Optional or Actual Auto Expense Method

The IRS provides taxpayers with two methods for deducting automobile-related expenses. These are known as the optional method (mileage rate) and the actual method. Find details about both below.

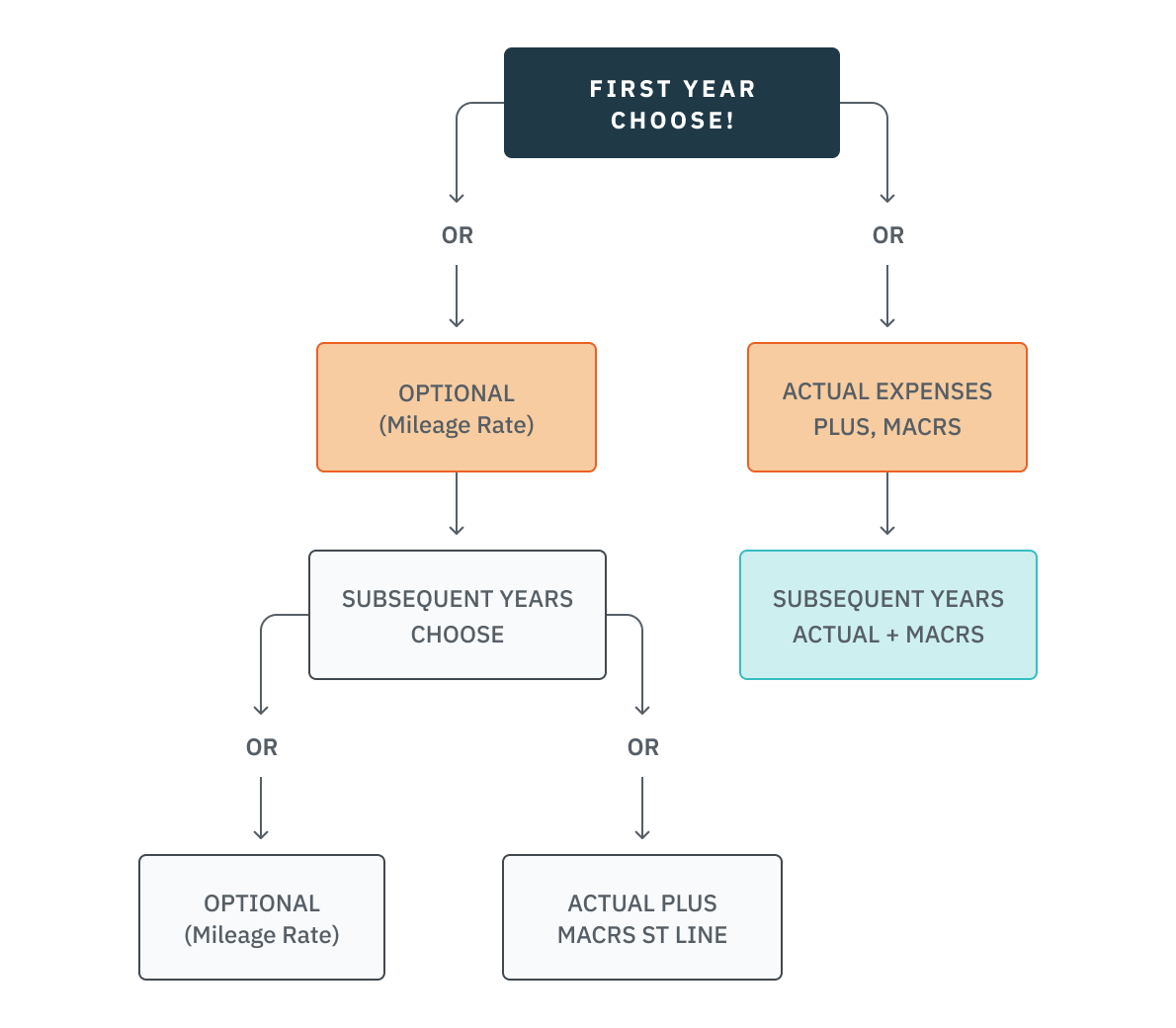

Taxpayers may choose to deduct automobile expenses using the actual operating expenses of an automobile plus depreciation (or lease payments if leased) or they can use the “optional standard mileage rate” to compute business auto deductions.

If the taxpayer chooses the actual method, which includes MACRS depreciation, in the first business use year, then the optional method may not be used in any future year. However, if the optional mileage rate method is chosen in the first year, the taxpayer can switch back and forth to the actual expense method in subsequent years for that vehicle but is limited to MACRS straight-line depreciation in years they opt for the actual method.

Switching Methods

More expensive cars are generally the ones most limited by the luxury auto rules. Choosing the optional mileage rate method, the first year of business use may be the better choice for these vehicles, since in subsequent years when the actual method may be elected the use of straight-line depreciation will produce only a small reduction in depreciation, leaving the taxpayer the option to switch methods at will in subsequent years.

Generally, the longer (more years) a vehicle is kept, the more beneficial it becomes to select the optional mileage method in the first year. There are two primary reasons: (1) older vehicles tend to have more substantial maintenance expenses, and (2) the luxury auto limit reaches its lowest level in the fourth and subsequent years. Therefore, the taxpayer would be able to switch to the actual method in years of high-maintenance costs and use the optional mileage rate during the earlier years where the vehicle warranty usually covers most repairs. Besides, once the vehicle is sold, the reduced depreciation will reduce the gain or increase the loss.

Trade-In

Prior to 2018 a business vehicle trade qualified as a Sec 1031 tax-deferred exchange. Effective for exchanges completed after 2017, for federal tax purposes, only real property used in a trade or business or held for investment is eligible for 1031 treatment. Therefore, when a business vehicle is traded-in for another vehicle in 2018 or later, the transaction will have to be reported as a sale.