Above the Line Deduction

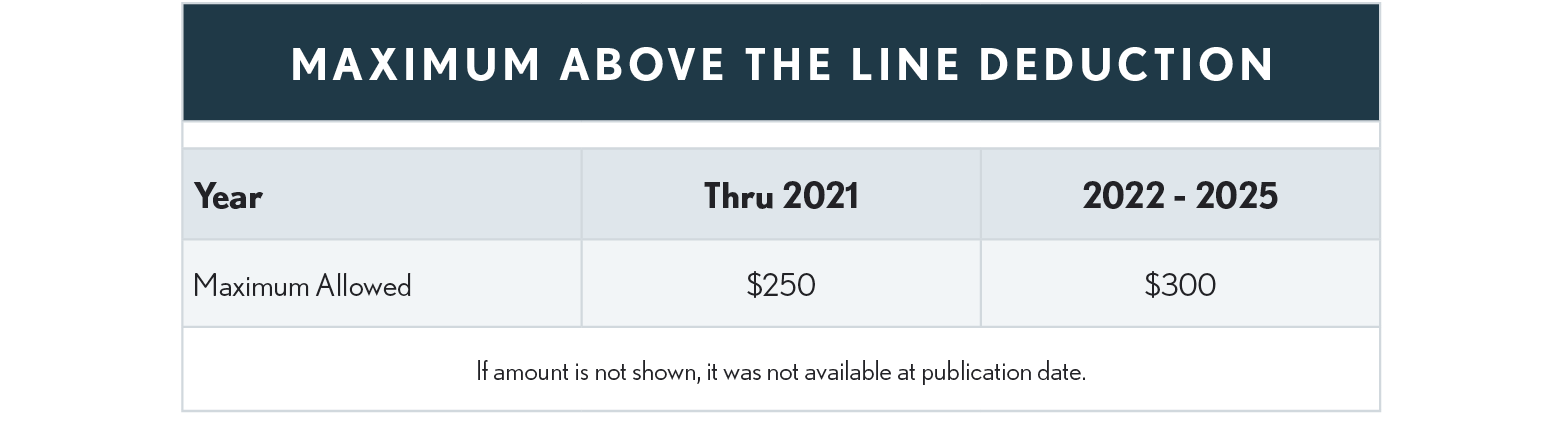

The deduction is limited to the amounts indicated in the table below (inflation adjusted after 2015).

Qualified Expenses

Qualified expenses are generally otherwise allowable Code Sec. 162 trade or business expenses paid or incurred by the eligible educator that were not reimbursed. The following fall under that category:

-

Books

-

Supplies (other than nonathletic supplies for courses of instruction in health or physical education)

-

Computer equipment (including related software and services) and other equipment

-

Supplementary materials used by the eligible educator in the classroom

-

Professional development expenses incurred after 2015 (added by the PATH Act of 2015). These courses must be related to the curriculum in which the educator provides instruction or to the students for which the educator provides instruction, and

-

COVID-19-related expenses paid after March 12, 2020 (Rev Proc 2021-15):

-

face masks

-

physical barriers (for example clear plexiglass)

-

disinfectant for use against COVID-19

-

hand soap

-

air purifiers

-

hand sanitizer

-

other items recommended by the CDC to be used for the prevention of the spread of COVID-19

-

disposable gloves

-

tape, paint or chalk used to guide social distancing

-

Eligible Educator

An eligible educator is, with respect to any tax year, an individual who is a kindergarten through grade 12:

-

Teacher, instructor

-

Principal, or

-

Counselor

-

Aide

Who works in a school for at least 900 hours during a school year. For this purpose, a school is any school that provides elementary education or secondary education (kindergarten through grade 12), as determined under state law. Educators who retire mid-year, who start work in the fall term, or substitute teachers may not meet the 900 hours test.

Example – During 2024, Mary, a 5th grade teacher, worked over 900 hours and spent $500 on classroom supplies that would otherwise be deductible as an employee business expense were it not for the TCJA suspension of tier 2 miscellaneous deductions in years 2018-2025. She received no reimbursement for the materials. Mary can take a $300 AGI deduction on her tax return.

-

Example – Pamela, a kindergarten teacher, retired at the end of the school year in June of 2024. Pamela worked 8 hours per school day but after accounting for holidays and spring break vacation, she only worked 108 days, for a total of 864 hours during the tax year. She is not eligible to claim the above-the-line deduction for the $225 of classroom supplies she purchased. However, if Pamela retired in a year other than 2018 through 2025 and she itemizes deductions for that year, she may claim the expenses as business expenses, subject to the 2%-of-AGI limitation.

Example – During 2024, Jack, an 8th grade teacher, had unreimbursed expenses of $800, consisting of the following: $200 for books and $600 for supplemental materials that were consumed by his class. He worked as a teacher for more than 900 hours. Jack can take a $300 AGI deduction on his tax return. Because Schedule A tier 2 miscellaneous deductions are suspended in 2018-2025, he cannot deduct the balance of the expenses as an itemized deduction. However, if Jack works for a public school and can get his school to provide him with a contribution receipt, Jack may take the remainder as a noncash contribution to a Governmental Body.

Limitation

The classroom expense deduction is allowed for expenses only to the extent the amount of those expenses exceeds the amount excludable for the tax year under:

-

Higher Education Savings Bond Redemptions - Code Sec. 135

-

Qualified State Tuition Program Distributions - Code Sec. 529(c)(1)

-

Coverdell Education Savings Account Distribution - Code Sec. 530(d)(2)