Who is a Beneficial Owner?

Per FinCEN Q&A #9 - In general, a beneficial owner is any individual (1) who directly or indirectly exercises “substantial control” over the reporting company, or (2) who directly or indirectly owns or controls 25 percent or more of the “ownership interests” of the reporting company.

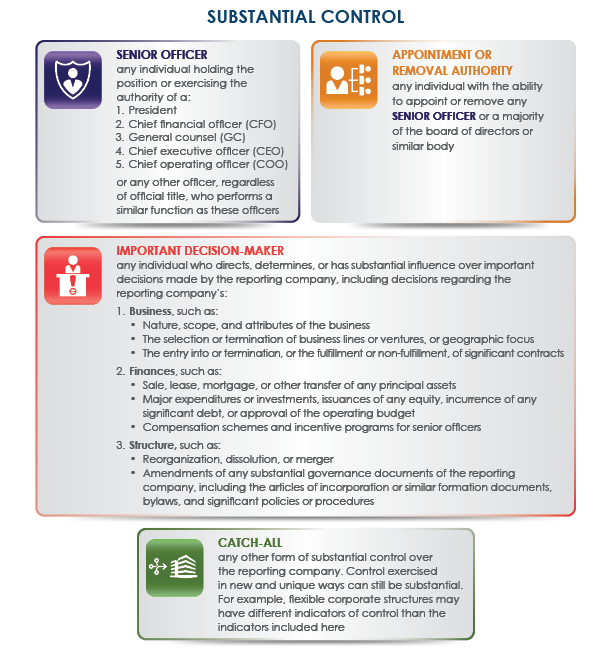

Whether an individual has “substantial control” over a reporting company depends on the power they may exercise over a reporting company. For example, an individual will have substantial control of a reporting company if they direct, determine, or exercise substantial influence over, important decisions the reporting company makes. In addition, any senior officer is deemed to have substantial control over a reporting company.Other rights or responsibilities may also constitute substantial control. Additional information about the definition of substantial control and who qualifies as exercising substantial control can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR§1010.380(d)(1).

Community Property Laws

According to FinCEN's guidance, whether a spouse is considered a beneficial owner in a community property state depends on the specific consequences of applying the applicable state law. If, under community property law, both spouses are deemed to own or control at least 25 percent of the ownership interests of a reporting company, then both spouses should be reported to FinCEN as beneficial owners unless an exception applies. Here is how FinCEN’s Q&A responds the issue:

Possibly. Whether State community property laws affect a beneficial ownership determination will depend upon the specific consequences of applying applicable State law. If, applying community property State law, both spouses own or control at least 25 percent of the ownership interests of a reporting company, then both spouses should be reported to FinCEN as beneficial owners unless an exception applies. [Issued October 3, 2024]

When in doubt the safe harbor approach would be to include the spouse.

Ownership Interests

Generally refer to arrangements that establish ownership rights in the reporting company, including simple shares of stock as well as more complex instruments. Additional information about ownership interests, including indirect ownership, can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR§1010.380(d)(2).

FinCEN expects that most reporting companies will have a simple ownership and control structure. A few examples of how to identify beneficial owners are described below.

Your client is a beneficial owner of the reporting company in two different ways, assuming no other facts. First, the client exercises substantial control over the company because the client is a senior officer of the company (the president) and because the client makes important decisions for the company. Second, the client is also a beneficial owner because the client own 25 percent or more of the reporting company’s ownership interests.

Because no one else owns or controls ownership interests in the LLC or exercises substantial control over it, and assuming there are no other facts to consider, the client is the only beneficial owner of this reporting company, and the client’s information must be reported to FinCEN.

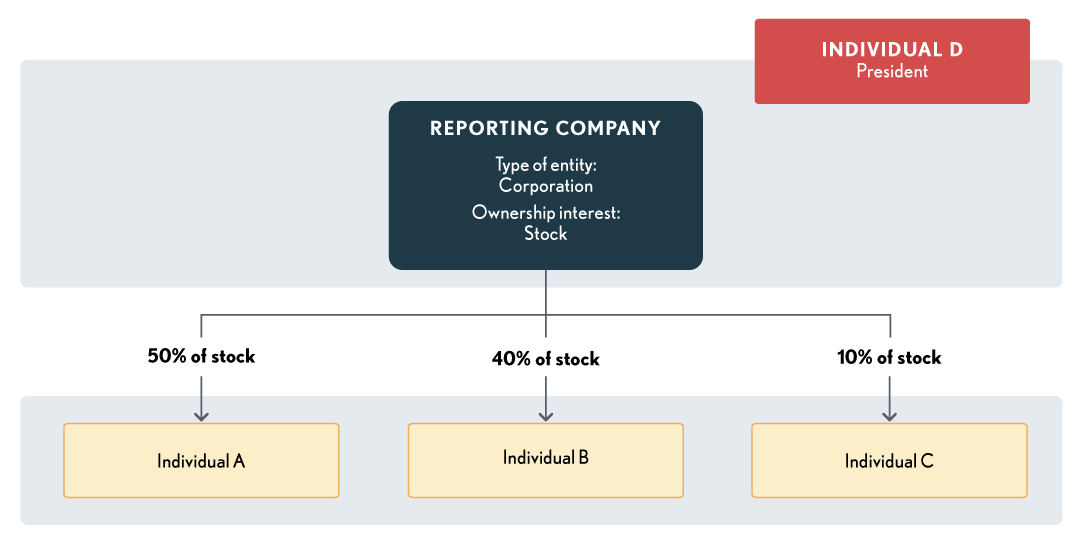

Example 2: The reporting company is a corporation. The company’s total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the President for the company but does not own any stock.

-

Assuming there are no other facts, Individuals A, B, and D are all beneficial owners of the company and their information must be reported. Individual C is not a beneficial owner.

Individual A owns 50 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

Individual B owns 40 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

Individual C is not a company officer and does not directly or indirectly exercise any substantial control over the company.

Individual C also owns 10 percent of your company’s stock, which is less than the 25 percent or greater interest needed to qualify as a beneficial owner by virtue of ownership interests. Individual C is therefore not a beneficial owner of the company.

Individual D is president of the company and is therefore a beneficial owner. As a senior officer of the company, Individual D exercises substantial control, regardless of whether the individual owns or controls 25 percent or more of the company’s ownership interests.

Example 3: The reporting company is a corporation owned by four individuals who each own 25 percent of the company’s ownership interests (e.g., shares of stock). Four other individuals serve as the reporting company’s CEO, CFO, COO, and general counsel, respectively, none of whom hold any of the company’s ownership interests.

-

In this example, there are eight beneficial owners. All four of the individuals who each own 25 percent of the company’s ownership interests are beneficial owners of the company by virtue of their holdings in it, even if they exercise no substantial control over it. The CEO, CFO, COO, and general counsel are all senior officers and therefore exercise substantial control over the reporting company, making them beneficial owners as well.

The term “senior officer” means any individual holding the position or exercising the authority of a president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other officer, regardless of official title, who performs a similar function. 31 CFR 1010.380(f)(8).

Substantial Control

Substantial Control is best described by graphics taken from FinCEN instructions: