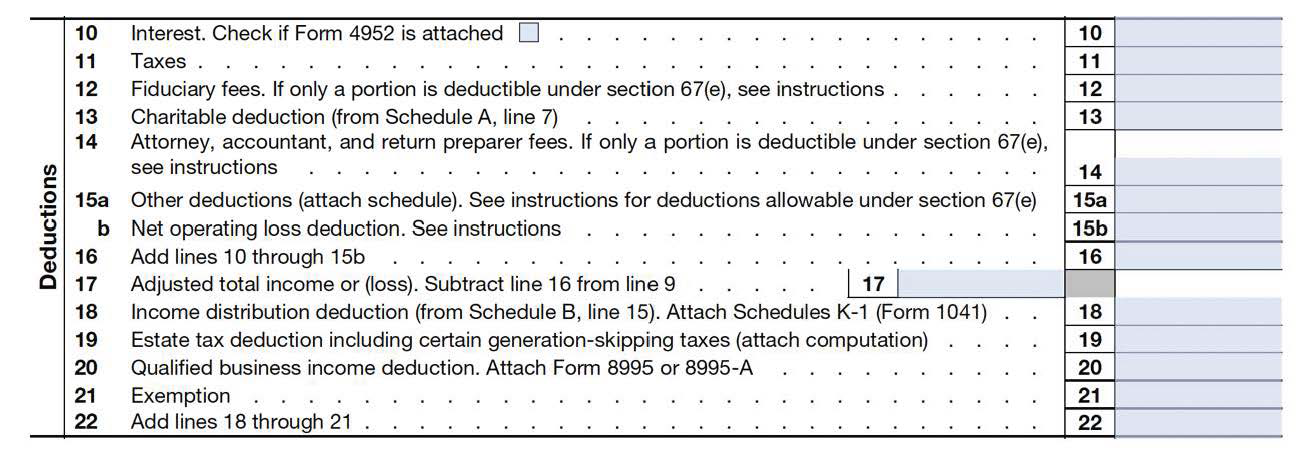

1041 Deductions

Generally, the allowable 1041 deductions are like those for individual taxation, except:

-

There is no standard deduction,

-

Loss carryovers pass to the beneficiaries at final return, and

-

Allocation of deductions to non-taxable income.

The following is a summary of 1041 deductions.

Line 10 – Interest

-

Interest paid or incurred by the estate or trust on amounts borrowed by the estate or trust, or on debt acquired by the estate or trust (for example, outstanding obligations from the decedent) that isn't claimed elsewhere on the return.

-

Don't include interest to purchase or carry obligations which are exempt from income tax.

-

Don’t include personal interest.

-

Don’t include trade or business interest. Instead include business interest on the appropriate business schedule C, E, or F, the net income or loss from which is shown on line 3, 5, or 6 of the form 1041.

-

Complete Form 4952 Investment Interest Expense and check the box on line 10 if the interest includes investment interest.

-

Include qualified residence interest incurred by an estate or trust on indebtedness secured by a qualified residence of a beneficiary of an estate or trust which would be treated as qualified residence interest if the residence would be a qualified residence (that is, the principal residence or the secondary residence selected by the beneficiary) if owned by the beneficiary. The beneficiary must have a present interest in the estate or trust or an interest in the residuary of the estate or trust. The interest is subject to the same limitations that apply to home mortgage interest on a 1040 Schedule A.

Line 11 – Taxes

1041 taxes are subject to the same $10,000 limitation as the 1040 Schedule A tax deductions.

Don’t include trade or business taxes. Instead include business taxes on the appropriate business schedule C, E, or F, the net income or loss from which is shown on line 3, 5, or 6 of the Form 1041.

State income tax or sales tax (don’t include sales tax incurred by a business). An estate or trust cannot use the sales tax tables.

Like the 1040 Schedule A, a deduction for a foreign real property tax is no longer allowed.

Foreign or U.S. possession income taxes. However, it may be more beneficial to take a credit for the tax instead of a deduction. See the 1041 instructions for Schedule G, part I, line 2a, for more details.

Generation-skipping transfer (GST) tax imposed on income distributions.

Line 12 – Fiduciary Fees

Include the deductible fees paid to or incurred by the fiduciary for administering the estate or trust during the tax year. These fiduciary expenses include probate court fees and costs, fiduciary bond premiums, legal publication costs of notices to creditors or heirs, the cost of certified copies of the decedent's death certificate, and costs related to fiduciary accounts.

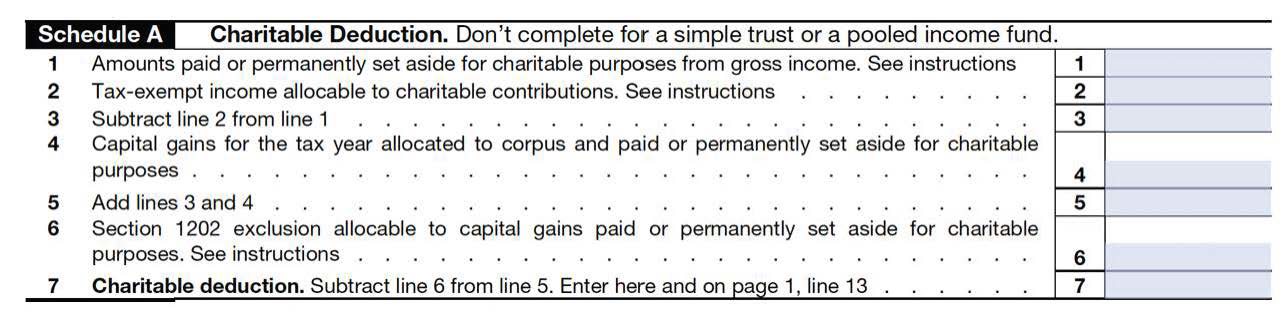

Line 13 – Charitable Deduction

-

Does not apply to simple trusts.

-

Generally, any part of the gross income of an estate or trust that, under the terms of the will or governing instrument, is paid (or treated as paid) during the tax year for a charitable purpose specified in section 170(c) is allowed as a deduction to the estate or trust. it isn't necessary that the charitable organization be created or organized in the United States.

-

A pooled income fund or a IRC Sec 4947(a)(1) nonexempt charitable trust treated as a private foundation must attach a separate sheet to Form 1041 instead of using Schedule A illustrated above to figure the charitable deduction.

Election to treat contributions as paid in the prior tax year - The fiduciary of an estate or trust may elect to treat as paid during the tax year any amount of gross income received during that tax year or any prior tax year that was paid in the next tax year for a charitable purpose.

To make the election, the fiduciary must file a statement with Form 1041 for the tax year in which the contribution is treated as paid. This statement must include:

-

The name and address of the fiduciary,

-

The name of the estate or trust,

-

An indication that the fiduciary is making an election under IRC Sec 642(c)(1) for contributions treated as paid during such tax year,

-

The name and address of each organization to which any such contribution is paid, and

-

The amount of each contribution and date of actual payment or, if applicable, the total amount of contributions paid to each organization during the next tax year, to be treated as paid in the prior tax year.

The election must be filed by the due date (including extensions) for Form 1041 for the next tax year. If the original return was filed on time, the election can be made on an amended return filed no later than 6 months after the due date of the return (excluding extensions). Enter “Filed pursuant to IRC Sec 301.9100-2” at the top of the amended return.

Schedule A - Line 1 - Amounts Paid or Permanently Set Aside – Generally this only applies to estates. For a trust to qualify, the trust may not be a simple trust, and the set aside amounts must be required by the terms of a trust instrument that was created on or before October 9, 1969. See the 1041 instructions for line 1 (2022 page 29) for further details.

If an estate provides for distributions to charity, and income is permanently set aside from the assets identified as passing to charity, the income is eligible for a charitable set-aside deduction in the year earned. This is true even if the income is not paid to the charity within the tax year.

Regs. Sec. 1.642(c)-2(d) provides that a set-aside deduction is not allowed "unless under the terms of the governing instrument and the circumstances of the particular case the possibility that the amount set aside, or to be used, will not be devoted to such purpose or use is so remote as to be negligible" (emphasis added). In Estate of Belmont,144 T.C. 84 (2015), the Tax Court noted that while the IRS has not interpreted the phrase "so remote as to be negligible" from a quantitative perspective in the income tax context, it has done so in the estate tax arena, requiring at least a 95% probability that the bequest will pass to the charity (see Rev. Rul. 70-452).

Schedule A - Line 2 - Tax-Exempt Income Allocable to Charitable Contributions - Any estate or trust that pays or sets aside any part of its income for a charitable purpose must reduce the deduction by the portion allocable to any tax-exempt income. See the 1041 instructions for line 2 (2022 page 29) for further details.

Schedule A - Line 4 - Capital Gains for the Tax Year Allocated to Corpus and Paid or Permanently Set Aside for Charitable Purposes Enter the total of all capital gains for the tax year that are:

-

Allocated to corpus, and

-

Paid or permanently set aside for charitable purposes.

Schedule A - Line 6 - Section 1202 Exclusion Allocable to Capital Gains Paid or Permanently Set Aside for Charitable Purposes - If the exclusion of gain from the sale or exchange of qualified small business (QSB) stock was claimed, enter the part of the gain included on Schedule A, lines 1 and 4, that was excluded under IRC Sec 1202.

Frequent Question: When an individual passes away, their personal items such as clothing are often donated to charity. Can the value of these items be included as a charitable contribution on the 1041? On the decedent’s final 1040? No – generally the deduction can only be claimed on the return of the beneficiary who inherited the property, if that person itemizes deductions. The trustee or beneficiary may need to have the items appraised if they think the value is $5,000 or more.

Line 14 – Attorney, Accountant, and Return Preparer Fees

Expenses for preparation of the following are fully deductible:

-

Fiduciary income tax returns,

-

Decedent's final individual income tax returns, and

-

All estate and GST tax returns.

However, expenses for preparing all other tax returns, including gift tax returns, are considered costs commonly and customarily incurred by individuals and are not deductible. Fiduciary fees deducted on Form 706 can't also be deducted on Form 1041.

Line 15a – Other Deductions

For other deductions, attach a statement, listing by type and amount all allowable deductions that aren't deductible elsewhere on Form 1041.

-

IRD Estate Taxes - Attributable to IRD under IRC Sec. 691(c).

-

Administration Costs - Other costs allowable under IRC Sec. 67(e) paid or incurred in connection with the administration of the estate or trust that would not have been incurred if the property were not held in the estate or trust.

-

Ownership Costs - Ownership costs are costs that are chargeable to or incurred by an owner of property simply by reason of being the owner of the property. Under IRC Sec. 67(b), they include, but are not limited to, condominium fees, insurance premiums, maintenance and lawn services, automobile registration and insurance costs, and partnership costs deemed to be passed through to and reportable by a partner. Other expenses incurred merely by reason of the ownership of property may be fully deductible under other provisions of the Code.

-

Appraisal Fees - Appraisal fees incurred to determine the FMV of assets as of the decedent's date of death (or the alternate valuation date).

-

Investment Advisory Fees - Typical investment advisory fees are not deductible. However, certain incremental costs of investment advice beyond the amount that would normally be charged to an individual investor are deductible.

-

Bundled Fees – Must allocate between those customarily incurred by individuals (not deductible) and those not customarily incurred by individuals (deductible).Bond premium(s) - For taxable bonds, if the fiduciary elected to amortize the premium, report the amortization on line 15a. The basis in the taxable bond must be reduced by the amount of amortization. If a bond premium deduction is claimed for the estate or trust, figure the deduction on a separate sheet, and attach it to Form 1041.

-

Casualty and Theft Losses - Use Form 4684, Casualties and Thefts, to figure any deductible casualty and theft losses and include on Line 15a.

-

Estate's or Trust's Share of Amortization, Depreciation, and Depletion Not Claimed Elsewhere – If these expenses could not be deducted on Schedule E (Form 1040), or as business or farm expenses on Schedule C or F (Form 1040), itemize the estate's or trust's apportioned share of the deductions on an attached sheet and include them on line 15a.

Line 15b—Net Operating Loss Deduction

An estate or trust is allowed a net operating loss deduction (NOLD) under Sec. 172. If an NOLD is claimed, figure the deduction on a separate sheet, and attach it to the return. Note: In the case the NOLD is not entirely absorbed, the excess can only be carried forward to subsequent years. However, if a portion of the loss is attributable to a farming loss, that portion can be carried back 2 years. Use Form 1045, Application for Tentative Refund, to figure the amount of the NOL that is available for carryback or carryover or use an amended return.

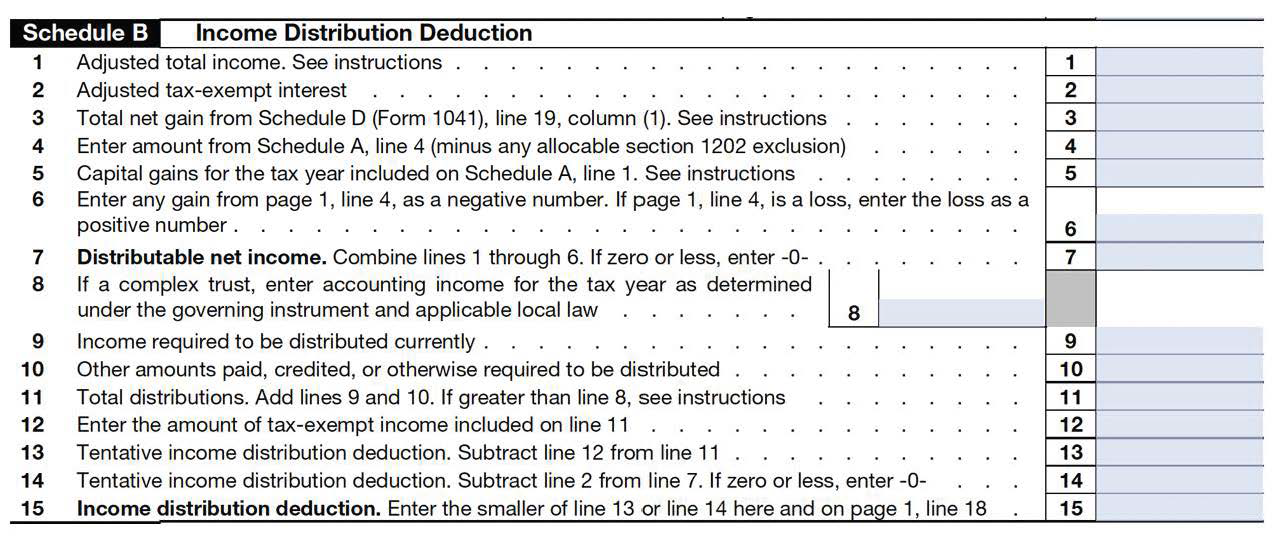

Line 18 - Income Distribution Deduction

The amount entered on line 18, income distribution deduction, is determined using Schedule B from page 2 of the 1041, illustrated below. While this calculation determines the distribution deduction, it also determines the amount of taxable income allocated to a particular beneficiary.

Therefore, the sum of the Schedule K-1 allocations should equal the total distribution deduction.

If the estate or trust was required to distribute income currently or if it paid, credited, or was required to distribute any other amounts to beneficiaries during the tax year, complete Schedule B (illustrated above) to determine the estate's or trust's income distribution deduction.

Pooled Income Funds - Don't complete Schedule B for these funds. Instead, attach a separate statement to support the computation of the income distribution deduction. See Pooled Income Funds, earlier, for more information.

Separate Share Rule - If a single trust or an estate has more than one beneficiary, and if different beneficiaries have substantially separate and independent shares, their shares are treated as separate trusts or estates for the sole purpose of determining the DNI allocable to the respective beneficiaries.

If the separate share rule applies, figure the DNI for each beneficiary on a separate sheet and attach to the return. Any deduction or loss that is applicable solely to one separate share of the trust or estate isn't available to any other share of the same trust or estate. For more information, see IRC Sec 663(c) and related regulations.

Schedule B - Line 1 – Is the amount from line 17 on page 1 of the 1041.

Schedule B - Line 2 – Begin with tax exempt interest (from line 2 of the 1041 Schedule A) and subtract fiduciary and other expenses allocated to tax exempt income (Sec 212 expenses).

Sec 212 expenses are ordinary and necessary expenses paid or incurred for the production or collection of income, management, conservation, or maintenance of property held to produce income, or with the determination, collection, or refund of any tax.

Schedule B - Line 3 – Enter the total net capital gain from Schedule D (Form 1041), line 19, column (1). If a loss, enter zero.

Schedule B - Line 4 – Enter the amount from Schedule A, line 4 less any allowable Sec 1202 exclusions.

Sec 1202 has to do with the exclusion of gain for qualified small business stock (QSBS).

Schedule B - Line 5 – If Schedule A Line 1 includes amounts paid, permanently set aside, or to be used for charitable purposes see the 1041 instructions. Otherwise enter an amount equal to line 1 of Schedule A multiplied by a fraction, the numerator of which is the amount of net capital gains that are included in the accounting income of the estate or trust (that is, not allocated to corpus) and are distributed to charities, and the denominator of which is all items of income (including the amount of such net capital gains) included in the DNI. Then reduce the amount on Line 5 by any allocable Sec 1202 exclusion (small business stock exclusion).

Schedule B - Line 6 – Enter any gain from Line 4 on the front of the 1041 as a negative number. If line 4 on the front of the 1041 is a loss enter as a positive number.

Schedule B - Line 7 – Distributive Net Income - Sum of lines 1 through 6. If zero or less enter -0-

Schedule B - Line 8 – Accounting Income - For a decedent's estate or a simple trust, skip this line. If filing for a complex trust, enter the income for the tax year determined under the terms of the governing instrument and applicable local law. Don't include extraordinary dividends or taxable stock dividends determined under the governing instrument and applicable local law to be allocable to corpus.

Schedule B - Line 9 —Income Required to Be Distributed Currently - Line 9 is to be completed by all simple trusts as well as complex trusts and decedents’ estates that are required to distribute income currently, whether it is distributed or not. The determination of whether trust income is required to be distributed currently depends on the terms of the governing instrument and the applicable local law.

The line 9 distributions are referred to as “first-tier distributions” and are deductible by the estate or trust to the extent of the DNI. The beneficiary includes such amounts in their income to the extent of their proportionate share of the DNI.

Schedule B - Line 10—Other Amounts Paid, Credited, or Otherwise Required to Be Distributed - Line 10 is to be completed only by a decedent's estate or complex trust (simple trusts cannot make corpus distributions). These distributions consist of any other amounts paid, credited, or required to be distributed and are referred to as “second-tier distributions.” Such amounts include annuities to the extent not paid out of income, mandatory and discretionary distributions of corpus, and distributions of property in kind.

If Form 1041-T was timely filed to elect to treat estimated tax payments as made by a beneficiary (see page 3.38.10), the payments are treated as paid or credited to the beneficiary on the last day of the tax year and must be included on line 10.

Unless an IRC Sec 643(e)(3) election is made, the value of all noncash property actually paid, credited, or required to be distributed to any beneficiaries is the smaller of:

1. The estate's or trust's adjusted basis in the property immediately before distribution, plus any gain or minus any loss recognized by the estate or trust on the distribution (basis of beneficiary); or

2. The FMV of such property.

If an IRC Sec 643(e)(3) election is made by the fiduciary, then the amount entered on line 10 will be the FMV of the property. The IRC Sec 643(e)(3) election applies to discretionary, or tier two distributions. Simple trusts do not permit discretionary distributions, thus not applicable to simple trusts. The IRC Sec 643(e)(3) election permits a fiduciary to treat the distribution of in-kind property as having been sold by the entity to the beneficiaries at fair market value (FMV). The election has several consequences and is not covered in this material.

Schedule B - Line 11 - Total Distributions - If line 11 is more than line 8, and if filing for a complex trust that has previously accumulated income, see the instructions for Schedule J, to determine if Schedule J (Form 1041), Accumulation Distribution for Certain Complex Trusts must be completed. Note: Schedule J generally no longer applies.

Schedule B - Line 12 - Adjustment for Tax-Exempt Income - In figuring the income distribution deduction, the estate or trust isn't allowed a deduction for any item of the DNI that isn't included in the gross income of the estate or trust. Thus, for purposes of figuring the allowable income distribution deduction, the DNI (line 7) is figured without regard to any tax-exempt interest.

If tax-exempt interest is the only tax-exempt income included in the total distributions (line 11), and the DNI (line 7) is less than or equal to line 11, then enter on line 12 the amount from line 2.

Schedule B - Line 13 – Tentative Income Distribution Deduction - line 11 less line 12

Schedule B - Line 14 – Tentative Income Distribution Deduction - line 7 less line 2 (If zero or less enter -0-)

Schedule B - Line 15 – Income Distribution Deduction – Smaller of line 13 or 14

Line 19 - Estate Tax Deduction Including Certain Generation-Skipping Transfer Taxes

If the estate or trust includes IRD in its gross income, and such amount was included in the decedent's gross estate for estate tax purposes, the estate or trust is allowed to deduct that portion of the estate tax imposed on the decedent's estate that is attributable to the inclusion of the IRD. For an example of the computation, see regulations section 1.691(c)-1 and Pub. 559.

If any amount properly paid, credited, or required to be distributed by an estate or trust to a beneficiary consists of IRD received by the estate or trust, don't include such amounts in determining the estate tax deduction for the estate or trust. Figure the deduction on a separate sheet and attach the sheet to the 1041.

Line 21 - Exemption Amount

The amounts have been unchanged since 1976.

-

Decedents' Estates - A decedent's estate $600. Also applies when the IRC Sec 645 is election has been made.

-

Trusts Required to Distribute All Income Currently - A trust whose governing instrument requires that all income be distributed currently is allowed a $300 exemption, even if it distributed amounts other than income during the tax year.

-

Qualified Disability Trusts - A qualified disability trust is allowed a $5,000 (2024) inflation adjusted exemption, up from $4,700 for 2023.

-

All Other Trusts - A trust not described above is allowed a $100 exemption.