Actual Expense Method For Vehicle Expenses

Below, learn about the IRS's actual expense method for deducting vehicle expenses on federal tax returns.

The actual expense method includes deducting the cost of gas, oil, lubrication, maintenance and repairs, vehicle registration fees, insurance, interest, state and local property taxes and depreciation (or lease payments if the vehicle is leased – see “Leased Vehicles” later in this chapter for possible limitation on lease deduction). However, these expenses must be allocated between deductible business use and non-deductible personal use where the vehicle is also used personally, making it necessary to also keep records of business miles and total miles in order to document the allocation between business and personal.

Depreciation

The so-called “luxury auto” rules of IRC Sec 280F(a) impose a maximum annual deduction for depreciation. These limits are included in the table below. In years after 2007 when the bonus depreciation is allowed, the first-year luxury auto limits were increased by $8,000 if the taxpayer elected bonus depreciation. Under the TCJA of 2017 the bonus depreciation element of the luxury auto continues to be $8,000 for years 2018 through 2024, with the following exceptions: In the case of a passenger automobile acquired by the taxpayer before September 28, 2017, and placed in service by the taxpayer:

-

September 28, 2017, through 2018, the limit is increased by $6,400.

-

During 2019, the limit is increased by $4,800.

Definition of a Luxury Auto

Vehicles subject to the luxury auto rules include any four-wheeled vehicle manufactured primarily for use on public streets, roads, and highways, and having an unloaded gross vehicle weight of 6,000 pounds or less. This definition may also include smaller trucks and vans, which meet the weight limitation.

Caution

Luxury auto limits are just as the title implies, a top limit for depreciation, and as example, to reach that limit the cost of the vehicle will have to be around $62,000 or so. Thus, if a vehicle costs less than that, then the deduction for the year will be less than the luxury limit, which is $20,200 for vehicles purchased and put into service in 2023 when bonus depreciation is also claimed.

Exempt Vehicles

The luxury auto limitations do not apply to any vehicle used directly in a taxpayer’s trade or business of transporting persons or property for compensation or hire (qualified non-personal use vehicle), such as an:

-

Ambulance

-

Hearse

-

Taxi, Uber, Lyft (or similar)

-

Bus

-

Qualified non-personal use vehicles (see definition in “Truck or Van” below), and

-

Commuter highway vehicles (may still be subject to the listed property rules).

-

Proposed regulations (12/3’2024) add the following as non-personal use vehicles: unmarked vehicles used by firefighters, members of rescue squads, or ambulance crews. (Proposed Reg, NPRM REG-106595-22, effective when finalized regs are published in the Federal Register, but can be relied on until then).

Truck or Van

To be a Qualified Non-Personal Use Vehicle a truck or van must have been specially modified with the result that it is not likely to be used more than a de minimis amount for personal purposes. The regulations’ example of a qualifying non-personal use vehicle is a van with only a front bench for seating in which permanent shelving that fills most of the cargo area has been installed, that constantly carries merchandise or equipment, and that has been specially painted with advertising or the company’s name. These specially manufactured or modified vehicles do not provide significant elements of personal benefit, and a taxpayer is not likely to purchase this type of truck or van unless there was a valid business purpose that could not be met with a less expensive vehicle.

Public Safety Officer Vehicles

IRS final regulations § 1.274-5 add clearly marked public safety officer vehicles as a type of qualified non-personal use vehicle under Code Sec. 274(i). As such, they are exempt from the strict substantiation requirements of Code Sec. 274(d)(4) that apply to listed property. They also qualify as a working condition fringe benefit so that the value of their use is excluded from income.

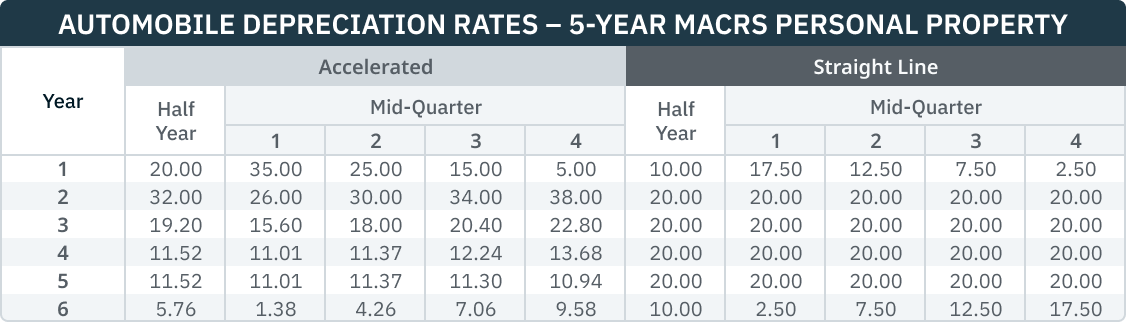

Depreciation Rates

Automobiles and small trucks are depreciated using a five-year life. As with other MACRS property, the half-year and mid-quarter conventions apply. Where the business use of a luxury auto is less than 50%, the listed property rules limit the depreciation method to straight line MACRS and prohibit a Sec 179 deduction.

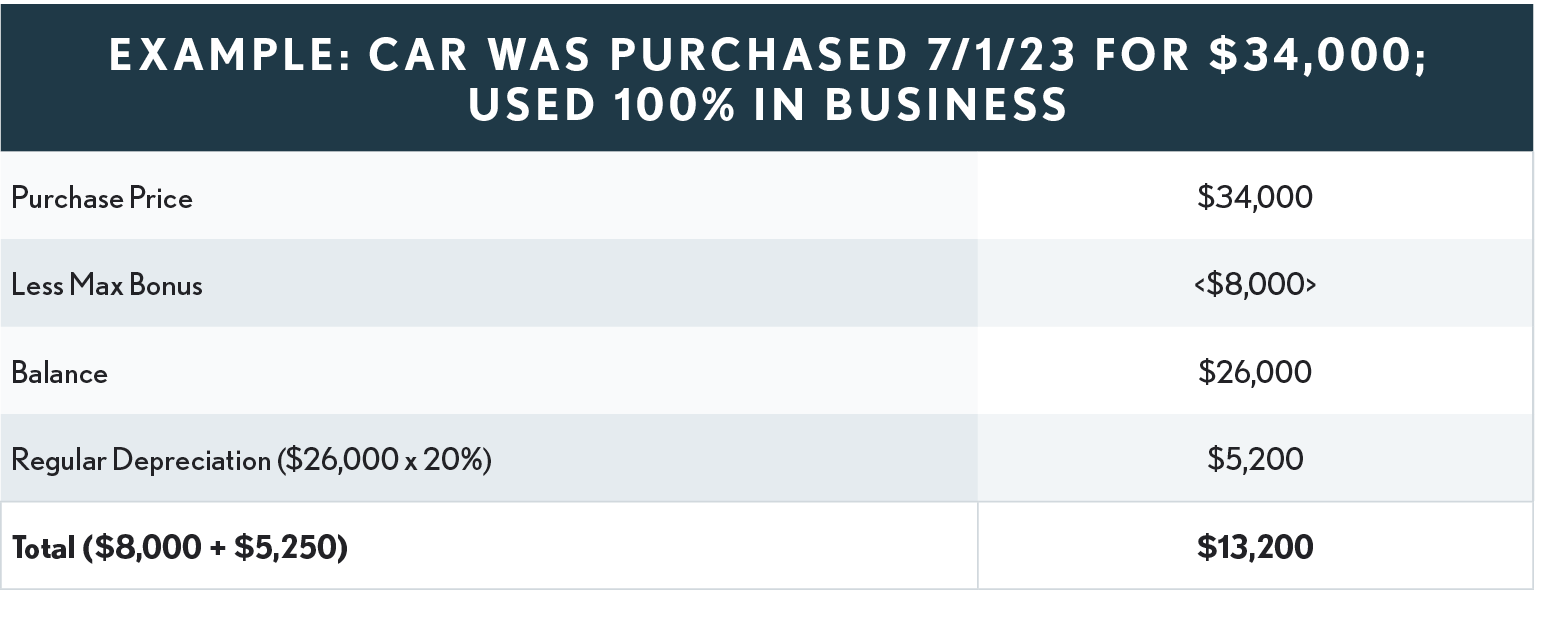

First-Year Calculation

When calculating the first-year depreciation, and using 100% of the cost basis, figure the Sec. 179 deduction first (if being claimed), then reduce the vehicle’s basis by the amount of the Sec 179 deduction before determining any bonus depreciation. Reduce the basis again by the amount of bonus depreciation claimed and then figure the otherwise allowable depreciation on the remaining basis – keeping in mind at each step the luxury auto first-year depreciation limit if applicable. Prorate the result by the business use percentage (business miles/total miles) if less than 100%.

Calculation After the First Year

Beginning with the second year of business use, and for each year thereafter, both the listed property rules and the luxury auto limitations must be applied each year. If the luxury auto was used more than 50% for business in the current year and all prior years, then the listed property restrictions do not apply; depreciation can continue to be calculated using whatever method was used the first year. However, if the business use is less than in any prior year, recapture rules may apply. If the auto was used 50% or less for business in the current year or in any prior year during the earnings and profits (ADS) life of the car, then the listed property limitations do apply; depreciation must be calculated using the straight-line method over the earnings and profits (ADS) life. Under MACRS, the earnings and profits (ADS) life for luxury autos is five years. If the auto was used 50% or less for business in the current year and more than 50% for business in all prior years, then the listed property rules regarding Section 280F recapture must be applied.

Vehicle Capital Improvement

A capital improvement to a vehicle (e.g., a new engine) is generally treated as a new depreciable asset placed in service the year the improvement is made. The improvement is also subject to the luxury auto limits. Therefore, the deduction limit for a given year is figured based on both the car and the improvement made to it. However, the de minimis safe harbor rule (see Repairs-Capital Improvements) of the capitalization and repair regulations would allow such capital improvements to be treated as an expense if the cost is within the safe harbor cost limits.