC that is formed between December 17 and December 31 is exempt from tax during the first tax year if it does no business in California during that period. A calendar year LLC that dissolves by January 15 is exempt from tax during the last tax year if it does no business in California during that period.

Key LLC Features

-

An LLC may have one or more owners and may have different classes of owners. In addition, an LLC may be owned by any combination of individuals or business entities. An LLC, therefore, is more flexible than an S corporation with regards to types and numbers of owners.

-

An LLC is treated as a legal entity separate from its owners, similar to how a corporation is treated, regardless of how the LLC is classified for tax purposes.

-

In general, the owners (members) are shielded from individual liability for debts and obligations of the LLC.

-

An LLC is formed by filing "articles of organization" with the California Secretary of State prior to conducting business.

-

Forming an LLC is simpler and faster than forming and maintaining a corporation.

-

LLCs do not issue stock and are not required to hold annual meetings or keep written minutes, which a corporation must do in order to preserve the liability shield for its owners.

-

Either before or after filing its articles of organization, the LLC members must enter into a verbal or written operating agreement. A formal, written agreement is advisable.

-

An LLC is typically managed by its members, unless the members agree to have a manager manage the LLC’s business affairs.

-

Generally, members of an LLC that are taxed as a partnership may agree to share the profits and losses in any manner. Members of an LLC classified as a corporation receive profits and losses in the same manner as shareholders of a corporation legally organized as such.

-

An LLC’s life is perpetual in nature. However, the members may agree in the articles of organization or the operating agreement to a date or event that will cause the LLC to terminate. In addition, members of the LLC may vote at any time to end the business operations of the LLC.

CA Penalty - LLC Failure to File

Effective January 1, 2013, the Franchise Tax Board (FTB) will assess a $2,000 penalty against an LLC (domestic/foreign) that is doing business within California while not registered to do business within the state or while suspended or forfeited and fails to file its required tax return upon notice and demand. (RTC §19135)