-

Your Acceptance

By using, accessing and/or visiting the Taxbuzz Website you agree to be bound by both these Terms and Conditions and Taxbuzz’s Privacy Policy, which is incorporated herein by reference. Taxbuzz may modify these Terms and Conditions and/or the Privacy Policy from time to time without notice and you agree that you will be bound by such modifications and that your use, access and/or visit to the Website is governed by the Terms and Conditions then in effect. If we make material modifications to these Terms and Conditions we will indicate at the top of this page the date that such modifications were made. Any such modification will be effective upon our posting of the new Terms and Conditions. You understand and agree that your continued use and/or access of the Website after the date of such modifications indicates your acceptance of the modifications. The Website may be modified, updated, interrupted, suspended and/or discontinued at any time without notice or liability. If you do not agree to these Terms and Conditions, then please do not access or use the Taxbuzz Website.

-

Taxbuzz Website

These Terms and Conditions apply to all Users including Users who contribute text, content, information and/or other materials or services to the Website. The Website may contain links to third party websites that are not owned or controlled by Taxbuzz. Taxbuzz has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third party websites and you assume all risk in accessing such third party websites. In addition, Taxbuzz will not and cannot censor or edit the content of any third party websites. You expressly release Taxbuzz and CountingWorks, Inc. from any and all liability arising from your use of any third-party websites. Accordingly, we encourage you to be aware when you leave the Website for a third party website and to read the terms and conditions and privacy policy of each third party website you visit.

-

Website Access

-

A. Taxbuzz hereby grants you permission to use the Website as set forth in these Terms and Conditions, provided that: (i) your use of the Website as permitted is solely for your personal use; (ii) you will not copy or distribute any part of the Website, or any Content or source code in any medium without Taxbuzz's prior written authorization; (iii) you will not alter or modify any part of the Website; and (iv) you will otherwise comply with these Terms and Conditions.

-

B. In order to access some features of the Website, you will have to create an account. You may never use another person’s account without permission. When creating your account you must provide accurate and complete information. You are solely responsible for the activity that occurs on your account, and you must keep your account password secure. You must notify Taxbuzz immediately of any breach of security or unauthorized use of your account. Although Taxbuzz will not be liable for your losses caused by any unauthorized use of your account, you may be liable for the losses of Taxbuzz or others due to such unauthorized use.

-

C. You agree not to use or launch any automated system, including without limitation, "robots," "spiders," "offline readers", or other automated device, process or means to access, retrieve, scrape, or index any portion of the Website or any Website Content in any manner including one that sends more request messages to the Taxbuzz servers in a given period of time than a human can reasonably produce in the same period by using a conventional on-line web browser. Notwithstanding the foregoing, Taxbuzz grants the operators of public search engines permission to use spiders to copy materials from the site for the sole purpose of creating publicly available searchable indices of the materials, but not caches or archives of such materials. Taxbuzz reserves the right to revoke these exceptions either generally or in specific cases.

-

D. TAXBUZZ AND CountingWorks, Inc. MAKE NO REPRESENTATIONS, WARRANTIES, CLAIMS OR PROMISES WITH RESPECT TO ANY THIRD PARTY, INCLUDED BUT NOT LIMITED TO THE BUSINESSES OR ADVERTISERS LISTED ON THE WEBSITE, THEIR SERVICES OR ANY SERVICE OR PRODUCT PROVIDED TO USERS. ACCORDINGLY, TAXBUZZ AND CountingWorks, Inc. AND THEIR AFFILIATES ARE NOT LIABLE TO YOU FOR ANY LOSS OR DAMAGE THAT MIGHT ARISE FROM THEIR ACTIONS OR OMISSIONS, INCLUDING BUT NOT LIMITED TO WHERE ANOTHER USER OR BUSINESS MISUSES YOUR CONTENT, IDENTITY OR PERSONAL INFORMATION, OR IF YOU HAVE A NEGATIVE EXPERIENCE WITH ONE OF THE BUSINESSES OR ADVERTISERS LISTED OR FEATURED ON THE WEBSITE. YOUR PURCHASE AND USE OF PRODUCTS OR SERVICES OFFERED BY THIRD PARTIES THROUGH THE WEBSITE IS AT YOUR SOLE DISCRETION AND RISK. YOU AGREE AND ACKNOWLEDGE THAT NEITHER TAXBUZZ NOR CountingWorks, Inc. IS LIABLE FOR ANY DISPUTE, CLAIM, CONTROVERSY, AND/OR LAWSUIT THAT A TAXBUZZ DIRECTORY PARTICIPANT AND YOU MAY HAVE AGAINST EACH OTHER ARISING UNDER ANY CIRCUMSTANCES, INCLUDING FROM THE ACCESS AND/OR USE OF THIS WEBSITE. WHILE YOU AGREE AND ACKNOWLEDGE THAT WHILE THERE IS NO CHARGE OR FEE TO YOU FOR THE USE OF TAXBUZZ, DIRECTORY PARTICIPANTS MAY PAY A FEE TO TAXBUZZ IN ORDER TO USE TAXBUZZ TO SOLICIT BUSINESS FROM YOU. YOU AGREE AND ACKNOWLEDGE THAT TAXBUZZ IS NOT RESPONSIBLE FOR ANY HARM THAT THESE SERVICES MAY CAUSE. YOU AGREE TO INDEMNIFY, DEFEND AND HOLD TAXBUZZ, CountingWorks, Inc. AND THEIR AFFILIATES HARMLESS FROM ANY AND ALL LIABILITY ARISING FROM OR IN CONNECTION WITH YOUR USE OF TAXBUZZ, INCLUDING ATTORNEYS’ FEES AND COSTS. TAXBUZZ DOES NOT GUARANTEE THAT USER WILL FIND A PROFESSIONAL TAXBUZZ DIRECTORY PARTICIPANT. TAXBUZZ DOES NOT INVOLVE ITSELF IN ANY AGREEMENT BETWEEN YOU AND ANY THIRD PARTY SELECTED BY YOU. WE DO NOT GUARANTEE THE COMPLETION OF ANY AGREEMENT BETWEEN YOU AND ANY DIRECTORY PARTICIPANT. YOU ARE SOLELY RESPONSIBLE FOR ASSESSING THE INTEGRITY, HONESTY, EXPERIENCE, CAPABILITY, AND RELIABILITY OF ANY DIRECTORY PARTICIPANT WITH WHOM YOU COMMUNICATE.

-

Intellectual Property Rights

Except as noted below all content on the Website including without limitation, the text, software, scripts, graphics, photos, sounds, music, videos, interactive features and the like (collectively, "Content") and the trademarks, service marks and logos contained therein ("Marks"), are owned by or licensed to Taxbuzz, subject to copyright and other intellectual property rights under United States and foreign laws and international conventions. Content on the Website is provided to you AS IS and with no representations for your information and personal use only and may not be copied, reproduced, distributed, transmitted, broadcast, displayed, sold, licensed, or otherwise exploited for any other purposes whatsoever without the prior written consent of Taxbuzz or the respective owners. Taxbuzz reserves all rights not expressly granted in and to the Website and the Content. If you download or print a copy of the Content for personal use, you must retain all copyright and other proprietary notices contained therein. You agree not to circumvent, disable or otherwise interfere with security related features of the Website or features that prevent or restrict use or copying of any Content or enforce limitations on use of the Website or the Content therein.

-

User Submissions and Content Guidelines

-

A. The Website may now or in the future permit the submission of videos, graphics, artwork, ideas, suggestions, contest or sweepstakes entries, the use of internet chat rooms, blogs, comment streams, or other communications submitted by you and other users ("User Submissions").

-

B. You shall be solely responsible for your own User Submissions and the consequences of posting or publishing them. In connection with User Submissions, you affirm, represent and warrant that: (i) you own or have the necessary licenses, rights, consents, and permissions to use and authorize Taxbuzz to use all patent, trademark, trade secret, copyright or other proprietary rights in and to any and all User Submissions to enable inclusion and use of the User Submissions in the manner contemplated by the Website and these Terms and Conditions; and (ii) you have the written consent, release, and/or permission of each and every identifiable individual person in the User Submission to use the name and/or likeness of each and every such identifiable individual person to enable inclusion and use of the User Submissions in the manner contemplated by the Website and these Terms and Conditions. By submitting the User Submissions to Taxbuzz, you hereby grant Taxbuzz and CountingWorks, Inc. a worldwide, non-exclusive, royalty-free, fully paid up, sub licensable and transferable license to use, reproduce, distribute, prepare derivative works of, display, and perform the User Submissions in connection with the Website and Taxbuzz's (and its successor's) business, including without limitation for promoting and redistributing part or all of the Website (and derivative works thereof) in any media formats and through any media channels. You also hereby grant each user of the Website a non-exclusive license to access your User Submissions through the Website and to use, reproduce, distribute, prepare derivative works of, display and perform such User Submissions as permitted through the Website and under these Terms and Conditions. You agree and acknowledge that all rights you grant to Taxbuzz in this Section shall be without compensation.

-

C. In connection with User Submissions, you further agree that you will not: (i) submit material that is copyrighted, protected by trade secret or otherwise subject to third party proprietary rights, including privacy and publicity rights, unless you are the owner of such rights or have permission from their rightful owner to post the material and to grant Taxbuzz all of the rights granted herein; (ii) publish falsehoods or misrepresentations that could damage Taxbuzz, CountingWorks, Inc. or any third party; (iii) submit material that is unlawful, obscene, defamatory, libelous, threatening, pornographic, harassing, hateful, racially or ethnically offensive, or encourages conduct that would be considered a criminal offense, give rise to civil liability, violate any law, or is otherwise inappropriate; (iv) post junk mail, chain letters, spam or any other mass email or solicitations of business; (v) impersonate another person or falsely state or otherwise misrepresent an affiliation with any person or entity. You further agree not to: (i) share usernames, passwords or other access credentials that allow access to personal information or protected areas of the Website; (ii) engage in or facilitate spamming; (iii) omit, delete, forge or otherwise misrepresent accurate transmission information, including headers, return mailing or internet protocol addresses or otherwise manipulate identifiers to disguise the origin of any content or person; or (iv) post, transmit or disclose any information that contains personally identifying information of a minor child.

-

D. Taxbuzz and CountingWorks, Inc. do not endorse any User Submission or any opinion, recommendation, or advice expressed therein, and Taxbuzz and CountingWorks, Inc. expressly disclaim any and all liability in connection with User Submissions. Taxbuzz does not permit copyright infringing activities and infringement of intellectual property rights on its Website, and Taxbuzz will remove all Content and User Submissions if properly notified that such Content or User Submission infringes on another's intellectual property rights. Taxbuzz reserves the right to remove Content and User Submissions without prior notice and without liability. Taxbuzz may also terminate a User's account and access to its Website if that User infringes a third party’s intellectual property rights and/or has had a User Submission removed from the Website. Taxbuzz reserves the right to decide whether Content or a User Submission is appropriate and complies with these Terms and Conditions for violations other than copyright infringement and intellectual property law, such as, but not limited to, pornography, obscenity or defamatory material. Taxbuzz may remove such User Submissions and/or terminate a User's account and access for uploading such material in violation of these Terms and Conditions at any time, without liability, without prior notice and at its sole discretion.

-

E. If you are a copyright owner or an agent thereof and believe that any User Submission or other content infringes your copyrights, you may submit a notification pursuant to the Digital Millennium Copyright Act ("DMCA") by providing our Copyright Agent with the following information in writing (see 17 U.S.C 512(c)(3) for further detail): (i) A physical or electronic signature of a person authorized to act on behalf of the owner of an exclusive right that is allegedly infringed; (ii) Identification of the copyrighted work claimed to have been infringed, or, if multiple copyrighted works at a single online site are covered by a single notification, a representative list of such works at that site; (iii) Identification of the material that is claimed to be infringing or to be the subject of infringing activity and that is to be removed or access to which is to be disabled and information reasonably sufficient to permit Taxbuzz to locate the material; (iv) Information reasonably sufficient to permit Taxbuzz to contact you, such as an address, telephone number, and, if available, an electronic mail; (v) A statement that you have a good faith belief that use of the material in the manner complained of is not authorized by the copyright owner, its agent, or the law; and (vi) A statement that the information in the notification is accurate, and under penalty of perjury, that you are authorized to act on behalf of the owner of an exclusive right that is allegedly infringed. Taxbuzz's designated Copyright Agent to receive notifications of claimed infringement is: Lee Reams, email: [email protected], telephone: 818-338-8700, fax: 818-743-0550. For clarity, only DMCA notices should go to the Copyright Agent; any other feedback, comments, requests for technical support, and other communications should be directed to Taxbuzz customer service through https://www.taxbuzz.com/contact. You acknowledge that if you fail to comply with all of the requirements of this Section 5(E), your DMCA notice may not be valid.

-

F. You understand that when using the Website, you will be exposed to User Submissions from a variety of sources, and that neither Taxbuzz nor CountingWorks, Inc. are responsible for the accuracy, usefulness, safety, or intellectual property rights of or relating to such User Submissions. You further understand and acknowledge that you may be exposed to User Submissions that are inaccurate, offensive, indecent, or objectionable, and you agree to waive, and hereby do waive, any legal or equitable rights or remedies you have or may have against Taxbuzz and CountingWorks, Inc. with respect thereto, and agree to indemnify, defend and hold Taxbuzz, CountingWorks, Inc., their affiliates, and/or licensors, harmless to the fullest extent allowed by law regarding all matters related to your use of the Website.

-

G. Taxbuzz permits you to link to materials on the Website for personal, non-commercial purposes only. User Submissions (including any that may have been created by users employed or contracted by Taxbuzz) does not necessarily reflect the opinion of Taxbuzz or CountingWorks, Inc. Taxbuzz reserves the right to remove, screen, edit, or reinstate User Submissions at our sole discretion for any reason or no reason and without notice or liability. Taxbuzz has no obligation to retain or provide anyone with copies of User Submissions, nor do we guarantee any confidentiality with respect to User Submissions.

-

H. You agree not to, and not to assist, encourage, or enable others to use the Website to:

-

Violate our Content Guidelines (below), for example, by writing a fake or defamatory review, trading reviews with other businesses, or compensating someone or being compensated to write or remove a review;

-

Violate any third party's rights, including any breach of confidence, copyright, trademark, patent, trade secret, moral right, privacy right, right of publicity, or any other intellectual property or proprietary right;

-

Threaten, stalk, harm, or harass others, or promote bigotry or discrimination;

-

Promote a business or other commercial venture or event, or otherwise use the Website for commercial purposes, except as expressly permitted;

-

Send bulk emails, surveys, or other mass messaging, whether commercial in nature or not; engage in keyword spamming, or otherwise attempt to manipulate the Website's search results or any third party website;

-

Solicit personal information from minors, or submit or transmit pornography;

-

Violate any applicable law;

-

Modify, adapt, appropriate, reproduce, distribute, translate, create derivative works or adaptations of, publicly display, sell, trade, or in any way exploit the Website or Website Content (other than your User Submissions), except as expressly authorized by Taxbuzz;

-

Reverse engineer any portion of the Website;

-

Remove or modify any copyright, trademark or other proprietary rights notice that appears on the Website or on any materials printed or copied from the Website;

-

Record, process, or mine information about other users;

-

Access, retrieve or index any portion of the Website for purposes of constructing or populating a searchable database of business reviews;

-

Reformat or frame any portion of the Website;

-

Take any action that imposes, or may impose, in our sole discretion, an unreasonable or disproportionately large load on Taxbuzz's technology infrastructure or otherwise make excessive traffic demands of the Website;

-

Attempt to gain unauthorized access to the Website, user accounts, computer systems or networks connected to the Website through hacking, password mining or other means;

-

Use the Website or any Website Content to transmit any computer viruses, worms, defects, Trojan horses or other items of a destructive nature;

-

Use any device, software or routine that interferes with the proper working of the Website, or otherwise attempt to interfere with the proper working of the Website;

-

Use the Website to violate the security of any computer network, crack passwords or security encryption codes; disrupt or interfere with the security of, or otherwise cause harm to, the Website or Website Content; or

-

Remove, circumvent, disable, damage or otherwise interfere with any security-related features of the Website, features that prevent or restrict the use or copying of Content, or features that enforce limitations on the use of the Website. The restrictions above only apply to the extent permissible under applicable law. Nevertheless, you agree not to act contrary to them (even if permissible under applicable law) without providing 30 days' prior written notice to Taxbuzz, together with any information that we may reasonably require to give us an opportunity to provide alternative remedies or otherwise accommodate you at our sole discretion.

- I. Content Guidelines. TaxBuzz allows Users to contribute different kinds of User Content including reviews, private messages, biographies, photos and more. What follows is a non-exhaustive list of general guidelines for the posting of User Content: Colorful language is acceptable, but defamatory language, threats, harassment, lewdness, hate speech and other forms of bigotry is not tolerated and will be removed. Please make sure that your reviews are a snapshot of your experience with the directory participant. TaxBuzz is not a forum for political views or employment practices that do not address your relationship with the directory participant. Do not post directory participant’s private information. Do not post your confidential information or the confidential information of third parties. Do not post reviews for your own business or solicit reviews from family or friends who are not clients. Do not post content from other sites. Make your reviews unique to TaxBuzz.

-

Warranty Disclaimer

PLEASE READ THIS SECTION CAREFULLY AS IT LIMITS THE LIABILITY OF TAXBUZZ, CountingWorks, Inc. AND THEIR AFFILIATES TO YOU. EACH SUBSECTION BELOW ONLY APPLIES UP TO THE MAXIMUM EXTENT PERMITTED UNDER APPLICABLE LAW. NOTHING HEREIN IS INTENDED TO LIMIT ANY RIGHTS YOU HAVE WHICH MAY NOT BE LAWFULLY LIMITED. IF YOU ARE UNSURE ABOUT THIS OR ANY OTHER SECTION OF THESE TERMS AND CONDITIONS, PLEASE CONSULT A LEGAL PROFESSIONAL PRIOR TO ACCESSING OR USING THE WEBSITE. BY ACCESSING OR USING THE WEBSITE YOU REPRESENT THAT YOU HAVE READ, UNDERSTOOD AND AGREE TO THESE TERMS AND CONDITIONS. YOU ARE GIVING UP SUBSTANTIAL LEGAL RIGHTS BY AGREEING TO THESE TERMS.

YOU AGREE THAT YOUR USE OF THE WEBSITE SHALL BE AT YOUR SOLE RISK. TO THE FULLEST EXTENT PERMITTED BY LAW, TAXBUZZ, CountingWorks, Inc. THEIR OFFICERS, DIRECTORS, EMPLOYEES, AND AGENTS DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, IN CONNECTION WITH THE WEBSITE AND YOUR USE THEREOF. NEITHER TAXBUZZ NOR CountingWorks, Inc. MAKE ANY WARRANTIES OR REPRESENTATIONS ABOUT THE ACCURACY OR COMPLETENESS OF THE WEBSITE'S CONTENT, THE DIRECTORY PARTICIPANTS OR BUSINESSES ADVERTISING ON THE WEBSITE OR THEIR SERVICES, THE USER SUBMISSIONS OR THE CONTENT OF ANY SITES LINKED TO THIS WEBSITE AND ASSUMES NO LIABILITY OR RESPONSIBILITY FOR ANY (I) ERRORS, MISTAKES, OR INACCURACIES OF CONTENT, (II) PERSONAL INJURY OR PROPERTY DAMAGE, OF ANY NATURE WHATSOEVER, RESULTING FROM YOUR ACCESS TO AND USE OF OUR WEBSITE, (III) ANY UNAUTHORIZED ACCESS TO OR USE OF OUR SECURE SERVERS AND/OR ANY AND ALL PERSONAL INFORMATION AND/OR FINANCIAL INFORMATION STORED THEREIN, (IV) ANY INTERRUPTION OR CESSATION OF TRANSMISSION TO OR FROM OUR WEBSITE, (IV) ANY BUGS, VIRUSES, TROJAN HORSES, OR THE LIKE WHICH MAY BE TRANSMITTED TO OR THROUGH OUR WEBSITE BY ANY THIRD PARTY, AND/OR (V) ANY ERRORS OR OMISSIONS IN ANY CONTENT OR FOR ANY LOSS OR DAMAGE OF ANY KIND INCURRED AS A RESULT OF THE USE OF ANY CONTENT POSTED, EMAILED, TRANSMITTED, OR OTHERWISE MADE AVAILABLE VIA THE WEBSITE. TAXBUZZ DOES NOT WARRANT, ENDORSE, GUARANTEE OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD PARTY THROUGH THE WEBSITE OR ANY HYPERLINKED WEBSITE OR FEATURED IN ANY BANNER OR OTHER ADVERTISING, AND TAXBUZZ WILL NOT BE A PARTY TO OR IN ANY WAY BE RESPONSIBLE FOR MONITORING ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES. AS WITH THE PURCHASE OF A PRODUCT OR SERVICE THROUGH ANY MEDIUM OR IN ANY ENVIRONMENT, YOU SHOULD USE YOUR BEST JUDGMENT AND EXERCISE CAUTION WHERE APPROPRIATE.

-

Limitation of Liability

IN NO EVENT SHALL TAXBUZZ, CountingWorks, Inc., OF THEIR RESPECTIVE OFFICERS, DIRECTORS, EMPLOYEES, AGENTS, OR LICENSORS BE LIABLE TO YOU FOR ANY INDIRECT, INCIDENTAL, SPECIAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES WHATSOEVER INCLUDING AS A RESULT OF ANY (I) ERRORS, MISTAKES OR INACCURACIES IN CONTENT, (II) PERSONAL INJURY OR PROPERTY DAMAGE, (III) ANY UNAUTHORIZED ACCESS TO OR USE OF OUR SERVERS AND/OR ANY AND ALL PERSONAL INFORMATION AND/OR FINANCIAL INFORMATION STORED THEREIN, (IV) ANY INTERRUPTION OR CESSATION OF TRANSMISSION TO OR FROM OUR WEBSITE, (IV) ANY BUGS, VIRUSES, TROJAN HORSES, OR THE LIKE, WHICH MAY BE TRANSMITTED TO OR THROUGH OUR WEBSITE, AND/OR (V) ANY LOSS OR DAMAGE OF ANY KIND INCURRED AS A RESULT OF YOUR USE OF ANY CONTENT POSTED, EMAILED, TRANSMITTED, OR OTHERWISE MADE AVAILABLE VIA THE WEBSITE. THE FOREGOING SHALL APPLY WHETHER THE DAMAGE IS BASED ON WARRANTY, CONTRACT, TORT, OR ANY OTHER LEGAL THEORY AND WHETHER OR NOT TAXBUZZ OR CountingWorks, Inc. IS ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. THE FOREGOING LIMITATION OF LIABILITY SHALL APPLY TO THE FULLEST EXTENT PERMITTED BY LAW IN THE APPLICABLE JURISDICTION. YOU SPECIFICALLY ACKNOWLEDGE THAT TAXBUZZ AND CountingWorks, Inc. SHALL BE LIABLE FOR USER SUBMISSIONS OR THE DEFAMATORY, OFFENSIVE, OR ILLEGAL CONDUCT OF ANY THIRD PARTY AND THAT THE RISK OF HARM OR DAMAGE FROM THE FOREGOING RESTS ENTIRELY WITH YOU. TAXBUZZ’S MAXIMUM LIABILITY TO YOU WITH RESPECT TO ANY DIRECT DAMAGE SHALL BE LIMITED TO $100.

The Website is controlled and offered by Taxbuzz from facilities in the United States of America. Taxbuzz makes no representations that the Website is appropriate or available for use in other locations. Those who access or use the Website from other jurisdictions do so at their own volition and are responsible for compliance with local law.

-

Indemnity

You agree to defend, indemnify and hold harmless Taxbuzz, CountingWorks, Inc. and their respective licensors, officers, directors, employees and agents, from and against any and all claims, damages, obligations, losses, liabilities, costs or debt, and expenses (including but not limited to attorneys’ fees) arising from: (i) your use of and access of the Website; (ii) your violation of any term of these Terms and Conditions; (iii) your violation of any third party right, including without limitation any copyright or any other intellectual property, property right, privacy right; and/or (iv) any claim that your User Submission(s) caused damage to a third party. This defense and indemnification obligation will survive these Terms and Conditions and your use of the Website.

-

Ability to Accept Terms and Conditions

You affirm that you are either older than 18 years of age, or an emancipated minor, or possess legal parental or guardian consent, and are fully able and competent to enter into the terms, conditions, obligations, affirmations, representations, and warranties set forth in these Terms and Conditions and to abide by and comply with these Terms and Conditions. In any case, you affirm that you are over the age of 13, as the Website is not intended for children under 13. If you are under the age of 13, then do not use the Website—there are lots of other great websites for you. Talk to your parents about any products you want to purchase, as Taxbuzz sells its products and services to adults only.

-

Assignment

These Terms and Conditions, and any rights and licenses granted hereunder, may not be transferred or assigned by you, but may be assigned by Taxbuzz or CountingWorks, Inc. without restriction.

-

General

You agree that: (i) the Website shall be deemed solely based in California; and (ii) the Website shall be deemed a passive website that does not give rise to personal jurisdiction over Taxbuzz or CountingWorks, Inc., either specific or general, in jurisdictions other than California. These Terms and Conditions shall be governed by the internal substantive laws of the State of California, without respect to its conflict of laws principles. Any claim or dispute between you and Taxbuzz that arises in whole or in part from the Website shall be decided exclusively by a court of competent jurisdiction located in Los Angeles County, California. These Terms and Conditions, together with the Privacy Policy at https://www.taxbuzz.com/t/privacy and any other legal notices published by Taxbuzz on the Website, shall constitute the entire agreement between you and Taxbuzz concerning the Website. If any provision of these Terms and Conditions is deemed invalid by a court of competent jurisdiction, the invalidity of such provision shall not affect the validity of the remaining provisions of these Terms and Conditions, which shall remain in full force and effect. No waiver of any term of this these Terms and Conditions shall be deemed a further or continuing waiver of such term or any other term, and Taxbuzz's failure to assert any right or provision under the Terms and Conditions shall not constitute a waiver of such right or provision. YOU AND TAXBUZZ AGREE THAT ANY CAUSE OF ACTION ARISING OUT OF OR RELATED TO THE WEBSITE MUST COMMENCE WITHIN ONE (1) YEAR AFTER THE CAUSE OF ACTION ACCRUES. OTHERWISE, SUCH CAUSE OF ACTION IS PERMANENTLY BARRED.

-

Liability Limitation and Usage Guidelines for TaxBuzz AI:

Limitation of Liability:

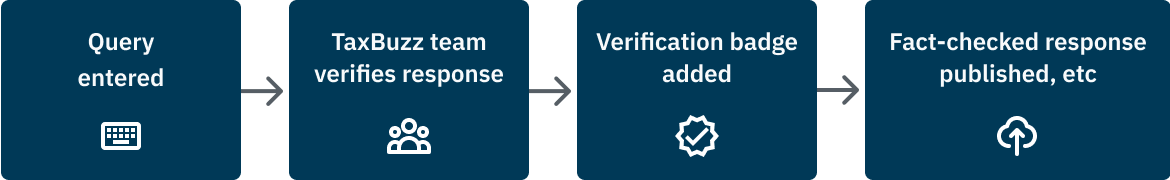

TaxBuzz AI is a tool designed to provide tax professionals with assistance in generating responses to tax research questions. While we strive to maintain the accuracy and reliability of the information provided, it is imperative to recognize that tax laws are dynamic and subject to change. Therefore, the use of TaxBuzz AI should be complemented by professional judgment and consultation with legal and tax experts.

By utilizing TaxBuzz AI, you acknowledge and agree that the information generated should not be considered as a substitute for professional advice tailored to your specific circumstances. We explicitly disclaim any liability for the consequences arising from the use of advice generated by TaxBuzz AI. Users are encouraged to independently verify the information and seek professional advice before making decisions based on the AI-generated responses.

Usage Guidelines:

-

Professional Judgment: TaxBuzz AI is a tool to aid tax professionals in research and analysis. It is not a replacement for professional judgment, and users should exercise their expertise when interpreting and applying the information generated.

-

Consultation with Experts: While TaxBuzz AI provides valuable insights, it is crucial to consult with legal and tax experts to ensure the advice aligns with the latest legal developments and specific nuances of a particular situation.

-

Verification of Information: Users are responsible for independently verifying the information provided by TaxBuzz AI, especially in instances where the advice generated is critical to decision-making.

-

Educational Purposes: TaxBuzz AI is intended for educational and informational purposes only. It is not intended to provide specific legal or tax advice tailored to individual circumstances.

-

Non-Endorsement: The use of TaxBuzz AI does not constitute an endorsement or guarantee of the accuracy of the information provided. Users are encouraged to corroborate the advice with other reliable sources.

By accessing and using TaxBuzz AI, you agree to abide by these terms and acknowledge the limitations outlined herein. We reserve the right to modify these terms at any time, and your continued use of TaxBuzz AI constitutes acceptance of any such modifications. If you do not agree with these terms, please refrain from using TaxBuzz AI.