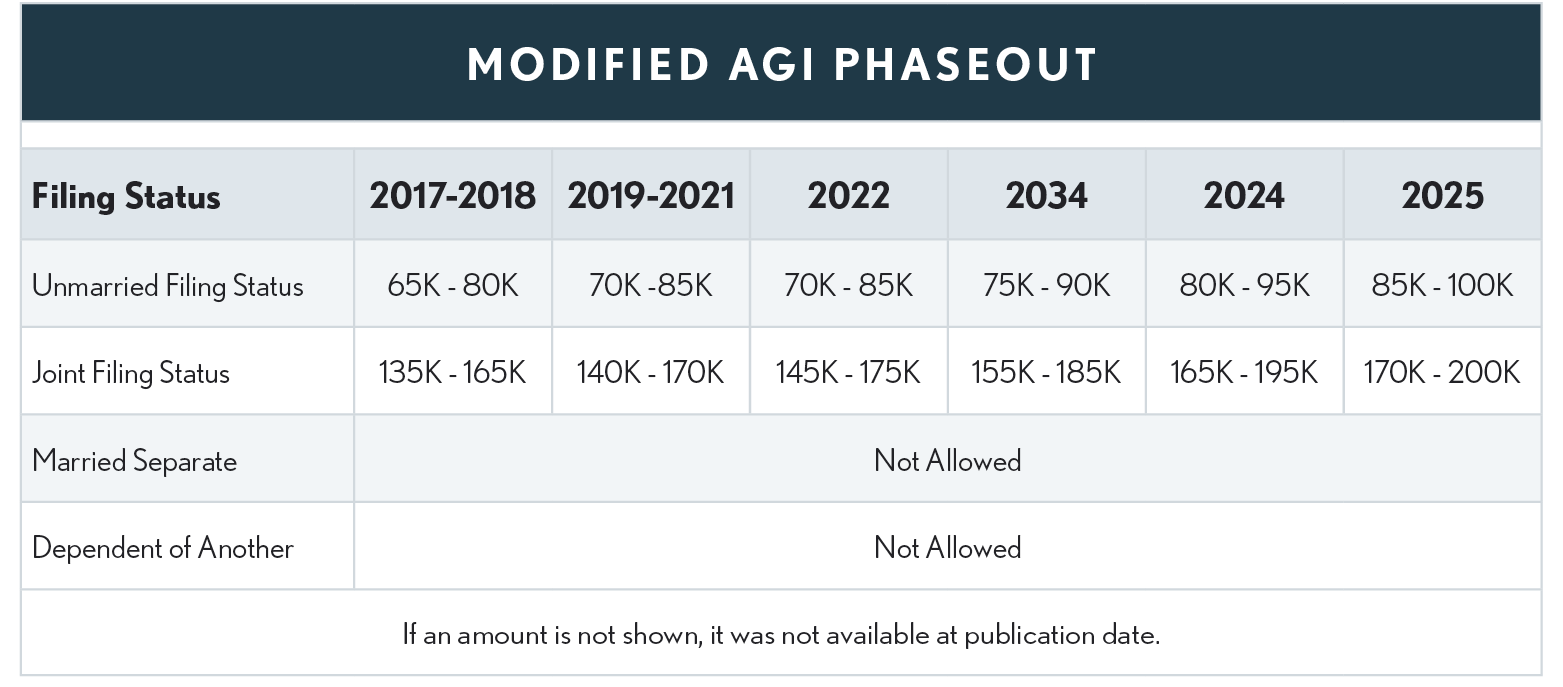

Modified AGI Phase Out

The phaseout AGI is inflation adjusted in $5,000 increments.

Modified AGI

Means AGI determined without regard to: the deduction for qualified education loan interest (§221), the foreign earned income and foreign housing exclusions and foreign housing deduction (§911), the exclusion of income from U.S. possessions (§931), the exclusion of income from Puerto Rico (§933), the qualified higher education tuition and fees deduction available in years prior to 2021 (§222) and before 2018 the domestic production activities deduction (§199) (repealed for years after 2017).

The inclusion in income of Social Security and Tier 1 Railroad Retirement Benefits, the deduction for qualified retirement contributions, and the limitations on passive activity losses and credits, are determined without regard to the deduction allowed for qualified education loan interest.