IRS "At-Risk" Overview

IRS Form 6198 explains at-risk limitations. At-risk rules are intended to prevent taxpayers from deducting more than their actual stake in a business or asset. Learn more about this concept in this guide.

Losses from certain activities are limited to the amount a taxpayer has “at risk” in the activities. The at-risk rules apply to individuals, estates and trusts, and certain closely held C corporations. Form 6198, At-Risk Limitations, must be filed by taxpayers who have a loss from an at-risk activity in which they have invested amounts for which they are not at risk.

What Does It Mean to Be “At Risk”?

To take a deduction for an item on a tax return, a taxpayer must have either actually paid for the item or be responsible for paying it. Good intentions aren’t enough to put a taxpayer at risk. The taxpayer must have either expended cash for something or become liable to pay for it through a credit purchase. A mere promise to pay is not enough.

Example - The Meaning of At Risk - John, a self-employed engineer using the cash method of accounting, has subscribed to The Journal of Mechanical Engineers for many years. His subscription expired in November 2021, but he didn’t renew until January 2022, because he was short on cash. He’d like to take a business expense deduction in 2021 based on his intention to renew. However, since he didn’t follow through with the intention in 2021, he gets no deduction on his 2021 return. He would claim the expense on his 2022 return. If John had renewed the subscription by December 31, 2021, by charging the cost to his credit card, he would have been at risk even though he had not paid any cash out of pocket, and he then could have deducted the expense on his 2021 return.

-

At-Risk Activities

The at-risk rules apply to the following types of activities:

-

Holding, producing and distributing motion picture films and/or videotapes.

-

Farming.

-

Leasing Section 1245 property.

-

Oil and gas exploration/exploitation as a trade or business or for production of income; Geothermal exploration/exploitation for percentage depletion purposes.

-

Any other activity where a taxpayer carries on a trade or business or engages in income production. Real property placed in service after 1986 is part of this category. However, there is an exception for real estate activities subject to nonrecourse financing (see additional information below).

Multiple Business Activities

In Chief Counsel Advice 201805013, the IRS has determined that a taxpayer couldn't treat business activities, conducted through three S corporations and a limited liability company (LLC) in which he was a minority owner, as a single activity for purposes of the at-risk rules. Accordingly, the taxpayer, who had personally guaranteed a line of credit that had been utilized by only the LLC, couldn't deduct losses for all four entities on the basis of the personal guaranty.

Computing the At-Risk Amount

To compute the amount a person has at risk in an activity, add the following amounts:

-

Cash contributed to the activity;,

-

Adjusted basis of property contributed to the activity;,

-

Amounts borrowed for use in the activity (in the case of investors in a partnership, a partner must generally be personally liable for the repayment or must have pledged property to secure the loan).,

The amount at risk [(a) + (b) + (c)] is then either reduced by losses/distributions from the activity or increased by its net profits.

Losses and Recapture

Losses from an activity that are not allowed because of the at-risk limits are treated as deductions from that activity in the following year; the loss carried over can be used as a deduction against the following year’s income from the same activity (subject to the amount at risk in the following year). If losses can’t be used in the following year, they can be carried over indefinitely to later years until they are able to be used.

Application of at-risk merely limits the loss amount that can be deducted; it doesn’t affect the basis of a taxpayer’s asset. Thus, for example, a partner’s basis in a partnership interest is generally unaffected by atrisk disallowances.

There is recapture of previously allowed losses when the at-risk amount goes below zero. The application of this rule means that if the amount at risk is reduced below zero (whether by distributions to the taxpayer, changes of liabilities from recourse to nonrecourse, etc.), a taxpayer recognizes income to the extent of the negative amount. This amount is limited to the excess of losses previously allowed in an activity over any amounts previously recaptured. The amount added to income is treated as a deduction allocable to the activity in the first succeeding year and is allowed if and when the taxpayer’s at-risk amount increases.

Recapture income isn’t treated as income from an activity for purposes of determining whether current or suspended losses are allowed under the passive loss rules. This rule prohibits using losses to offset at-risk recapture income.

Special At-Risk Rules for Real Estate

Generally, taxpayers are not at risk for non-recourse loans (loans for which they are not personally liable). However, there is an exception to the at-risk limitations for non-recourse loans on real property when the loans are transacted in arms’ length transactions. To qualify for this exception, the lender must not be:

-

Related to the taxpayer, as defined in IRC Sec 267(b) (unless the loan provides for commercially reasonable interest and terms);,

-

The seller of the property (or a person related to the seller);,

A party who is paid a fee, because of the taxpayer’s investment in the property (e.g., a realtor).

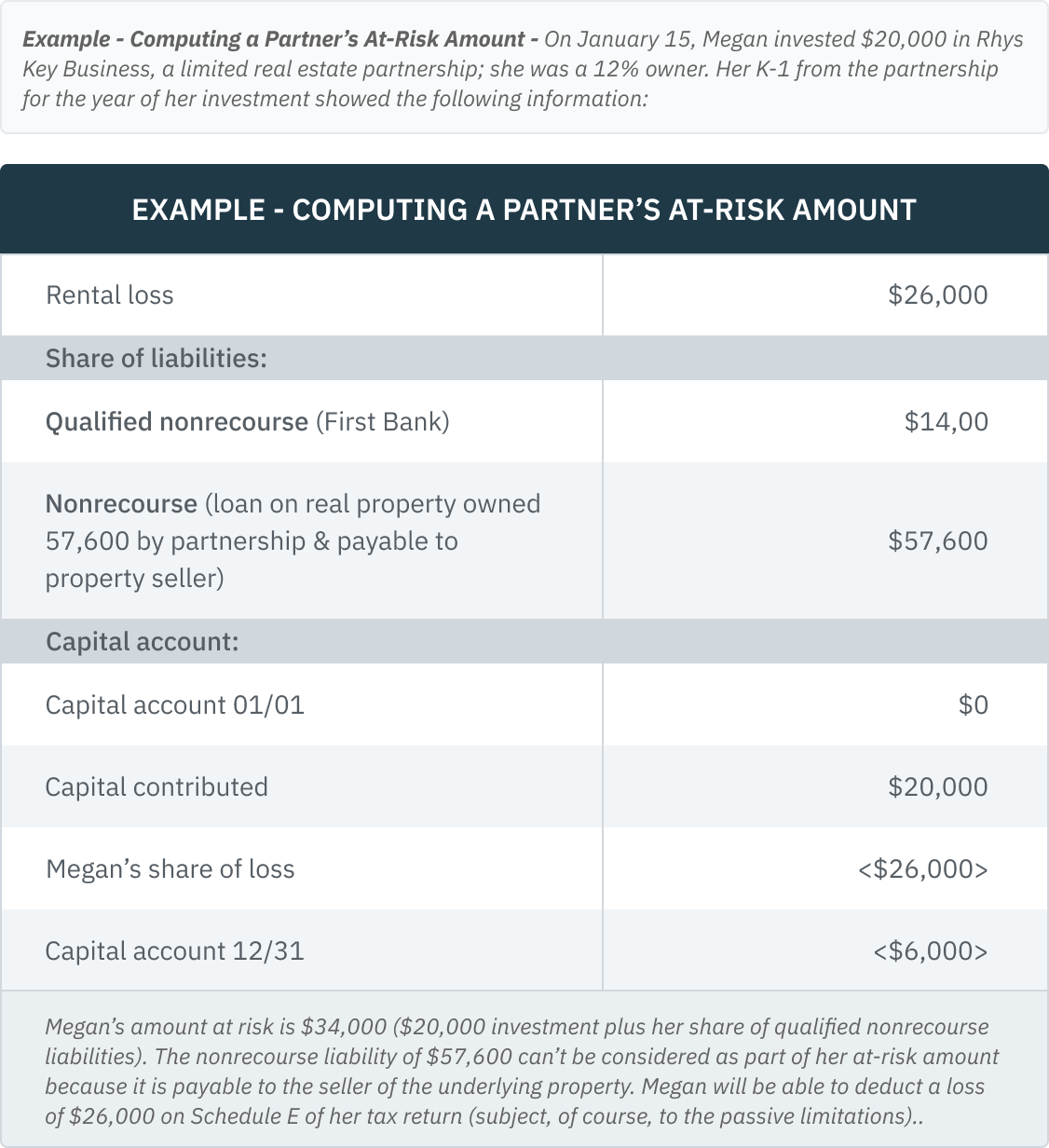

At-Risk and Partnership Interests

A partner’s at-risk amount is determined using the following information:

-

The type of activity the partnership is involved in (e.g., real estate, etc.)

-

Analysis of the partner’s capital account on Schedule K-1 (Form 1065), and

-

The partner’s share of partnership liabilities (shown on the K-1 in Part II, item K).

Form 6198

Form 6198, At-Risk Limitations, is a highly misunderstood form. It serves two purposes in a tax return.

-

It makes certain that the taxpayer doesn’t get a deduction once their limit of risk is reached; and

-

It tracks disallowed deductions so that they may be used in the future when the at-risk position changes.

The at-risk limit goes down when a taxpayer is able to deduct items on his/her tax return, or when he/she gets distributions from the venture. At-risk limit goes up when a taxpayer has income from the activity or makes a capital contribution to it.

The instructions to Form 6198 say that if there is any non-recourse financing in an activity, the form must be filed.

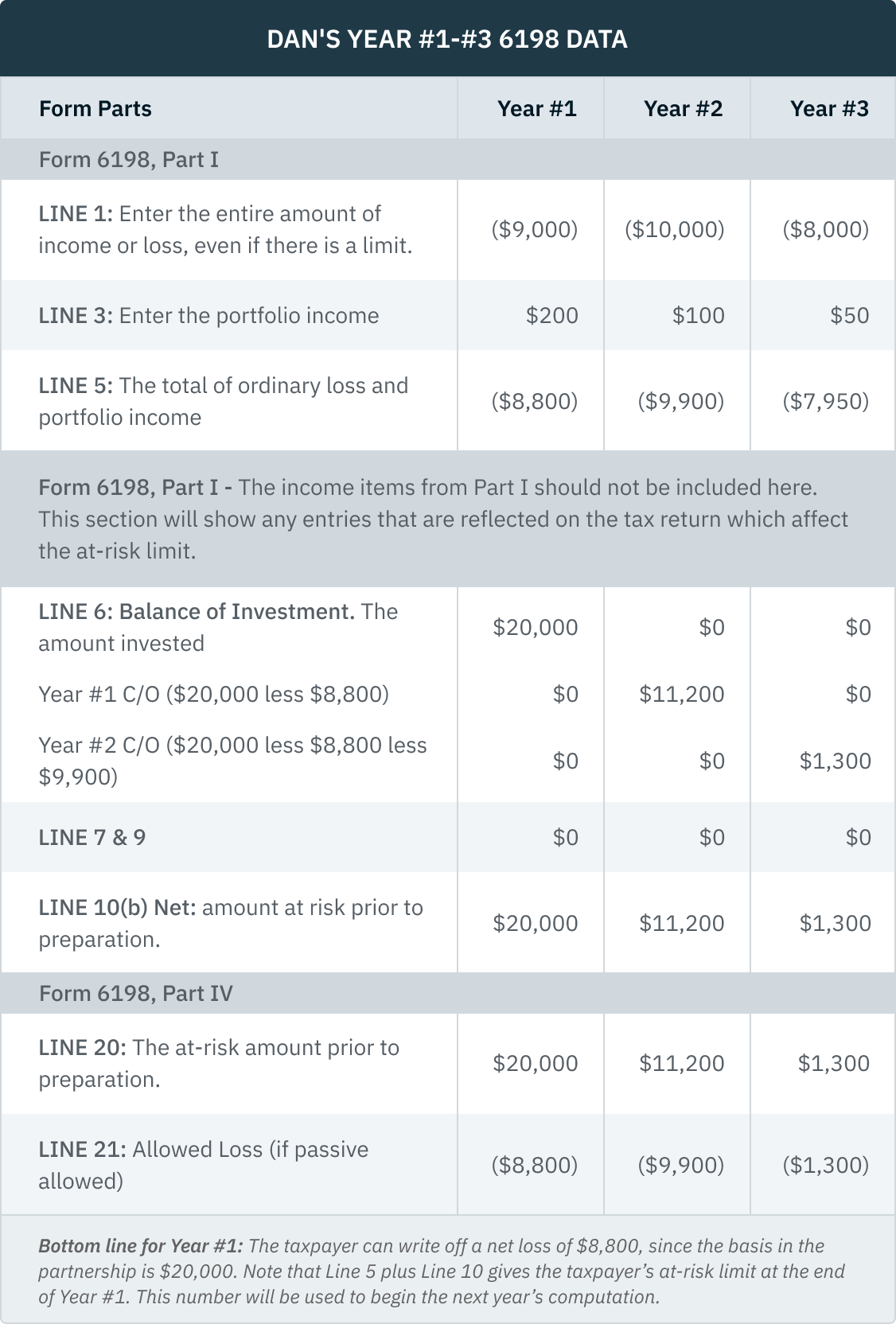

Bottom line for Year #1: The taxpayer can write off a net loss of $8,800, since the basis in the partnership is $20,000. Note that Line 5 plus Line 10 gives the taxpayer’s at-risk limit at the end of Year #1. This number will be used to begin the next year’s computation.

Bottom line for Year #2: The taxpayer started the year with an at-risk limit of $11,200 and had a net loss of $9,900 passed through from the partnership. The loss can be written off, but now the taxpayer’s at-risk limit as of the end of Year #2 is just $1,300. (Line 5 plus Line 10).

Bottom line for Year #3: The taxpayer started the year with an at-risk limit of $1,300 and had a net loss of $7,950 passed through from the partnership. The Year #3 loss that can be written off is limited to $1,300 due to the at-risk rules. The remaining $6,650 is disallowed. For Year #4, the at-risk limitation is ($6,650), the amount of the disallowed loss (Line 5 plus Line 10). This disallowed loss can be carried to later tax years if not absorbed by profits or additional investment amounts in Year #4 or later years.

Several other tax limitations may disallow the losses, which are allowed to pass through due to Form 6198 computations. Always compute the at-risk limit first and use the amount allowed on Form 6198 as the basis for computing the other limits on the tax return--passive limits, capital loss limits, etc.