Dispositions of Installment Obligations

The IRS has specific regulations that pertain to dispositions of installment obligations. If this tax topic applies to you, it is important for you to understand these rules. Seek help from

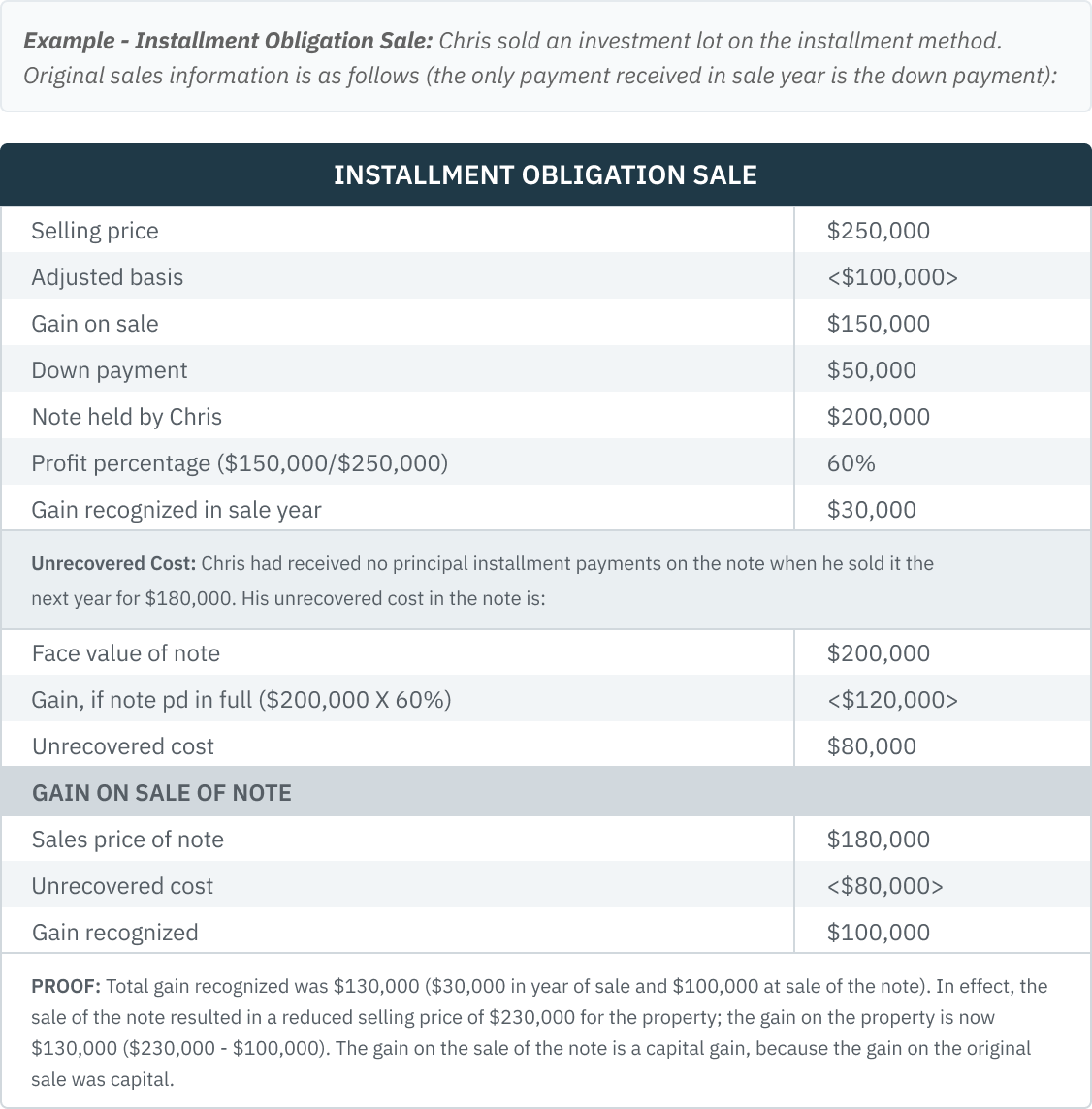

When an installment obligation is disposed of before all gain from the underlying installment sale has been recognized, the seller must usually recognize gain/loss because of the disposition. A disposition can result from any of the following transactions: a sale, exchange, debt cancellation, or bequest, among other possibilities. The character of the gain or loss from the disposition of the obligation is the same as the character of the gain on the original installment sale.

If an instalment obligation is sold or exchanged, or if the holder of the obligation accepts less than face value for it, the gain or loss on the transaction is the difference between the basis of the obligation and the amount realized on the disposition.If the obligation is disposed of in any other kind of transaction, the gain or loss is the difference between the holder’s basis in the obligation and the FMV of the obligation.