Foreign Earned Income Exclusion

Overview

U.S. citizens or resident aliens of the United States who live abroad are taxed on their worldwide income. However, they may qualify under IRC § 911 to exclude from income foreign earnings not to exceed an annual maximum amount. In addition, taxpayers may be able to exclude or deduct certain foreign housing cost amounts.

-

To qualify for this exclusion, a taxpayer must:

-

Have foreign earned income,

-

Have a “tax home” in a foreign country, and

-

Be one of the following:

-

A U.S. citizen who is a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year, or

-

A U.S. resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year, or

-

A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

-

-

-

First/Last years – Generally the first and last years qualify under the physically present rules.

-

Annual Exclusion Limit – is inflation adjusted and is $126,500 for 2024

-

Housing Allowance Limit –The limit is the expense in excess of 16% of the exclusion amount for the year and capped at 30% of the taxpayer’s exclusion amount for the year (higher cap if expenses incurred in designated high-cost location).

-

Taxpayer’s Other Income – taxed at marginal rates determined without the exclusion.

-

Earned Income – can be from a foreign or domestic company.

-

Spouse – may qualify separately.

-

Credit Limitations – Taxpayers that claim the foreign earned income exclusion are not eligible to claim the earned income tax credit (EITC) or the refundable part of the child tax credit.

Related IRC and IRS Publications and Forms

-

Form 2350 – Application for Extension of Time to File U.S. Tax Return

-

Form 2555 – Foreign Income Exclusion

-

Pub 54 – Tax Guide for U.S. Citizens and Resident Aliens Abroad

-

Pub 514 – Foreign Tax Credit for Individuals

-

IRC Sec 911

-

Notice 2023-26 – 2023 Elective Housing Allowances

-

Notice 2022-10 – 2022 Elective Housing Allowances

-

Notice 2021-18 – 2021 Elective Housing Allowances

-

Rev Proc 2023-19 – List of the countries for which 2022 waiver applied

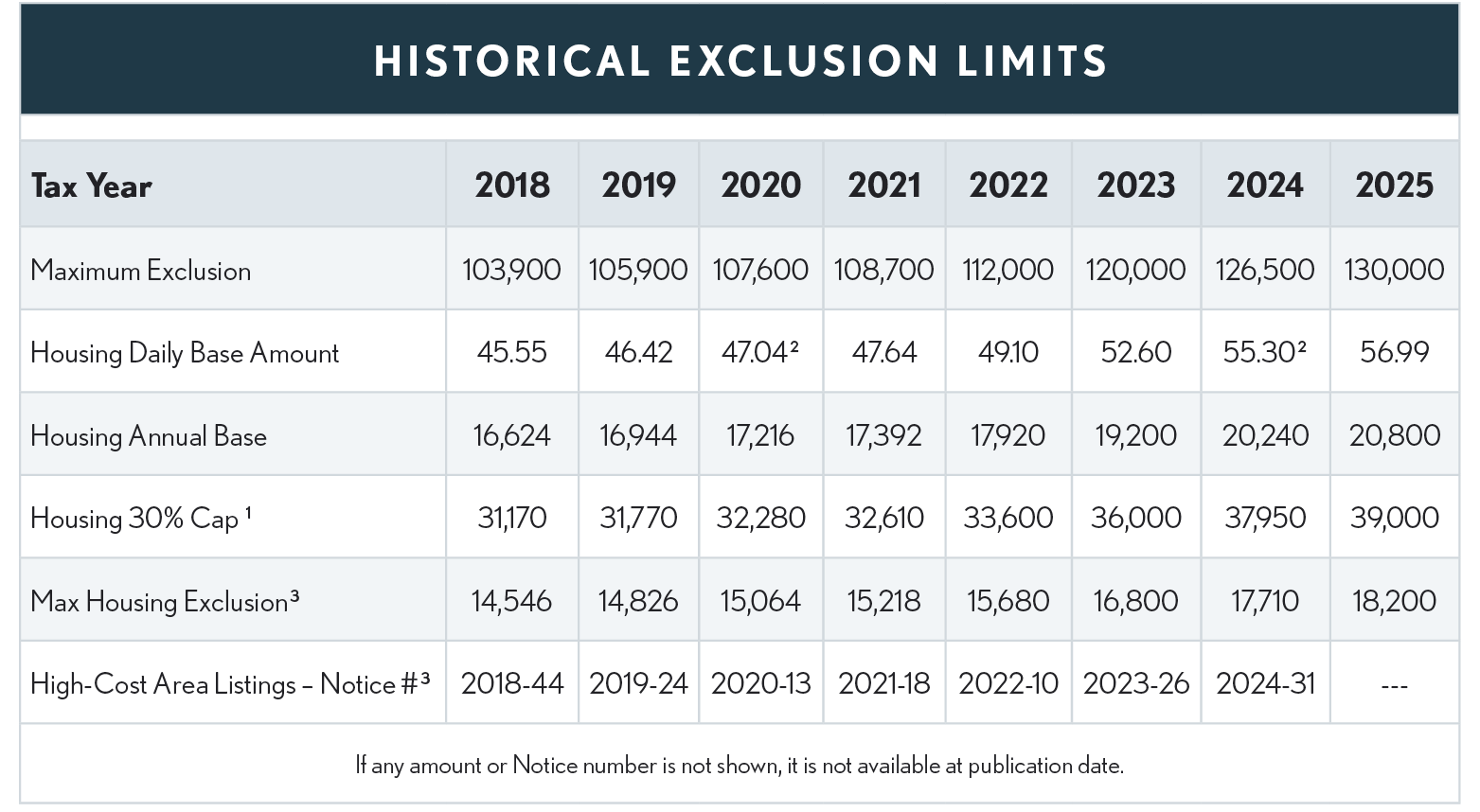

A U.S. citizen’s or resident alien’s worldwide income generally is subject to U.S. income tax regardless of where the taxpayer is living. However, taxpayers are allowed to exclude from their income a certain amount of foreign earned income and housing allowance if they meet certain requirements while living abroad. The following is a table of the annual limits for this exclusion for recent years followed by qualifications and exclusion computation details.

The amounts shown (other than the Housing Daily Base Amt.) are for a full year. These amounts must be prorated by the day for taxpayers who only qualify for a partial year.

-

The housing exclusion is capped at 30% of the earned income exclusion except in what is deemed to be high- cost areas (see IRS tables found in the notices listed in the above table), in which case the cap is increased for the specific area. The base amount is equal to 16% of the annual exclusion amount.

-

Leap Year (366 days)

-

The IRS is authorized to adjust limitations for high-cost areas. Please check the table in the applicable IRS notice before using the standard amounts listed above.