Disallowance of Business Interest

The Tax Cuts and Jobs Act of 2017 made changes to certain parts of the tax code that pertained to the disallowance of business interest.

Effective beginning in 2018, TCJA gets rid of the special and complicated “earnings strippings” rules that were put in place to prevent a U.S. corporation from borrowing money from a foreign subsidiary in a lower tax bracket and then deducting interest on the U.S. corporate return. We won’t get into that big business tactic other than to provide a little understanding why this provision was passed.

Regardless of business form, the interest expense is limited to the sum of:

-

The taxpayer's business interest income for the tax year;

-

30% of the taxpayer's adjusted taxable income (ATI) for the tax year; plus

-

The taxpayer's floor plan financing interest (certain interest paid by vehicle dealers) for the tax year.

Special Rules for 2019 and 2020

A provision in the CARES Act generally allows businesses to elect to increase the interest limitation from 30% of ATI to 50% of ATI for 2019 and 2020 and allows businesses to elect to use 2019 ATI in calculating their 2020 limitation.

Net Interest Expense Disallowance

The net interest expense disallowance is determined at the taxpayer level. (IRC Sec 163(j)(1) as amended by TCJA Sec. 13301(a))

Definitions and Rules

For purposes of this limitation, the following definitions and rules apply:

-

Adjusted Taxable Income - For 2018 through 2021, adjusted taxable income is determined without regard to depreciation, amortization or depletion deductions. In addition, adjusted taxable income means taxable income computed without regard to:

-

Any item of income, gain, deduction, or loss which is not properly allocable to a trade or business;

-

Any business interest income or business interest expense;

-

The amount of any net operating loss deduction;

-

The amount of any qualified business income deduction allowed under section 199A; and

-

Adjustments described in published guidance.

-

-

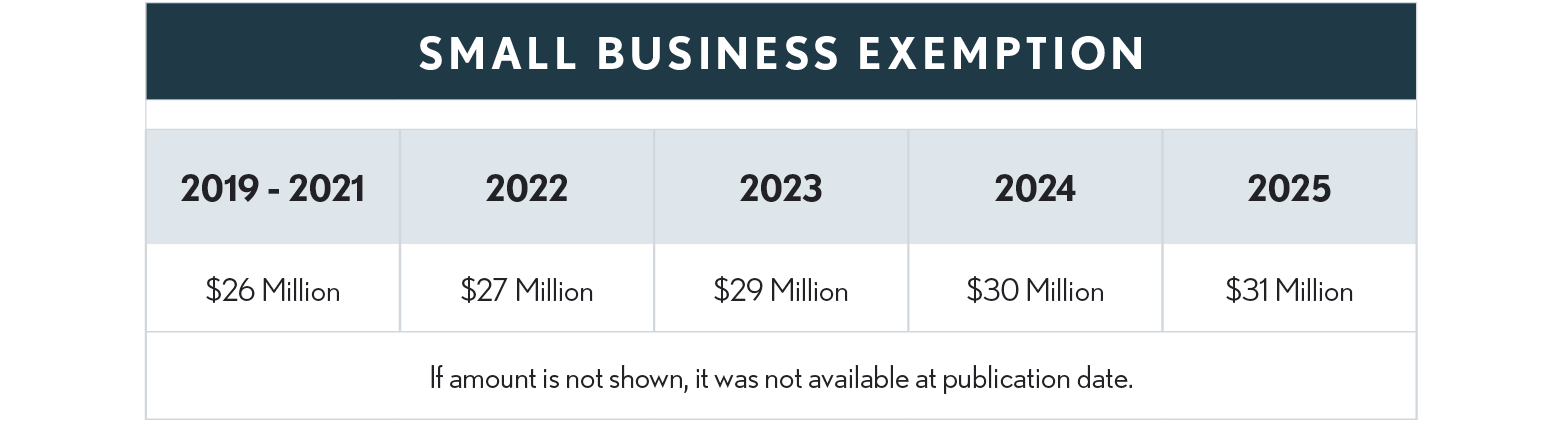

Small Business Exemption – An exemption from the business interest limitation rules applies to taxpayers (other than tax shelters) with average gross receipts for the three prior years of $25 million or less. This amount is inflation-adjusted for years after 2018 (see table below).

-

Rental Real Estate Activities – A rental real estate activity is not subject to the limitation on business interest unless the rental real estate activity is a trade or business. If the rental real estate activity is a trade or business, and the small business exception does not apply, Form 8990 must be filed to deduct any interest expenses for that rental real estate activity unless one of the filing exceptions listed in the instructions for Form 8990 is met. These exceptions include:

-

Those meeting the small business exception,

-

Providing services as an employee,

-

An electing real property trade or business,

-

An electing farming business, or

-

Certain utility business.

-

-

Real Property Trades or Businesses Election – A real property trade or business can elect out of the interest limitation by using the alternative depreciation system (ADS) to depreciate the real property used in the trade or business. For this purpose, a real property trade or business means any real property development, redevelopment, construction, reconstruction, acquisition, conversion, rental, operation, management, leasing, or brokerage trade or business. (Form 8990 instructions)

Revenue Procedure 2019-8 stated that pre-2018 residential property that is switched to the ADS method in order to escape the interest limitation must use the 40-year life that was in place prior to 2018, rather than the 30-year recovery period set by the TCJA. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 overrides this revenue procedure for tax years beginning after Dec. 31, 2017, by assigning a 30-year ADS depreciation period to residential rental property even though it was placed in service before Jan. 1, 2018, if the property is held by an electing real property trade or business and, before Jan. 1, 2018, wasn't subject to the ADS.

-

Farming Businesses - Farming businesses and specified agricultural or horticultural cooperatives can elect out of this provision if they use ADS to depreciate any property used in the farming business with a recovery period of ten years or more. For this purpose, a farming business includes livestock, dairy, poultry, fish (includes an area where fish and other marine animals are grown or raised and artificially fed, protected, etc., but not an area where they are merely caught or harvested), fruit, nuts, and truck farms. It also includes plantations, ranches, ranges, and orchards. A plant nursery is a farm for purposes of deducting soil and water conservation expenses. (Form 8990 instructions)

See Rev Proc 2019-08 for an explanation how electing real property trades or businesses or farming businesses change to the ADS for property placed in service before 2018. This revenue procedure provides that it is not a change in accounting method.

-

See Rev Proc 2020-22 for guidance relating to elections to be an electing real property or farming trade or business.

See Rev Proc 2021-9 for a safe harbor that allows a trade or business that manages or operates a qualified residential living facility to be treated as a real property trade or business, solely for purposes of qualifying to make the election to be an electing real property trade or business for purposes of the business interest limitation (i.e., code Sec163(j)(7)(B)).

-

Automobile, Boat, Farm Machinery Dealers – Interest on debt secured by the inventory is exempt from the limitation.

-

Partnerships and S Corporations - There are special rules for partnerships and sub-S corporations not covered here, since this course is related to small business and the $27 million gross receipts should effectively provide an exemption for most small businesses. See Form 8990 and its instructions or proposed regulations for additional information.

A special rule for partnerships in the CARES Act allows 50% of any excess business interest allocated to a partner in 2019 to be deductible in 2020 and not subject to the 50% (formerly 30%) ATI limitation. The remaining 50% of excess business interest from 2019 is subject to the ATI limitation. The 2019 ATI limitation remains at 30% of partnership ATI rather than 50% of ATI.

The ATI limitation for 2020 is 50% of partnership ATI and partnerships may elect to use 2019 partnership ATI in calculating their 2020 limitation.

-

Carryover - Any business interest that isn't deductible because of the business interest limitation is treated as business interest paid or accrued in the following tax year, and may be carried forward indefinitely, subject to the restrictions applicable to partnerships. If a partnership or S corporation is subject to the business interest deduction limitation, the limitation is applied at the entity level and any disallowed business interest expense (excess business interest expense) is not carried over by the partnership but is allocated to the partners. In contrast, disallowed business interest expense is carried over by an S corporation and the S corporation treats it as business interest expense paid or accrued in the following year.

-

Application of Limitations - Section 163(j) applies before the application of the at-risk rules (§ 465), passive activity loss provisions (§ 469), and the § 461(l) limitation on excess business losses of noncorporate taxpayers discussed above. ( Reg 1.163(j)-3)

IRS Guidance

In Notice 2018-28 (April 3, 2018) the IRS

announced its intention to produce regulations addressing various issues related

to this new provision, and that in the meantime, taxpayers could rely on the

rules described in sections 3 through 7 of the notice. In late December 2018,

the IRS issued the promised proposed regulations (NPRM REG-106089-18) that provide general rules and definitions and are organized into eleven sections, proposed §§1.163(j)-1 through

1.163(j)-11. Regulations were finalized in January 2021.