Form 1095-C Employer Provided Health Insurance Offer & Coverage

Form 1095-C is a multipurpose form. It is used to both determine if the employer is subject to the employer penalty for not providing insurance and to determine if the employee is qualified for the premium tax credit.

-

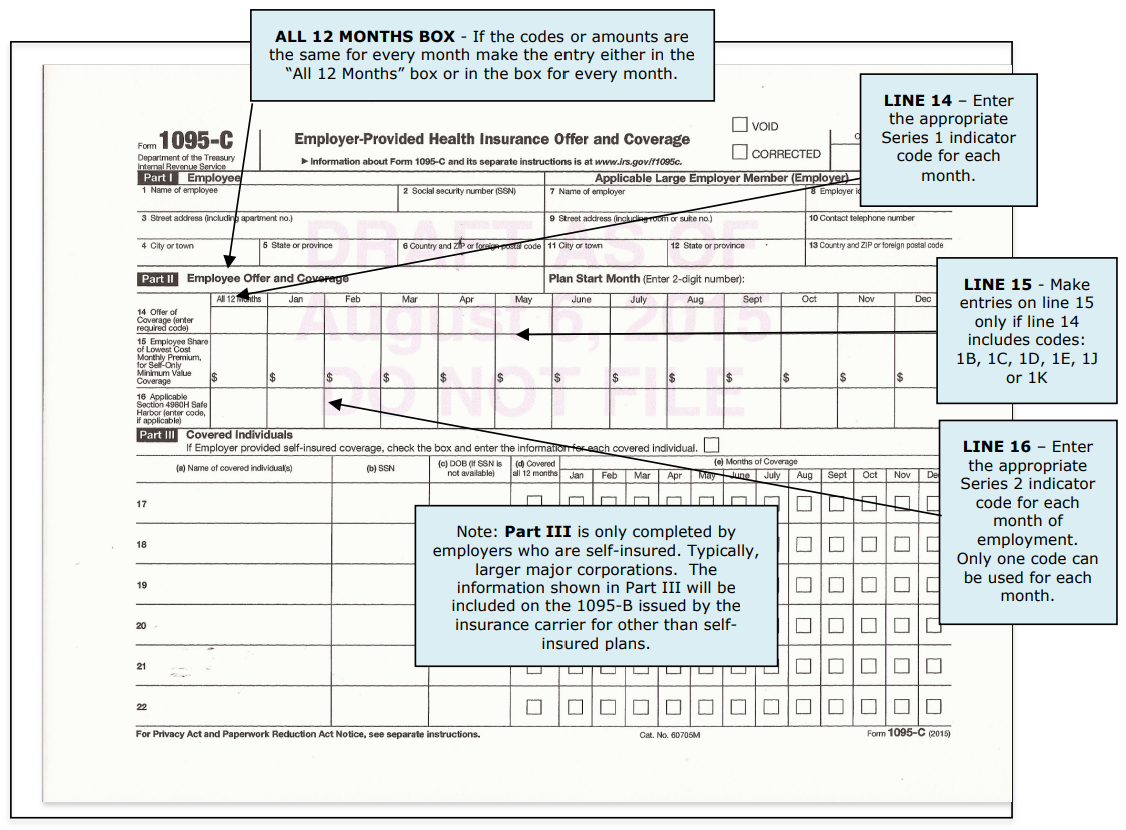

Part I: Includes employer and employee information.

-

Part II: Use to report information needed to determine if the employer is subject to the excise tax penalty for not making affordable minimum essential coverage available to their employees.

Part III: Is only used by an employer that provides health coverage through an employer-sponsored self insured health plan, typically larger corporations. The employer must complete Parts I and III, for any employee who enrolls in the health coverage, whether or not the employee is a full-time employee for any month of the calendar year. For other than self-insured plans, the insurance company or plan sponsor will provide the information included in part III using Form 1095-B

Who Must File 1095-Cs For 2023

Applicable Large Employers (ALE), generally employers with 50 or more equivalent full-time employees (EFTEs) in the previous year, must file a Form 1095-C for each full-time (for any month of the year) employee (including a Form 1094-C Transmittal). Employers with fewer than 50 EFTEs do not have a 1095-C reporting requirement.

Line 14 Indicator Codes - Code Series 1

If the type of coverage, if any, offered to an employee was the same for all 12 months in the calendar year, enter the Code Series 1 indicator code corresponding to the type of coverage offered in the “All 12 Months” box or in each of the 12 boxes for the applicable calendar months.

Code 1A - Qualifying Offer - Minimum essential coverage providing minimum value offered to full-time employee with employee contribution for self-only coverage equal to or less than 9.12% (2023) of the mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s). Note: When 1A is used, leave line 15 blank for all months for which code 1A was used.

Code 1B - Qualifying Offer - Minimum essential coverage providing minimum value offered to employee only.

Code 1C - Qualifying Offer - Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse).

Code 1D - Qualifying Offer - Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)).

Code 1E - Qualifying Offer - Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse.

Code 1F – Not a Qualifying Offer - Minimum essential coverage NOT providing minimum value offered to employee; or employee and spouse or dependent(s); or employee, spouse and dependents.

Code 1G – Not a Full Time Employee - If an employer offers coverage through an employer self-insured plan and the employee is not full time, Code 1G is entered at Line 14 in the “All 12 Months” box or in each separate box. The employer must complete Parts I and III.

Code 1H – No Offer of Coverage - Employee not offered any health coverage or employee offered coverage that is not minimum essential coverage, which may include one or more months in which the individual was not an employee.

Code 1J - Minimum essential coverage providing minimum value offered to employee; minimum essential coverage conditionally offered to employee’s spouse; and minimum essential coverage NOT offered to employee’s dependent(s).

Code 1K - Minimum essential coverage providing minimum value offered to employee; minimum essential coverage conditionally offered to employee’s spouse; and minimum essential coverage offered to employee’s dependent(s).

Code 1L - Individual coverage HRA offered to employee only with affordability determined by using employee’s primary residence location ZIP code.

Code 1M - Individual coverage HRA offered to employee and dependent(s) (not spouse) with affordability determined by using employee’s primary residence location ZIP code.

Code 1N - Individual coverage HRA offered to employee, spouse, and dependent(s) with affordability determined by using employee’s primary residence location ZIP code.

Code 1O - Individual coverage HRA offered to employees only using the employee’s primary employment site ZIP code affordability safe harbor.

Code 1P - Individual coverage HRA offered to employee and dependent(s) (not spouse) using the employee’s primary employment site ZIP code affordability safe harbor.

Code 1Q - Individual coverage HRA offered to employee, spouse, and dependent(s) using employee’s primary employment site ZIP code affordability safe harbor.

Code 1R - Individual coverage HRA that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse and dependents.

Code 1S - Individual coverage HRA offered to an individual who was not a full-time employee.

Code 1T – Individual coverage HRA offered to employee and spouse (no dependents) with affordability using employee’s primary residence ZIP code.

Code 1U – Individual coverage HRA offered to employee and spouse (no dependents) using the employee’s primary employment site ZIP code affordability safe harbor.

Line 16 Indicator Codes - Code Series 2

For each month applicable, enter a Series 2 indicator code. These codes are used to indicate when the employer qualifies for one of the affordability safe harbors or other relief.

Code 2A – Employee Not Employed During the Month - Enter code 2A if the employee was not employed on any day of the calendar month.

Code 2B - Employee Not a Full-time Employee - Enter code 2B if the employee is not a full-time employee for the month and did not enroll in minimum essential coverage, if offered for the month.

Code 2B – Full-Time Employee – Terminated Employment During Month – Coverage Would Have Continued - Enter code 2B if the employee is a full-time employee for the month and whose offer of coverage (or coverage if the employee was enrolled) ended before the last day of the month solely because the employee terminated employment during the month (so that the offer of coverage or coverage would have continued if the employee had not terminated employment during the month).

Code 2C - Employee Enrolled in Coverage Offered - Enter code 2C for any month in which the employee enrolled in health coverage offered by the employer for each day of the month, regardless of whether any other code in Code Series 2 might also apply.

Code 2D - Employee in a Limited Non-Assessment Period - Enter code 2D for any month during which an employee is in a Limited Non-Assessment Period for section 4980H(b). If an employee is in an initial measurement period, enter code 2D (employee in a section 4980H(b) Limited Non-Assessment Period) for the month, and not code 2B (employee not a full-time employee). For an employee in a section 4980H(b) Limited Non-Assessment Period for whom the employer is also eligible for the multi-employer interim rule relief for the month, enter code 2E (multi-employer interim rule relief) and not code 2D (employee in a Limited NonAssessment Period).

Code 2E - Multi-Employer Interim Rule Relief - Enter code 2E for any month for which the multi-employer interim guidance applies for that employee. This relief is not covered in this material; refer to the instructions for Form 1095-C.

Code 2F - Form W-2 Safe Harbor - Enter code 2F if the employer used the section 4980H Form W-2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year. If an employer uses this safe harbor for an employee, it must be used for all months of the calendar year for which the employee is offered health coverage.

Code 2G - Federal Poverty Line Safe Harbor - Enter code 2G if the employer used the section 4980H federal poverty line safe harbor to determine affordability for purposes of section 4980H(b) for this employee for any month(s).

Code 2H – Rate of Pay Safe Harbor - Enter code 2H if the employer used the section 4980H rate of pay safe harbor to determine affordability for purposes of section 4980H(b) for this employee for any month(s).

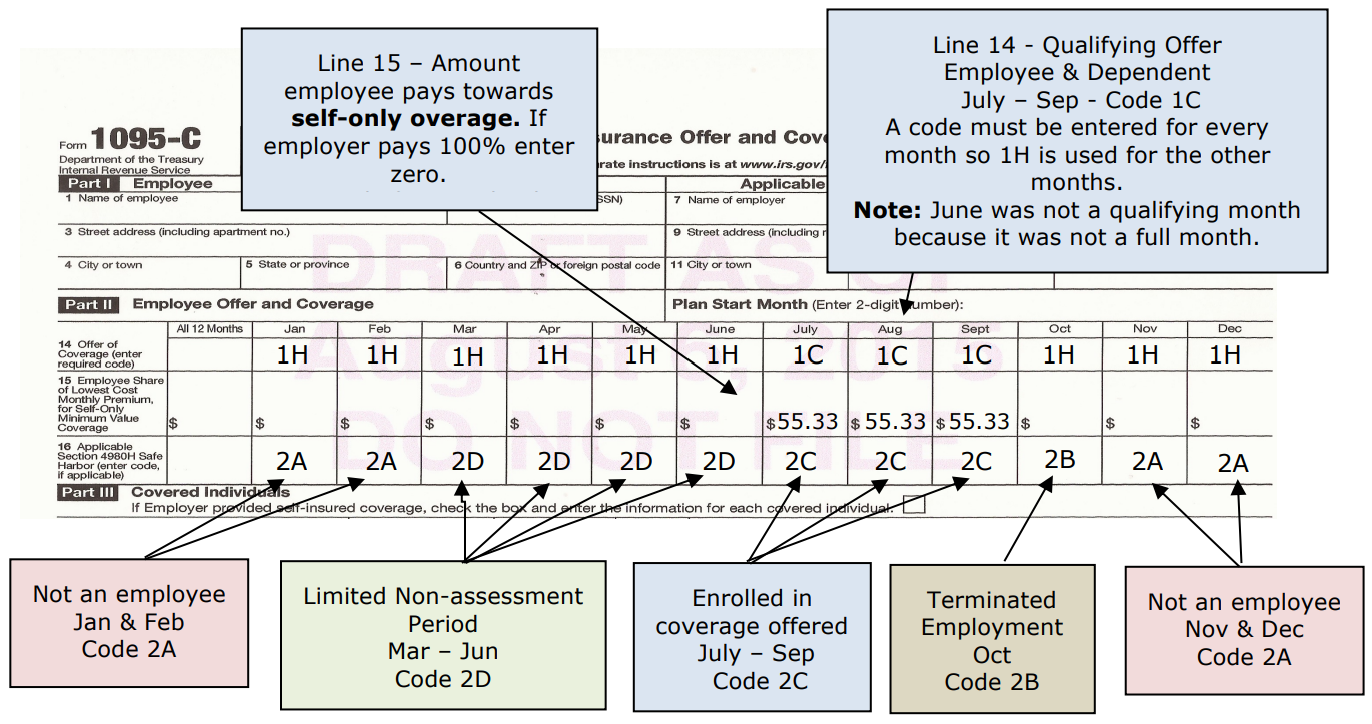

Example: ABC Inc. hired Kevin Haight on March 15. ABC has a 90-day probationary period for new employees before they offer health care insurance. On June 5, Kevin was offered insurance for himself and his dependents and enrolled in the coverage. Kevin subsequently terminated his employment October 1.

-

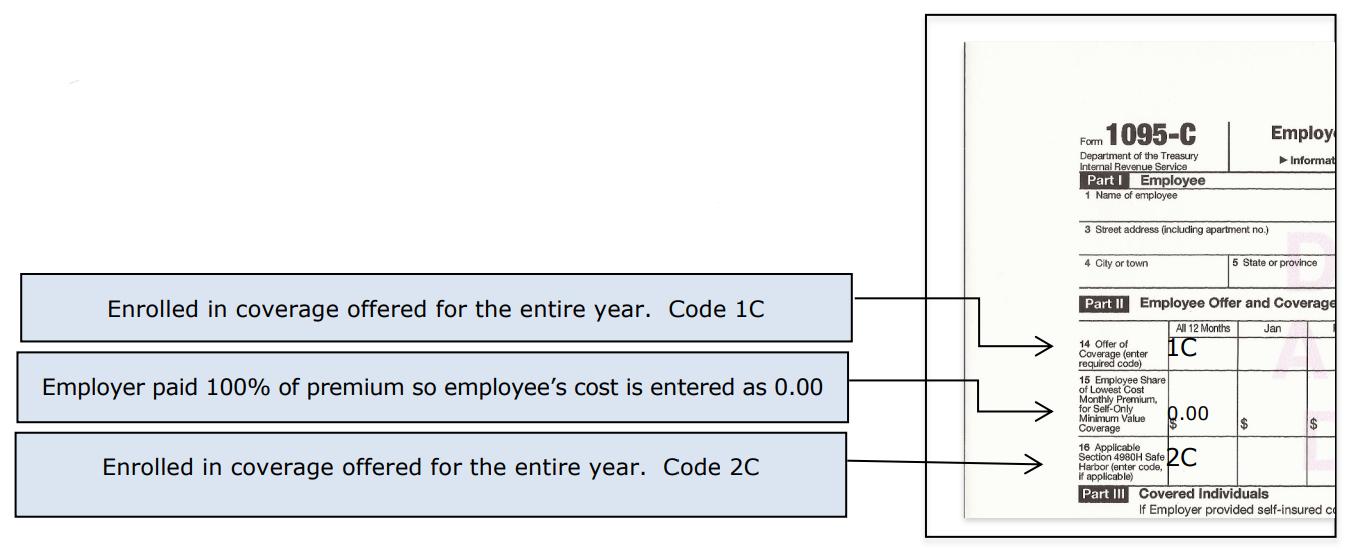

Example: Marty Lewis worked as a full-time employee for Carson Fabricators the entire year and was offered health insurance that provided minimum essential coverage for himself and his dependents for the entire year. The employer pays the entire premium for Marty. Marty was enrolled in coverage for the full year.In this situation only the “All 12 months” column need be completed.

-

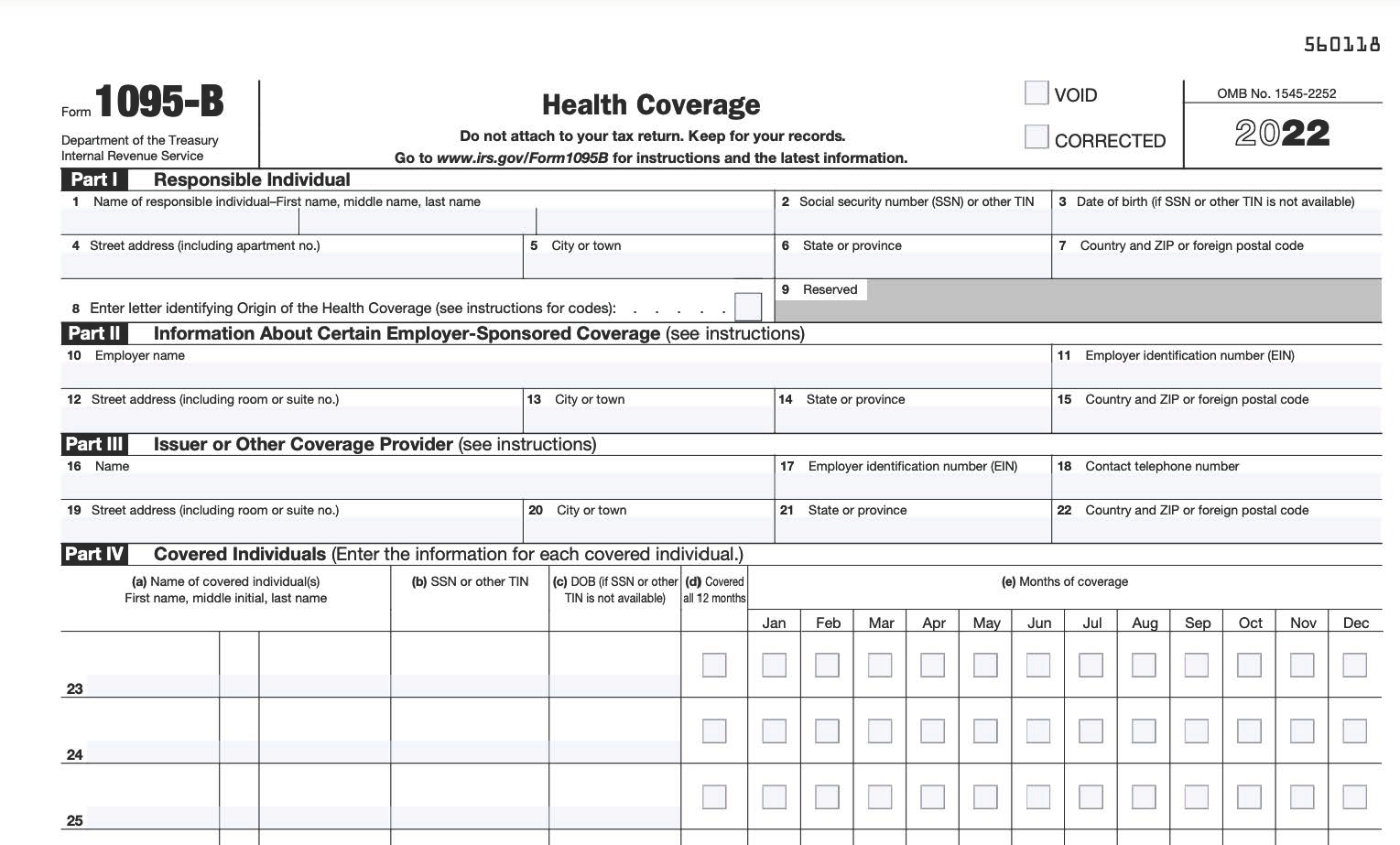

1095-B – Health Coverage

Form 1095-B is used by providers of minimum essential health coverage, typically insurance companies, to report which months the individuals have minimum essential coverage. A simple check box is all that is needed since the insurance providers using this form only provide minimum essential coverage. Employers, including government employers, subject to the employer shared responsibility provisions that sponsor self-insured group health plans will report information about the coverage in Part III of Form 1095-C.

This information is used to determine if the individual(s) are subject to the shared responsibility payment (penalty for not being insured). Because the individual shared responsibility payment is reduced to zero starting in 2019, individuals no longer need the information on Form 1095-B to compute their federal tax liability or file their federal income tax return.

Before 2019, individuals who did not have minimum essential coverage and did not qualify for an exemption from this requirement could be liable for the individual shared responsibility payment. Beginning in 2019, individuals will not be subject to a shared responsibility payment (penalty) because the payment amount is reduced to $0. However, if individuals in the taxpayer’s tax family are eligible for certain types of minimum essential coverage, the taxpayer may not be eligible for the premium tax credit.

2020 Information Reporting Relief

See page 6 of the Form 1095-B instructions for penalty relief and penalty waivers for failure to file form 1095-B.

NOTE: Large employers: An employer subject to the shared responsibility provisions will never complete a Form 1095-B; it is for insurance companies to report insurance coverage the insurance carrier provided to the employer’s employees. Thus, unless the employer is self-insured, the employee will receive a 1095-C from the employer, with Parts I and II completed, and possibly, a Form 1095-B from the insurance carrier. If the employer is self-insured the employee will only receive a 1095-C, which will include Part III completed (in lieu of a 1095-B). Small employers: An employer not subject to the shared responsibility provisions that sponsors a self-insured group health plan will use Form 1095-B to report information about covered employees. The 1095-B is not required for 2019 and possibly later years. See “1095-B Health Coverage” above regarding filings for 2019 and later years.

Form 1095-B Due Dates

-

Copy to employees: by January 31.

-

Filed with government: by February 28 (March 31 if filed electronically)