IRS Section 179 Investment Limit

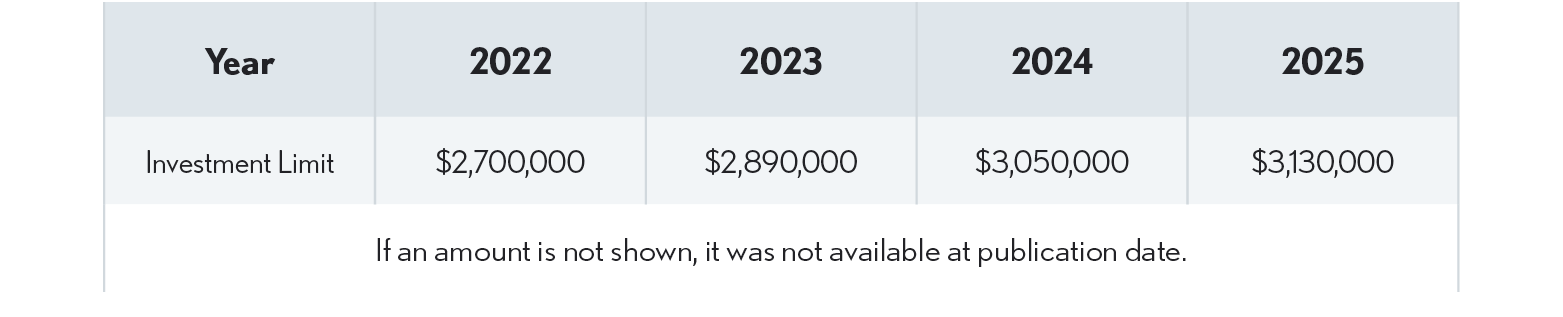

There are certain investment limits that taxpayers should be aware of before taking the tax deductions that are allowed in IRS tax code Section 179.

When the total cost of qualifying property placed in service in any given year exceeds the investment limit, decrease the expense cap amount for the year by one dollar for each dollar over the investment limit. The investment limit is annually inflation adjusted, rounded to the nearest $10,000, after 2015.

Example – Computing Section 179 Under Investment Limit: Jack placed business machinery costing $2,960,000 in service during 2023 when the investment limit was $2,890,000 and the Sec 179 deduction cap was $1,160,000. Jack’s net profit from his business is $2,990,000 before his Section 179 expense deduction. His maximum 179 expense deduction for the placed-in-service year is $1,090,000,

-