Withholding Rates

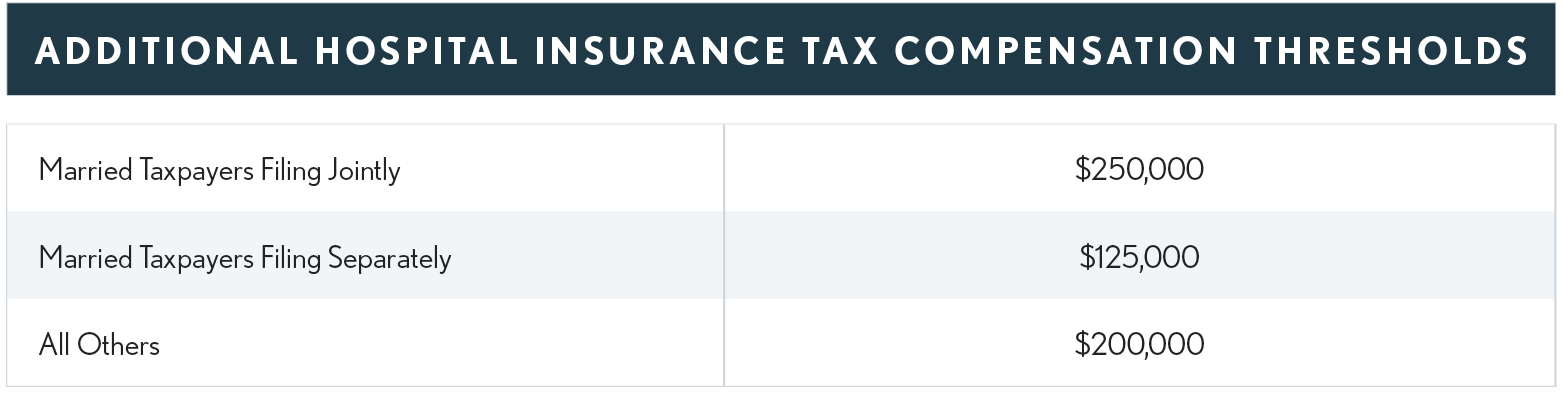

The Hospital Insurance (HI) (aka Medicare) tax rate (currently at 1.45%) is increased by 0.9 percentage points on individual taxpayer earnings (wage withholding and SE tax) in excess of compensation thresholds for the taxpayer’s filing status; see table below. (Code Sec. 3101(b)(2))

All wages currently subject to Medicare tax will be subject to the additional Medicare tax, if they are paid in excess of the applicable threshold amount. The same is true of Railroad Retirement Tax Act (RRTA) compensation.

No special rules apply for nonresident aliens and U.S. citizens living abroad. Wages, other compensation, and self-employment income that are subject to Medicare tax will also be subject to additional Medicare tax after the threshold is reached.

Wage Withholding

An employer must withhold additional Medicare tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual’s filing status or wages paid by another employer. Thus, an employee’s wage withholding HI rate will be 1.45% on the first $200,000 of wages paid by his employer and 2.35% (1.45 + 0.9) on amounts in excess of $200,000. An individual may owe more than the amount withheld by the employer, depending on the individual’s filing status, wages, compensation, and selfemployment income.

SE Tax

The HI component of the SE tax rate will be 2.9% up to the income threshold and 3.8% (2.9 + 0.9) on amounts in excess of the threshold.

These amounts are not adjusted for inflation.

All Income Combined for Purposes of the Threshold

For purposes of determining the additional HI tax, all wage and self-employment income is combined. For married taxpayers, the spouses’ wages and self-employment incomes are combined.

Married Taxpayers

Where both spouses work, their wages are combined for purposes of determining whether they as a couple filing a joint return are responsible for the additional HI tax.

Multiple Employers

Employers will not consider income from other employers when determining the amount to be withheld UNLESS the employers utilize a common paymaster. This will create under-withholding for employees with multiple employers whose wages from all employers exceed the filing status threshold.

Spouses Both Working

Where both spouses work, even though their wages must be combined for purposes of determining whether they as a couple are responsible for the additional HI tax, employers withhold only on the wages 12.06.01 of the individual who is their employee. Even though a couple may work for the same employer, the wages of each spouse are considered separately by the employer.

Excess Medicare Withholding

If the employer over-withholds the Medicare tax, the excess can be claimed as additional income tax withholding when the taxpayer files his or her return. After completing Form 8959 and determining that the taxpayer’s Medicare tax is over-withheld, the excess Medicare tax is combined with the taxpayer’s income tax withholding for the year for entry on Form 1040 Schedule 2 Line 11.

Employer Fails to Withhold Additional Amount

An employer that does not deduct and withhold Additional Medicare Tax as required is liable for the tax unless the tax that it failed to withhold from the employee’s wages is paid by the employee. Even if not liable for the tax, an employer that does not meet its withholding, deposit, reporting, and payment responsibilities for additional Medicare tax may be subject to all applicable penalties.

Tips

To the extent that tips and other wages exceed $200,000, an employer applies the same withholding rules for additional Medicare tax as it does currently for Medicare tax. An employer withholds additional Medicare tax on the employee’s reported tips from wages it pays to the employee.

Employer Matching

An employer is not required to make a matching contribution.