General IRS Rules For Foreign Business Travel Expenses

Find the IRS's general rules for foreign business travel expenses below. There are unique regulations that differ from domestic travel, so it is important for taxpayers to conduct research before filing their taxes.

-

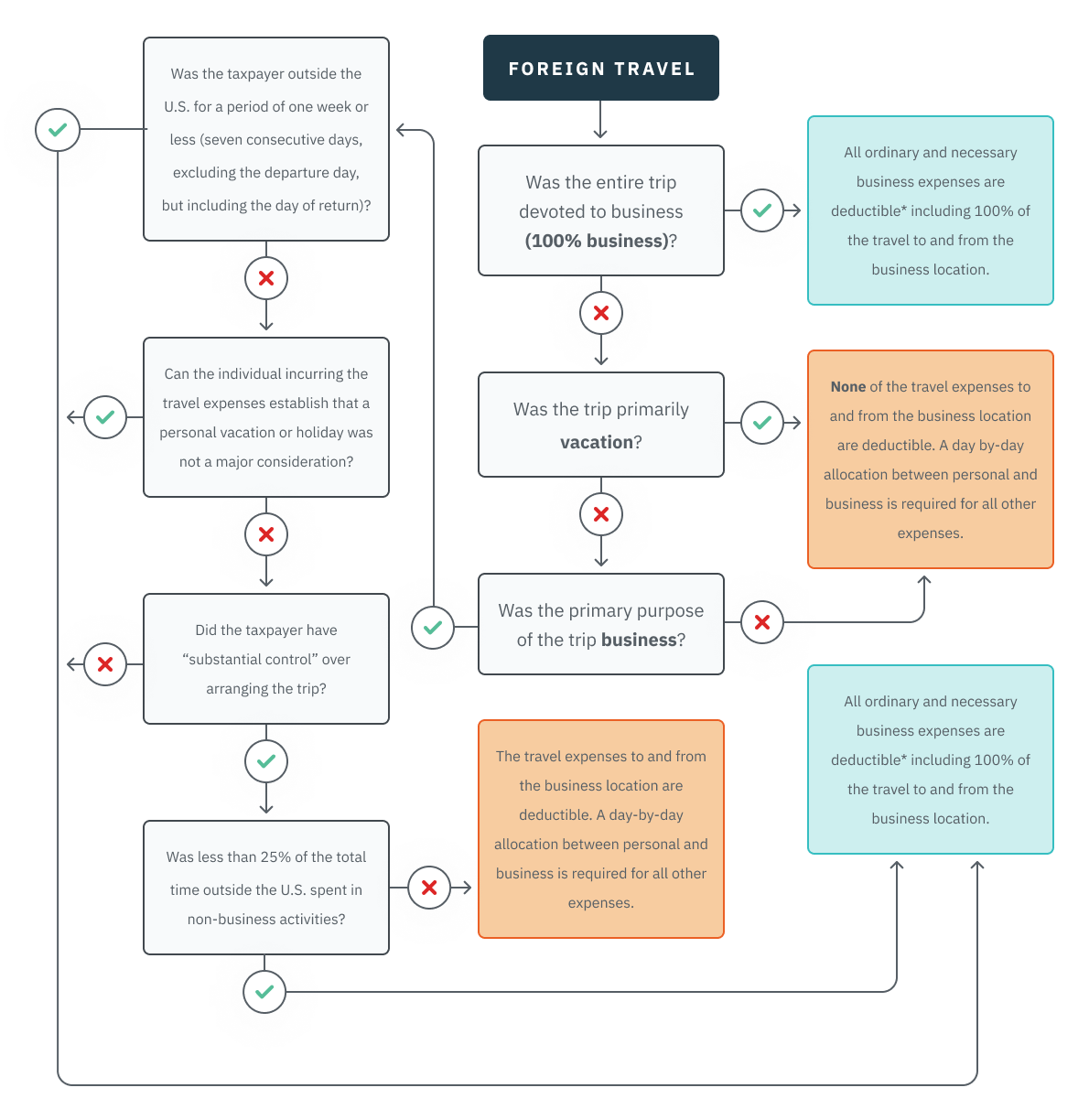

If the entire time is devoted to business, all ordinary and necessary travel expenses are deductible.

-

If the travel is primarily for vacation and only a few hours are spent attending professional seminars or meeting with clients, vendors, or business colleagues in the foreign locale, none of the expenses incurred in traveling to and from the business location are deductible.

-

If, during a business trip, personal activities take place at, near, or beyond the business destination, then the expenses incurred in traveling to and from the business location have to be allocated between the business and non business expense.

-

If the travel outside the U.S. meets certain conditions (see below), the expenses incurred in traveling to and from the business destination are deductible in full as long as the primary purpose of the trip is for business (same as for travel within the U.S.).

Travel, otherwise deductible under §162 or §212, that is outside the U.S., comes under the same rules that apply to travel within the U.S. if a taxpayer meets any one of the following conditions:

-

The travel outside the U.S. is for a period of one week or less (seven consecutive days, excluding the departure day, but including the day of return).

-

Less than 25% of the total time outside the U.S. is spent in non-business activities., (If 25% or more of the total time is spent on non-business activities, a day-by-day allocation between personal and business activities is necessary.)

-

The individual incurring the travel expenses can establish that a personal vacation or holiday was not a major consideration.

-

The taxpayer did not have “substantial control” over arranging the trip.

Business Days

-

Days en route to or from the business destination by a reasonably direct route without interruption;

-

Days when actual business is transacted;

-

Weekends or standby days which fall between business days;

-

Days when business was to have been transacted but was cancelled due to unforeseen circumstances.

Non-Business Days

-

Days spent on non business activities, and

-

Weekends, holidays, and other standby days that fall at the end of the business activity, if the taxpayer remains at the business destination for personal reasons.

"Substantial Control"

-

An employee traveling outside the U.S. on behalf of his employer under a reimbursement allowance is not considered to have substantial control over arranging his trip and is subject to the same rules that apply to U.S. travel.

-

Managing executives (i.e., employees who have authority and responsibility to decide on the need for the business travel, without any effective veto procedures) are presumed to have control., An employee owning over 10% of the employer’s stock is in this category.

-

Being able to control the time of the trip does not indicate substantial control.

-

A self-employed person is usually regarded as having substantial control.

Reg. 1.274-4(f)

Requires an allocation of business and non business expenses, unless one of the exceptions applies. The expenses which have to be allocated depend on where the non business activity takes place. The allocation is done on a day-by-day basis, unless the taxpayer establishes that some other method more clearly reflects expenses attributable to non business activity.

Personal Activities at, Near, or Beyond Business Destination

If the personal activities take place at, near or beyond the business destination, travel expenses (including meals and lodging) from the place where travel outside the U.S. began to the place of business activity and return to the U.S. must be allocated between business and personal amounts. The portion allocated to non business activities is not deductible.

The formula for computing the non-deductible expense when personal activities take place at, near or beyond the business destination is:

Total nonbusiness days/Total business and nonbusiness days

TIMES

Roundtrip transportation + In-transit meals and lodging from a point in U.S. to the business location outside U.S.

Example - Allocation of Expenses for Travel Outside the U.S. - If an individual travels from New York to London on business, and then takes a vacation in Paris before returning to New York, the amount of the travel expense subject to allocation is the expense which would have been incurred in traveling from New York to London and returning [Reg. 1.274-4(f)(2)].

-

Personal Activities En Route To or From Business Destination

If the non-business destination is on the route to or from the business destination, allocate the cost of traveling from the point of departure from the U.S. to the non-business destination and returning to the U.S., including meals and lodging. The expenses incurred on non-business days and the cost of travel to and from non-business locations (except “en route”) are non-deductible. The formula for the non-deductible travel when the non-business destination is en route to the business destination is:

Total nonbusiness days/Total business and nonbusiness days

TIMES

Roundtrip transportation + In-transit meals and lodging from a point in U.S. to en route nonbusiness destination outside U.S.