Sport Utility Vehicles (SUVs) Special Tax Rules

SUVs are subject to certain special tax rules, including an exemption from the luxury auto depreciation limit rule.

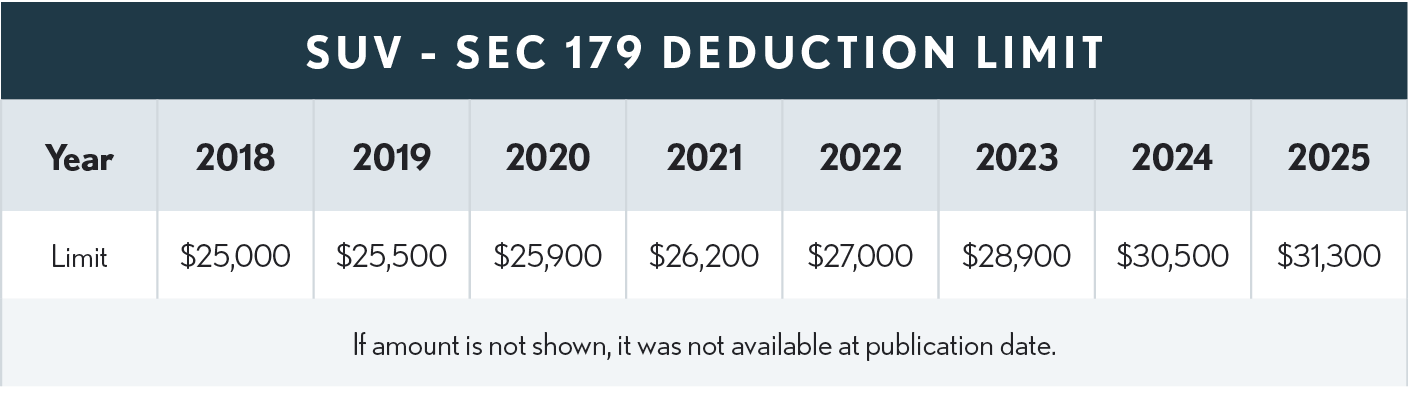

Sport Utility Vehicles (SUVs) with weight in excess of 6,000 pounds are not subject to the luxury auto depreciation limit rules and can utilize the §179 expense deduction up to the annual inflation adjusted limit. This applies to sport utility vehicles rated at 14,000 pounds gross vehicle weight or less.

Tip - The gross vehicle weight rating can be found on the inside of the driver’s door to verify the gross vehicle weight rating.

Excluded from the above limitations is any vehicle that:

-

Is designed for more than nine individuals in seating rearward of the driver's seat;

-

Is equipped with an open cargo area, or a covered box not readily accessible from the passenger compartment, of at least six feet in interior length; or

-

Has an integral enclosure, fully enclosing the driver compartment and load carrying device, does not have seating rearward of the driver’s seat, and has no body section protruding more than 30 inches ahead of the leading edge of the windshield.

Section 179 Recapture

If the taxpayer subsequently disposes of the vehicle early, as many do, a portion of the Sec 179 expense deduction will be recaptured and must be added back to income (SE income for self-employed individuals). The future ramifications of deducting the entire or a significant portion of the vehicle’s cost using §179 should be carefully considered. In lieu of a Sec 179 deduction consider bonus depreciation instead.

Bonus Depreciation

By definition, an SUV must weigh more than 6,000 and therefore is not subject to the luxury vehicle rules. Thus, bonus depreciation can be used, the entire business portion of the vehicle can be expensed by using 100% bonus depreciation in the first year. 100% bonus depreciation is available through 2022, after which the bonus rate is reduced by 20 points per year and sunsets after 2026. Thus, for 2023 the bonus rate is 80% for 2024 it is 60&, 2025 it is 40%, and 2026 it is 20%.