Examples of Section 179 Qualifying Property

Personal Tangible Property - Grocery counters, refrigerators, display racks, shelves, neon signs, machinery, equipment, gas pumps, gas storage tanks, grain storage bins, autos, trucks, elevators, escalators, certain livestock, greenhouses, single-purpose livestock structures, and coin-operated vending machines.

Off-the-Shelf Computer Software - Off-the-shelf computer software (made permanent by the PATH Act of 2015).

Air Conditioning and Heating Units - Beginning after 2015, AC and heating units qualify for Sec 179 expensing, but only if they are Sec 1245 property, such as portable units – for example a window air conditioner and portable plug-in unit heaters. An example of an air conditioning or heating unit that will not qualify as Sec. 179 property is any component of a central air conditioning or heating system of a building, including motors, compressors, pipes, and ducts, whether the component is in, on, or adjacent to a building. However, AC and heating units that meet the definition of qualified real property (see below), placed in service after 2015 (Rev. Proc. 2017-33), and HVAC equipment put in service after 2017 in non-residential real estate (see below), may qualify if the taxpayer so elects.

Furnishings - Beginning after 2017, furnishings, e.g., beds and other furniture, refrigerators, ranges, and other equipment – used in the living quarters of a lodging facility such as an apartment house, dormitory, or any other facility (or part of a facility) used predominantly to furnish lodging or in connection with furnishing lodging.

Commentary

Previously Sec. 179 could only be used for a transient lodging activity, such as hotels and motels.

Post-Construction Improvements to Non-Residential Real Property - As qualified real property, any of the following improvements to non-residential real property placed in service after the date such property was first placed in service and after 2017: roofs; heating, ventilation, and air-conditioning property; fire protection and alarm systems; and security systems.

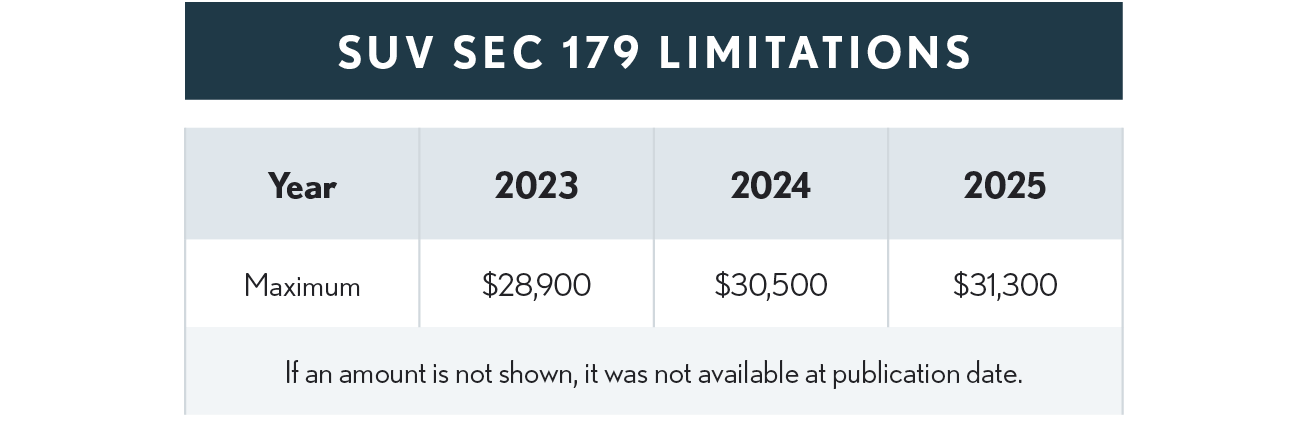

SUV Limitations - The Sec 179 deduction for SUVs is limited and applies to sport utility vehicles rated at 14,000 pounds gross vehicle weight or less. See table for amounts for 2021 – 2023.

Note: By definition, an SUV must weigh more than 6,000 and therefore is not subject to the luxury vehicle rules. Thus, bonus depreciation can be used. 100% bonus depreciation is available through 2022, after which the bonus rate is reduced by 20% per year and sunsets after 2026.

Excluded from the SUV limitation is any vehicle that:

-

is designed for more than nine individuals in seating rearward of the driver's seat.

-

is equipped with an open cargo area, or a covered box not readily accessible from the passenger compartment, of at least six feet in interior length, or

-

has an integral enclosure, fully enclosing the driver compartment and load carrying device, does not have seating rearward of the driver’s seat, and has no body section protruding more than 30 inches ahead of the leading edge of the windshield.

Vineyards - In Chief Counsel Advice (CCA201234024), IRS has concluded that vineyards are eligible for the Code Sec. 179 expensing deduction. Fruit bearing trees and vines aren't considered placed in service until they have reached an income-producing stage. (Reg. § 1.46-3 (d)(2)(iii)) To utilize the Sec 179 deduction, the cost of a newly planted vineyard must be capitalized until such time as the vines reach the income producing stage (placed in service) and then capitalized costs may be expensed under Sec 179.

Qualified Real Property - Includes the following property. (Under TCJA the property in the first 3 bullets below were combined into the single definition of qualified real property.):

-

Qualified leasehold improvement property

-

Qualified restaurant property, and

-

Qualified retail improvement property

-

Effective for property placed in service after 2017, any of the following improvements to non-residential real property placed in service after the date such property was first placed in service: roofs; heating, ventilation, and air-conditioning property; fire protection and alarm systems; and security systems.

Qualified improvement property generally means an internal improvement to non-residential real property if the improvement is placed in service after the date the building was first placed in service but does not include any improvement that enlarges the building, any elevator or escalator, or the internal structural framework of the building. (Code Sec. 168(e)(6)).

For this purpose, the term “qualified real property” means property acquired by purchase for use in the active conduct of a trade or business (Sec. 179(d)(1)), is property that is normally depreciated (Sec. 179(d)(1)) and is not:

-

(prior to 2018) property used for lodging, except for property used by a hotel or motel in which the predominant portion of the accommodations is used by transients.

-

property used outside the U.S; and

-

property used by governmental units, foreign persons or entities, and certain tax-exempt organizations, and

-

(prior to 2016) air conditioning or heating units.

Special Dollar Limitation - Prior to 2016 no more than $250,000 of the Sec 179 deduction limitation applicable can be used for Qualified Real Property.